Welcome to Q4 2025, where the crypto battlefield looks suspiciously like the same old story, but with a few spicy plot twists.

The Altcoin Season Index just blasted through the roof to a rare, seven-year high of 100, cue the trumpets!

Yet, beneath this flashy headline, the market’s pulse feels more like a cautious tapping than a full-throttle charge.

Brutal resistance

First, let’s talk numbers, because numbers doesn’t lie. Bitcoin is holding its ground, barely moving a muscle at 3% above its $108K monthly open.

The total crypto market cap lingers about 3% above its $3.7 trillion starting line, having surrendered a nice 97% of September’s gains.

But altcoins, the flashy younger siblings in this story, have taken the brunt, with TOTAL2, the market cap of everything except Bitcoin, diving more than 4%.

Twice the Bitcoin losses, mind you, after banging up against some brutal resistance.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

A party with nobody dancing

And the plot thickens. Back in summertime, Ethereum dominance, the ETH.D flirted with doubling to 15%, fueling a $510 billion charge into altcoins, a juicy rocket boost for the market.

But now? ETH.D is in retreat, slowly dribbling downward since its August peak. Alts, starved of their usual ETH lifeline, sit with a TOTAL2 ceiling at $1.73 trillion, like a party with nobody dancing.

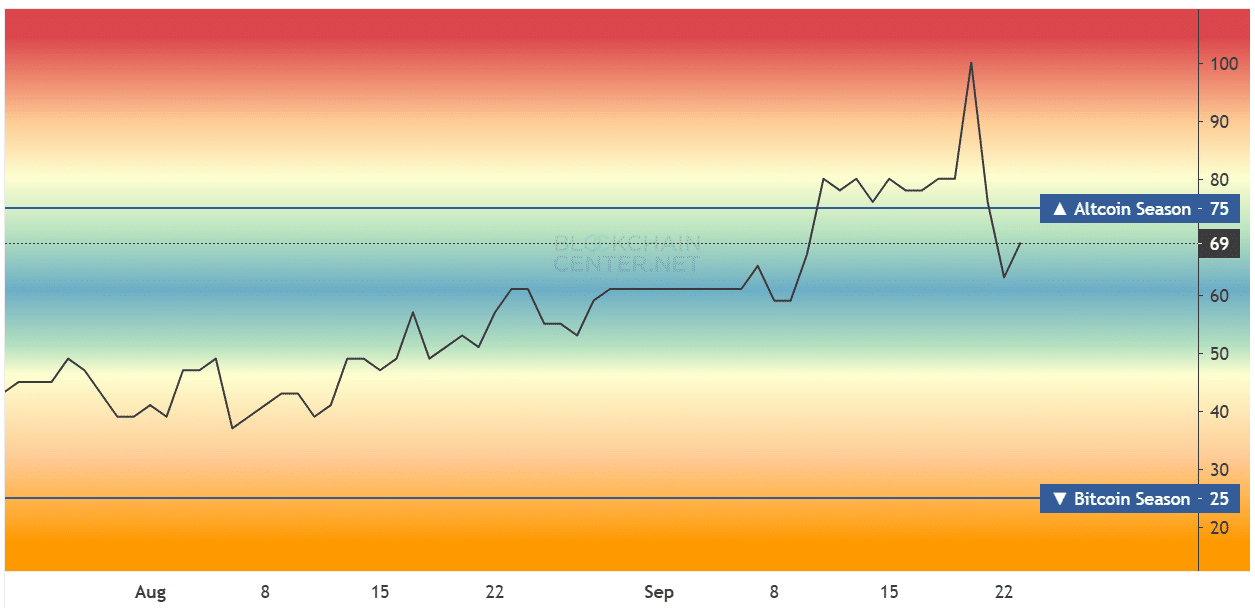

Here’s where the hero’s charm shows. The Altcoin Season Index, usually capped around 80 for mere mortals, broke free on September 19th, surfacing to 100.

Credit goes to a wild card named Aster, whose launch pumped speculative capital into altcoins, momentarily lighting up the scene like a pyrotechnics show. But the afterparty fizzled fast.

In the time of writing, the index cooled back to 69, barely 10% above its September kickoff.

Traders are retreating

So what’s the lesson here? Altcoin season feels less like a tidal wave and more like a fizzing soda, lots of bubbles, not much soda.

Meh. Bitcoin dominance crept up 1.01% this week, holding its ground like the old reliable, while ETH.D slipped nearly 3%, hinting traders are retreating from altcoins and shoring up their Bitcoin forts.

With altcoin gains capped, fading ETH/BTC rotations, and a speculative haze over smaller altcoins, the market whispers a warning, brace for a deeper correction.

Q4 might just be the stage where altcoins take a breather, and Bitcoin, ever the stoic protagonist, reclaims the spotlight.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 25, 2025 • 🕓 Last updated: September 25, 2025

✉️ Contact: [email protected]