US banking groups want to stop crypto firms from getting national bank charters. On July 18, the American Bankers Association and other financial trade groups sent a letter to the Office of the Comptroller of the Currency (OCC).

They asked the OCC to pause decisions on crypto bank licenses until applicants like Ripple, Circle, and Fidelity Digital Assets provide full business details.

The letter claims the OCC charter applications lack transparency. The banking groups say these companies don’t explain how they meet trust bank requirements.

They argue the Ripple bank license and similar bids would be a major shift from past OCC practices.

“There are significant policy and legal questions as to whether the Applicants’ proposed business plans involve the types of fiduciary activities performed by national trust banks,”

the letter said.

Ripple, Circle, and Fidelity Push for Trust Bank Status

Ripple, Circle, and Fidelity Digital Assets have each applied for national trust bank status. If approved, they could operate federally and bypass state-by-state rules.

These licenses would let them process payments and hold assets like a traditional bank.

The Ripple bank license and Circle bank license bids raise concerns from traditional banks. The letter says the companies want to provide custodial services for digital assets.

But those services, according to the trade groups, are not fiduciary duties required by national trust banks.

“Providing custodial services for digital assets is not a fiduciary activity,”

the letter said. The banking groups want the OCC to hold a full public notice and comment period before making any changes to trust bank policy.

Bank Groups Warn of Risk to Financial System

The letter says if the OCC approves the crypto bank licenses, it would set a new standard. Other non-traditional firms could then apply.

This could lead to a weaker regulatory system if those firms operate without traditional capital requirements.

The trade groups said that trust bank charter rules require less capital than full bank charters.

If crypto firms get approval, others might follow, leading to what they describe as a “material risk to the US banking and financial system.”

The groups also argued the public must be able to review these applications. Without access to full business models, the public cannot make informed comments or hold the OCC accountable.

Caitlin Long and Paradigm Respond to OCC Dispute

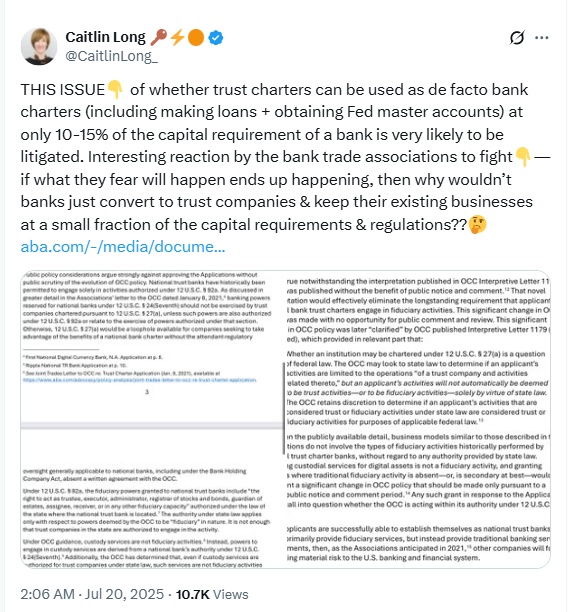

Caitlin Long, founder of Custodia Bank, commented on the OCC dispute. On July 20, she posted on X that the debate over trust bank charter rules may end up in court.

She noted that if firms can use trust charters like full bank licenses, banks might switch to those models.

“Interesting reaction by the bank trade associations to fight,”

she wrote.

“If what they fear will happen ends up happening, then why wouldn’t banks just convert to trust companies and keep their existing businesses at a small fraction of the capital requirements and regulations?”

Alexander Grieve, policy head at venture firm Paradigm, also reacted. He pointed out that banks and credit unions rarely agree, but now share concern over growing crypto bank licenses.

“They seem to agree that they’re finally about to have some competition from crypto,”

Grieve said.

GENIUS Act Drives Crypto Push for OCC Charters

New federal rules under the GENIUS Act are another reason crypto firms are applying for OCC charter applications. Under this act, stablecoin issuers can get a license, but it only covers stablecoin issuance. It does not allow other financial services.

Logan Payne, a lawyer at Winston & Strawn, told that many stablecoin issuers do more than just issue tokens. These firms often operate wallets, manage reserves, or process payments. So, the GENIUS Act license alone is not enough.

Payne said this creates a strong reason for firms to seek national trust bank status from the OCC. These charters allow them to work nationwide and provide more services, without needing individual state licenses.

“The charter allows for them to engage in stablecoin issuance plus a wider range of activities, but without having to get state-to-state licenses,”

Payne said.

The OCC has not released a statement in response to the US banking groups. The debate over crypto bank licenses remains active, as Ripple, Circle, and Fidelity Digital Assets await a decision.

Banking associations continue to push for more public review before any trust charters are granted to crypto firms.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.