Dutch cryptocurrency firm Amdax has raised €20 million ($23.3 million) to launch a Bitcoin treasury company called AMBTS. The company plans to list on Amsterdam’s Euronext stock exchange.

Amdax announced that several investors participated in the initial funding round. The new Bitcoin treasury will operate as an independent company with its own governance.

The capital raised will be used to expand the Bitcoin treasury strategy and strengthen shareholder access through equity markets.

AMBTS Targets 1% of Bitcoin Supply

AMBTS has set a goal to accumulate 1% of all Bitcoin that will ever exist, which equals about 210,000 BTC. At current prices, this amount is worth more than $23 billion.

In its official statement, Amdax said:

“AMBTS intends to leverage the capital markets to increase its Bitcoin holdings and sequentially generate equity appreciation and grow Bitcoin per share for its shareholders, subject to market and other conditions.”

The new Bitcoin treasury company will pursue steady accumulation to expand its long-term Bitcoin holdings.

Corporate Bitcoin Treasury Model Expands

The launch of AMBTS reflects the growth of the Bitcoin treasury model. Since MicroStrategy (now renamed Strategy) first adopted this approach, other listed companies have followed.

Major corporations holding Bitcoin include Tesla, KULR Technology, Aker ASA, Méliuz, MercadoLibre, Samara Asset Group, Jasmine Telecom, Alliance Resource Partners, and Rumble. These companies are not solely focused on Bitcoin but have integrated it into their balance sheets.

Alongside them, dedicated Bitcoin treasury companies have continued to accumulate large amounts, reducing the circulating supply.

Global Bitcoin Treasury Growth

Several global firms are expanding their Bitcoin treasury strategies. Earlier this week, Metaplanet, a Japanese Bitcoin treasury company, approved plans to raise ¥130 billion ($880 million). Of this, nearly ¥123 billion ($835 million) is allocated for Bitcoin purchases.

On Monday, Sequans Communications, a French semiconductor company, filed for a $200 million equity offering to help fund its Bitcoin treasury.

Meanwhile, Michael Saylor, co-founder of Strategy, confirmed preparations for the company’s third Bitcoin acquisition in August. Strategy remains the world’s largest Bitcoin treasury company, holding 632,457 BTC worth more than $69.5 billion, or over 3% of all Bitcoin that will ever exist.

Bitcoin Treasuries Concentrate Supply

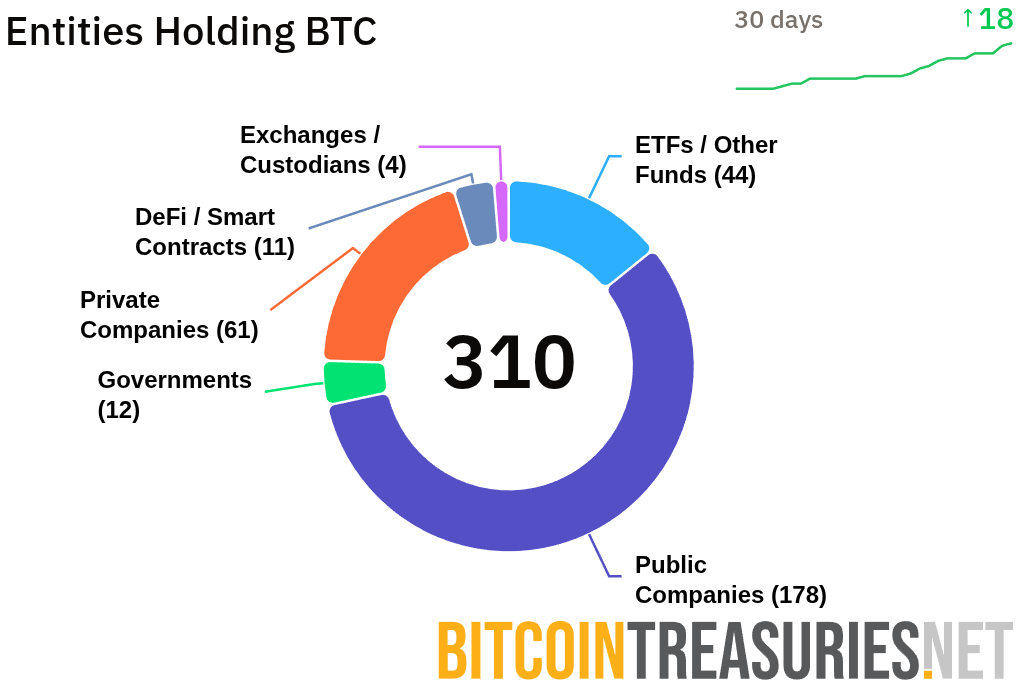

Data from BitcoinTreasuries.NET shows a rising concentration of Bitcoin among corporate treasuries.

Entities such as Strategy, Tesla, and others collectively control hundreds of thousands of BTC.

With its target of 210,000 BTC, AMBTS joins this global trend. By operating through capital markets and public equity, the Dutch firm strengthens its position within the expanding Bitcoin treasury landscape.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 29, 2025 • 🕓 Last updated: August 29, 2025