Bitcoin, born in the shadows but now hitting the spotlight like a boss. And now, an email from the mysterious Satoshi Nakamoto to cryptographer Adam Back, resurfacing after 17 years.

Yeah, the one where Satoshi talks about his grand vision for a decentralized digital cash system, no middlemen, no funny business.

This is the kind of throwback that crypto heads drool over.

Revolution

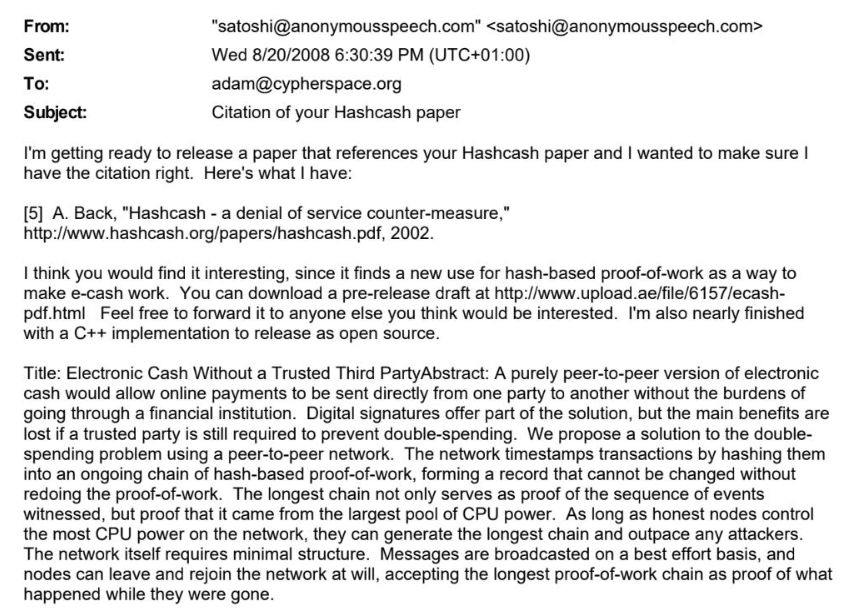

Back in August 2008, Satoshi sent Adam an email referencing Back’s 2002 HashCash paper, the tech that inspired Bitcoin’s proof-of-work backbone.

Attached? The very first draft of the Bitcoin whitepaper titled Electronic Cash Without a Trusted Third Party.

Satoshi breaks down the genius idea of timestamping transactions on a chain secured by honest nodes using CPU power, making fraud a sucker’s game.

He just actually reinvented the wheel, as he was building a bulletproof network where anyone could join or exit freely, but only the longest chain counted.

Sounds simple, but trust me, this was revolutionary. It is.

Big guys are in the game

Fast forward today, and Bitcoin’s come a long way from those early emails. No longer just a rumor on internet forums, it’s a big dog financial asset. Institutional players like BlackRock and Fidelity are grabbing serious stacks of Bitcoin.

On August 17, U.S. spot Bitcoin ETFs hit a record 1.25 million BTC under management. BlackRock’s iShares Bitcoin Trust alone controls nearly 60% of that ETF-held stash.

Fidelity’s FBTC chimes in with almost 200,000 BTC, showing the big guys are in the game to win.

Dominance

Grayscale’s GBTC, once the kingpin holding over 620,000 BTC, has been practically dethroned, down to 180,576 BTC.

The market’s shifting from a solo act to a gladiator arena where traditional asset managers battle for dominance.

It’s not a battle royale tho, there could be more winners. The rise of ETFs also signals Bitcoin’s firm seat at the mainstream finance table, offering investors a regulated, hassle-free way to get exposure without wrestling with wallets.

Market insiders say these whales are quietly manipulating the game, buying when the street’s spooked, selling into the hype, like seasoned players shaking out the jittery crowd.

Bitcoin’s no longer just a rebellious experiment, it’s tethered to massive fund movements, corporate interests, and serious dollar signs.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 21, 2025 • 🕓 Last updated: August 21, 2025

✉️ Contact: [email protected]