Picture the crypto market as your office bullpen, everyone’s hustling, trading, making moves.

Now enter SUI, the new kid on the block, swaggering past veterans in sheer trading volume.

Impressive? You bet. But while SUI’s volume is flexing big muscles, its price is wobbling like a rookie on a first day at the copier machine. How, you may ask?

New protocols for Bitcoin trading

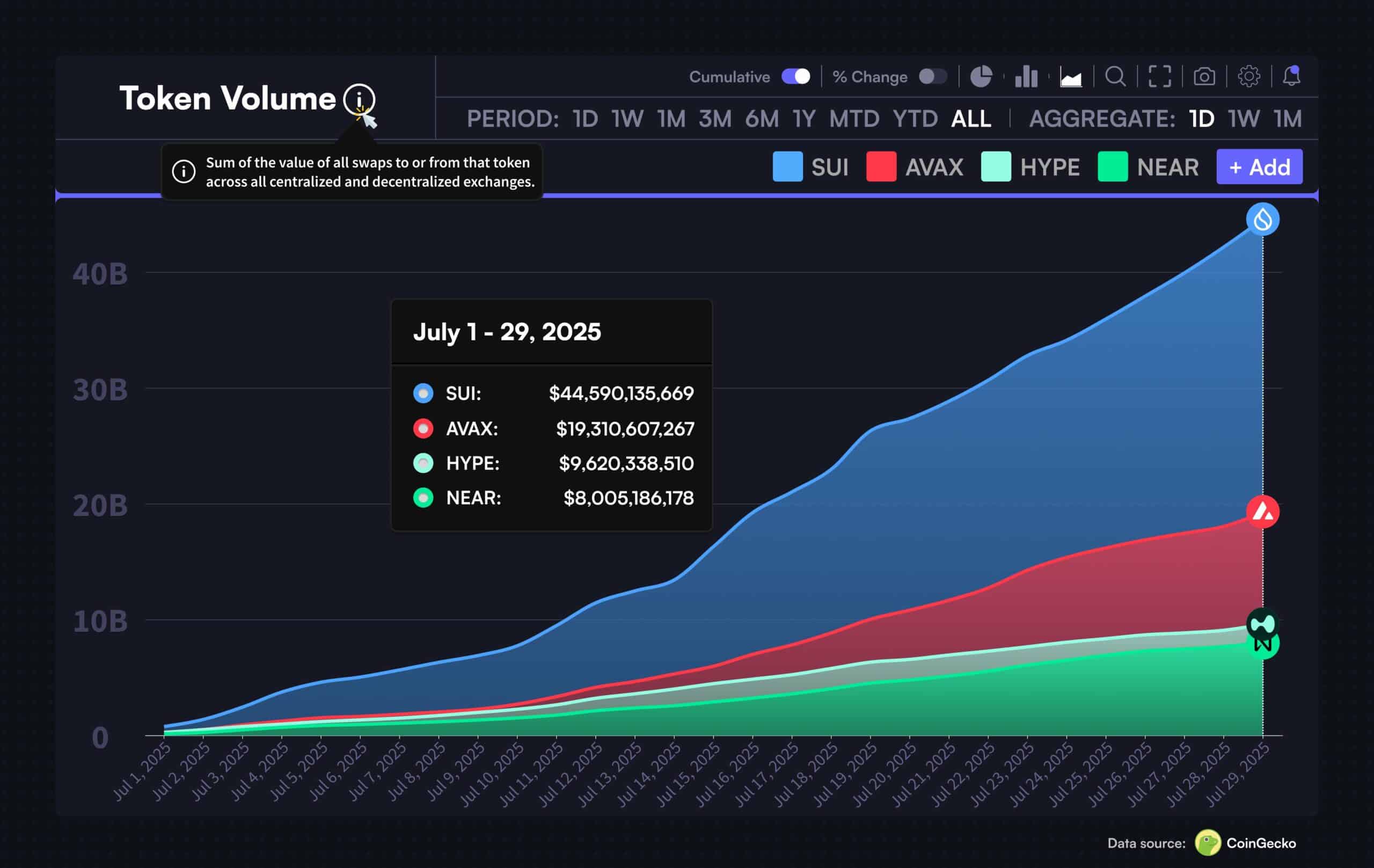

What’s going on? First off, SUI’s on-chain trading volume for July blasted to over $44.5 billion, outpacing big names like AVAX, NEAR, and HYPE combined by a solid $8 billion.

This growth didn’t happen by accident, it’s fueled by new protocols like Cetus and the freshly minted BTCfi, which have unlocked fresh streams of liquidity.

Bitcoin, notoriously tough to scale onto other chains, just got a new playground on SUI’s DeepBook, letting you trade, borrow, and lend BTC-linked assets.

SUI price barely holding above resistance

Now, think of that Total Value Locked like the company’s lunch fund. Since January, SUI’s TVL shot up 480%, hitting $2.3 billion by July’s end.

So what can you do with BTC on Sui?

✔️ Trade

✔️ LP

✔️ Lend or borrow

✔️ Leverage

✔️ Earn yield

✔️ Explore perps & optionsLet’s break it down ↓

— Sui (@SuiNetwork) July 29, 2025

Factor in liquid staking, borrowing, and all that jazz, and you’re looking at a massive $3.48 billion stack, the highest ever.

Even stablecoins are holding steady, with a $1 billion market cap and daily inflows keeping the cash flowing across SUI’s protocols. Party time!

But while all this volume and liquidity talk makes you wanna cheer, SUI’s price isn’t playing along.

In the time of writing, it slipped a few percentage in a day, cooling off from a recent high around $4.40 to about $3.8, flirting with support at $3.61.

Technical traders and analysts eyeballing the Ichimoku cloud see the price barely holding above resistance, like a boxer wobbling on one foot.

Waiting for the next play

But on the other hand, derivative data shows long traders paying shorts, so some big players aren’t throwing in the towel just yet.

Open interest slid to $2.41 billion, but at least, it’s still above $2 billion.

That tells us whales and institutions might be lurking, waiting for the next play, even if the broader market’s catching a chill.

So, SUI’s crushing it on the volume front, thanks to serious innovation with BTCfi and DeFi protocols.

That’s the good news. But price-wise? It’s a bit of a shaky dance, strong fundamentals, but traders are hesitant. That’s the bad news.

Frequently Asked Questions (FAQ)

Why did SUI’s trading volume increase while the price dropped?

A sudden spike in trading volume often reflects short-term speculation or large token unlocks, which can lead to selling pressure even if overall activity remains high. SUI’s dip follows such volume-driven dynamics.

Does volume growth signal bullish momentum despite the price dip?

Not necessarily. While high volume shows interest, the price decline and technical indicators like stronger USD or resistance around key levels suggest caution.

What might happen next for SUI in the short term?

If selling pressure continues, SUI could dip further toward support zones near ~$3.50–3.60. But if underlying fundamentals—like growing TVL and institutional interest—hold, a recovery is possible.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 1, 2025 • 🕓 Last updated: August 2, 2025

✉️ Contact: [email protected]