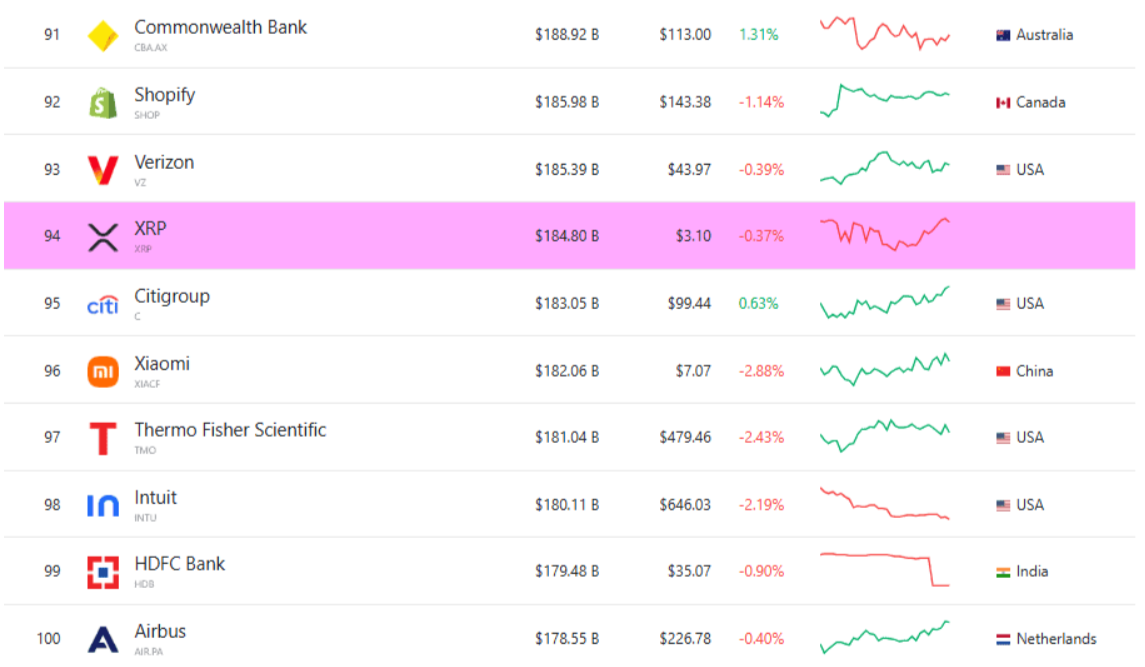

There’s been some serious shuffling going down in the big leagues of global assets. Ripple’s XRP just made a knockout move, back in the Top 100 global assets by market cap.

Yup, after a little tumble, it’s standing tall again at about $185 billion.

Comeback

Ripple’s token had slipped out of the top group for a spell. It was cruising at around $3.02, holding its spot at nearly $180 billion market cap.

Then boom, down to a $2.70 low. That slide kicked it out of the prestigious club. But, like every good comeback story, XRP didn’t stay down.

The past week’s rally gave it a 10% boost, pushing it back up to $3.10, with a fresh market cap near $185 billion.

XRP’s crushing it past giants like Citigroup, Xiaomi, and Airbus. Up next on the list? Verizon, Shopify, Commonwealth Bank, and Uber. No small fry.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Gold is still reign supreme

Now, Bitcoin had been playing with the big boys too. It’s been the first crypto inducted into the global top 100, and for a while, it climbed all the way up to 8th place worth over $2.3 trillion.

But then silver edged past Bitcoin, sitting pretty at $2.4 trillion. Yeah, precious metal took that round.

Don’t get it twisted, gold’s still reigning supreme, with a monstrous $25 trillion market cap after hitting an all-time high against the dollar just this week.

Ethereum, on the other hand, is climbing fast, its meteoric rise landed it in the 22nd spot globally, right around familiar names like Mastercard and Netflix, showing it’s no wallflower in this asset party.

Clash of the titans

Look, this isn’t just about numbers or bragging rights. It’s about the story, the rise, the fall, and the bounce back in the finance industry.

XRP’s comeback shows the token’s utility and staying power, especially as cross-border payments heat up and regulatory clarity creeps in.

But Bitcoin fighting silver? Clash of the titans, you know.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 16, 2025 • 🕓 Last updated: September 16, 2025

✉️ Contact: [email protected]