Guys, it was a bright hopeful morning for crypto lovers and market hustlers alike. Everyone thinking, hey, maybe the Fed’s gonna slice interest rates come September.

But no, the man at the helm, Jerome Powell, dropped the mic hard on those dreams.

No promises

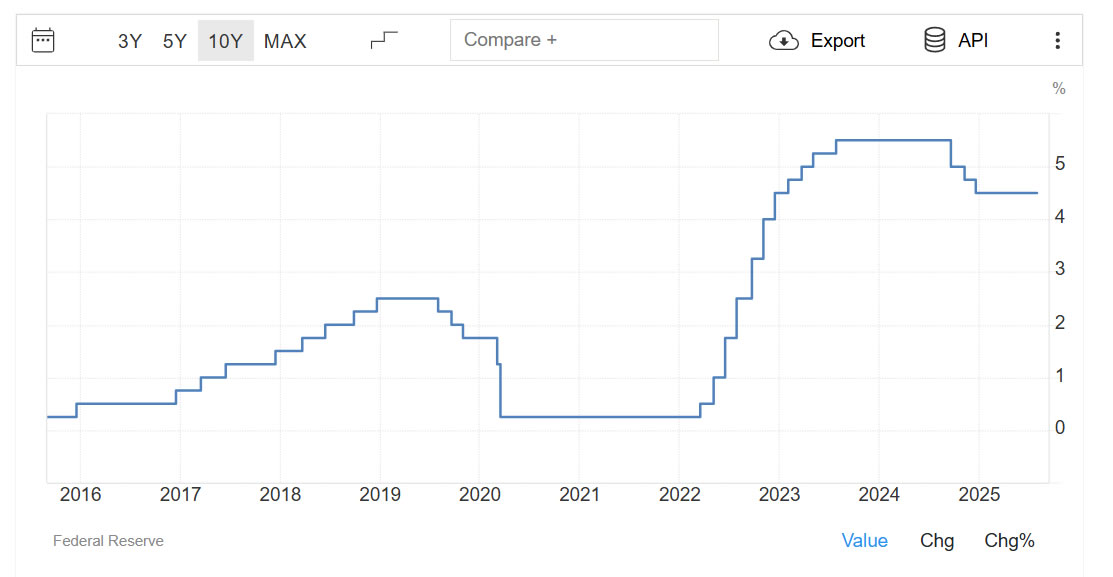

The Federal Reserve just decided to leave interest rates steady, locked tight between 4.25% and 4.5%.

Why? Because the economic forecast? Well, it’s murky, like trying to read a map in a fog.

Uncertainty’s the word of the day you know. Powell himself said the tariffs are starting to show up in what we pay for stuff.

That inflation’s stubborn, climbing back up to 2.7%, just like an unwanted guest at the party.

Now, before you get your hopes too high for a rate cut, Powell wasn’t making any promises for September. Said it straight up, no decisions made yet, just watching the numbers play out.

If unemployment stays steady and inflation keeps its iron grip thanks to tariffs, cutting rates soon? No way.

Slow but steady

Remember when Trump was banging on the table, yelling for lower rates? Well, Powell just gave him the cold shoulder, sticking to the wait-and-see routine. That’s the new game, the Fed’s moving cautious, slow but steady.

And honestly, even before the Fed’s announcement, chances for a September rate cut were iced at 63%. After Powell’s performance? Slid down to 40%.

Yeah, that’s almost like a bad poker hand for crypto investors dreaming of more liquidity to boost the bull run.

Some smart cats like Nick Ruck from LVRG Research say sure, the pace of this crypto bull market might slow down, but the big money’s still lurking in the shadows, ready to keep a floor underneath the market for when the rebound kicks in. And eventually, it will.

Not today

Let’s not forget, two Fed commissioners actually dissented this time, something unseen in three decades, wanting the rates to drop by a quarter point.

A little chaos in the family, you might say. Sure enough, crypto prices took a dip right after the announcement, only to bounce back by Thursday morning trading in Asia.

The total crypto market cap’s sitting steady near $3.94 trillion, cruising sideways like a cab waiting for a fare.

What does all this mean for the average players? When interest rates stay high, traditional banks keep your dollars cozy and safe, less reason to chase risky assets like crypto.

Lower rates? That’s when investors get hungry for bigger wins, pushing crypto prices up. But not today.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 2, 2025 • 🕓 Last updated: August 1, 2025

✉️ Contact: [email protected]