Bitcoin’s dream of hitting $200K by the end of the year? It’s riding on what September’s gonna do.

That one month, like the quiet before the storm in some office drama, decides if Q4’s gonna be a blockbuster or just another rerun.

The Fed eases up?

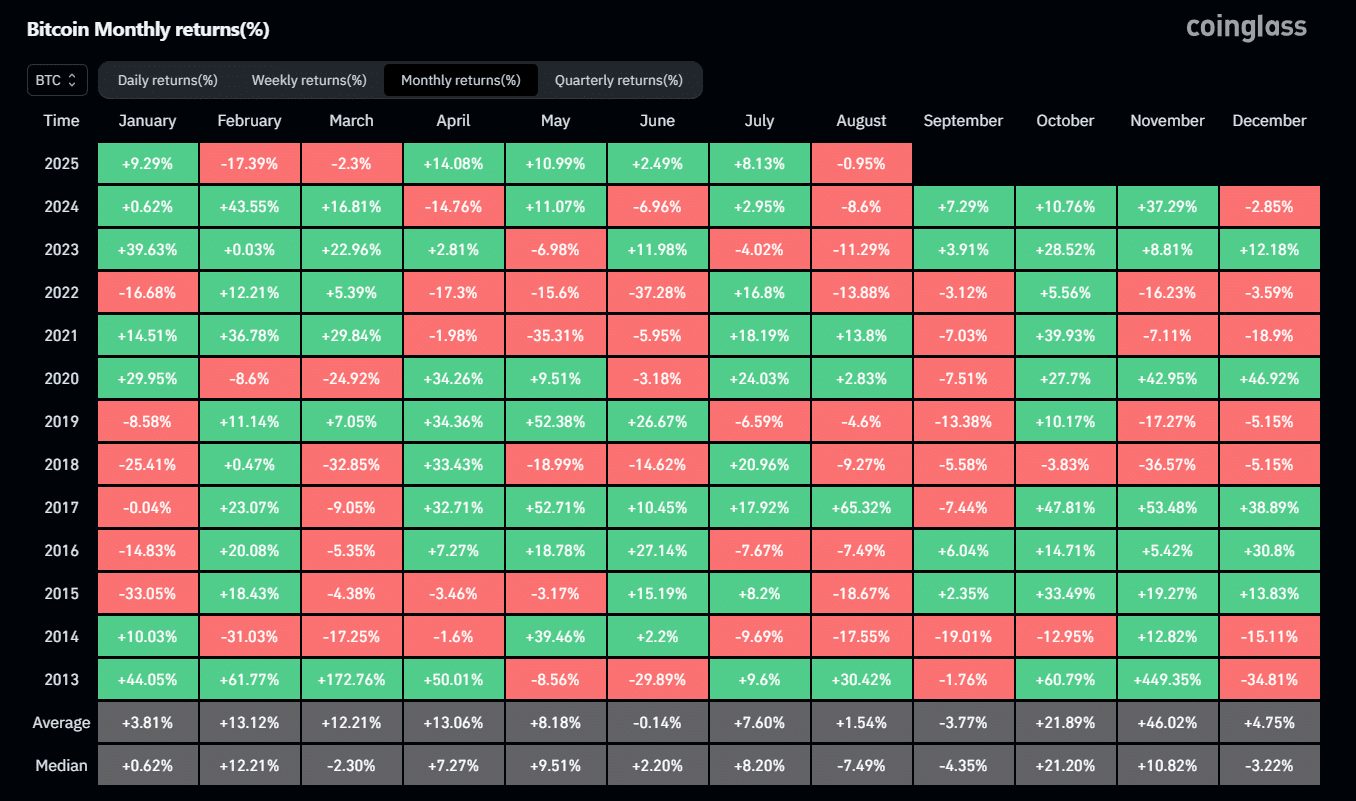

Here’s how it’s been in the past cycles. Bitcoin’s Q4 track record is legendary. Historically, the last three months crank out an average return of 85.4%.

We’re talking double-digit rallies that make other quarters look like small potatoes.

Why? Because when the Fed eases up and drops interest rates, risk assets like Bitcoin get a turbo boost. Makes sense, right? More money flows in, prices climb, and buyers get happy.

Now, everybody’s buzzing about a 50 basis points rate cut in September. Inflation’s still been a stubborn guest at the party, but markets look like they’re betting the Fed’s gonna soften up.

If that happens, Bitcoin could add an extra $86K on top of what it’s trading at today, aiming for that sweet $200K level. No small feat.

Timing

Technically, analysts say Bitcoin is building a solid base between $110K and $115K.

That’s good news, the ETF inflows just flipped positive, pulling in $90 million after bleeding out $1.5 billion in just four days.

It’s like the office coffee pot suddenly starting to brew strong again after a weak stretch. Investors are paying attention.

August and September have a reputation, as they’re usually quiet months for Bitcoin, flat or even down.

So that $125K breakout everybody’s whispering about? Might be a bit too soon.

Think of it as trying to launch a big client project when half your team is on vacation, is it a good move? Timing is everything.

Stepping stone

The real magic comes in October and November. These months have historically been Bitcoin’s high-performance period, clocking combined returns close to 68%.

That’s where the real rallies get their legs and investors start popcorn-worthy action. December?

More like the calm after the storm, where everyone locks in gains. If that Fed cut drops in September and Bitcoin hits around $125K resistance, it’ll sync perfectly with these historical momentum windows.

We could be looking at a breakout fiesta, starting a price discovery journey unlike anything before.

So, the next 45 days are more than poker chips on a table. They’re the turning point for Bitcoin’s Q4 story.

To see $200K, it needs to turn the $125K level from a wall into a stepping stone and prove liquidity is actually flowing. Until then? It’s a waiting game.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 8, 2025 • 🕓 Last updated: August 8, 2025

✉️ Contact: [email protected]