Probably the story of the year. Michael Saylor has his company Strategy hitting a new all-time market cap high.

Now, Strategy is showing the world that doubling down on Bitcoin can pay off, even if the ride’s been bumpier than a commuter during rush hour.

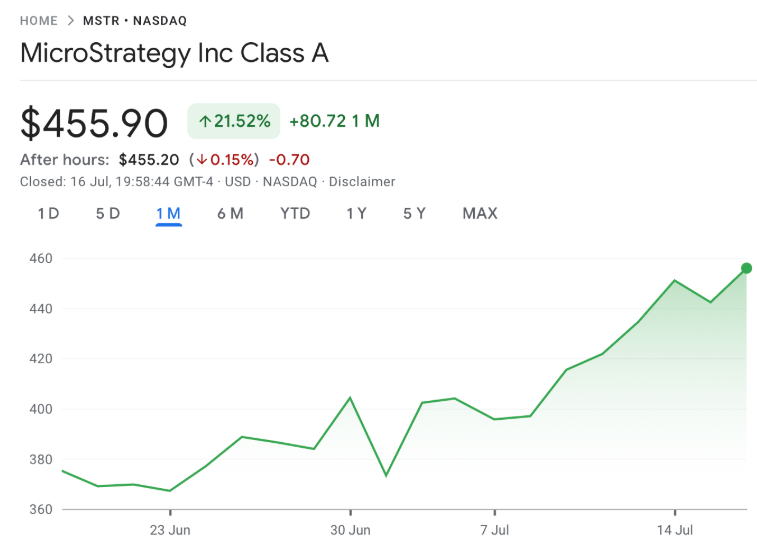

$MSTR just closed at an all-time high market cap. pic.twitter.com/2MtLBczzzu

— Michael Saylor (@saylor) July 16, 2025

Higher

Mirroring Bitcoin’s performance, MSTR’s stock price sprinted over 21% in just the past month, closing at a solid $455.90 on Wednesday.

That’s the kind of leap you want to see on your portfolio’s scoreboard. Bitcoin itself has been no slouch, dancing near record highs, peaking at $122,884 this Monday before tipping slightly back to around $118,413.

It’s like the crypto elevator just keeps shooting higher, with no sign of stopping.

An options trader known as Sean Trades threw in the prophecy that MSTR is gearing up for the next leg to all-time highs. Say what you will, but these moves have some teeth behind them.

Confidence

Now don’t get it twisted, even with this shiny new record, MSTR’s stock still sits about 19% shy of its absolute peak from November last year, when it touched $543.

But hey, the company’s been busy issuing new stock like hot pizza slices to fund their endless Bitcoin stash, the game plan here is accumulation, not resting on laurels.

And Strategy just chalked up its 11th day of qualifying for the S&P 500, a milestone signaling its growing muscle in the stock market arena.

Jeff Walton, Strategy’s VP of Bitcoin Strategy, predicted this beast would become the number one publicly traded equity thanks to Bitcoin’s firepower.

Big words, but when you’re stacking 4,225 Bitcoin for nearly half a billion dollars in just one week, that’s confidence, my friend.

To the top

Yes, it hasn’t all been sunshine and roses, as Strategy’s been in the red for the last three quarters.

Those loss columns aren’t easy to swallow. But if you think Michael Saylor is sweating it, think again.

It’s like your beleaguered but stubborn coworker who’s been grinding overtime, betting big for the long haul while everyone else complains about Mondays.

The big reveal? Strategy’s next earnings report drops August 5. Will it confirm the prophecy or deliver the hangover?

No one knows. But for now, Strategy is the tale of risk, resilience, and a whole lotta Bitcoin swagger, proof that sometimes, betting big can take you straight to the top.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.