Ethereum’s wobble against Bitcoin is turning heads, and stirring whispers that the real market muscle behind its treasury companies might be enthusiastic South Korean retail traders, not the big institutional whales.

The next big strategy play?

Ethereum has been limping along, losing about 5% versus Bitcoin over the last month and dipping nearly 2% in a single day as of Monday.

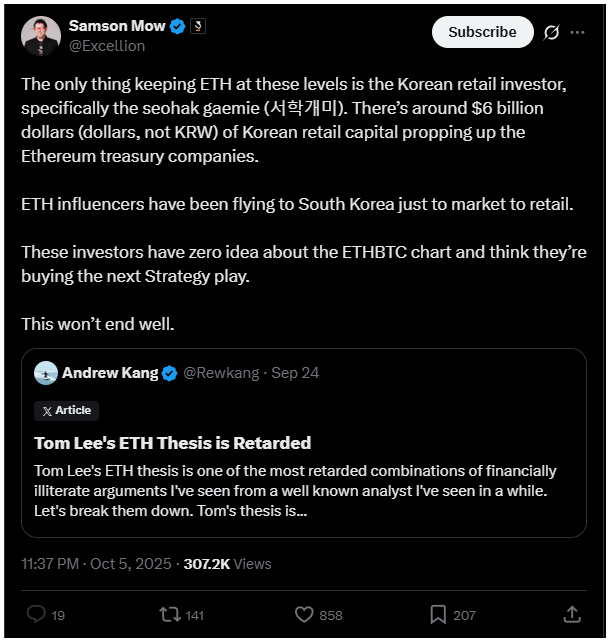

But Bitcoin advocate Samson Mow dropped a spicy claim on the weekend, suggesting roughly $6 billion of South Korean retail cash is propping up Ethereum treasury firms.

These companies are stacking ETH on their books in a bid to mimic the corporate Bitcoin-buying frenzy sparked by Strategy.

Mow calls out a cult of seohak gaemie, the South Korean retail traders, who’ve been wooed by crypto influencers jetting into Seoul, pitching these Ethereum treasuries as the next big strategy play.

The analogy? Like Bitcoin’s big institutional accumulation, but with a retail twist.

Problem is, many of these traders don’t peek at the ETH/BTC charts, industry commentators say they just chase shiny narratives, thinking they’re riding the wave of a corporate accumulation mania without realizing the underlying tech is dragging its feet.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Undisciplined strategy?

And the numbers don’t lie. Strategic ETH Reserve data pegs 67 corporate entities, think BitMine and SharpLink, holding about 5.49 million ETH, roughly $25 billion.

That’s substantial, until you realize that much of the enthusiasm fueling this stash is retail-driven, a fact underscored by Ethereum’s stagnant price.

ETH has been stuck below its ATH of $4,946 and losing ground to Bitcoin.

Andrew Kang, co-founder of Mechanism Capital, chimes in with a shot across the bow, labeling many Ethereum treasury strategies as undisciplined compared to Bitcoin’s more mature playbook.

His takeaway? Without fundamental shifts, ETH might just couch-surf somewhere between $1,000 and $4,800 for the foreseeable future.

Financial illiteracy?

Both Mow and Kang point to a uncomfortable truth, a lot of Ethereum’s valuation owes more to investor excitement, a.k.a. financial illiteracy, than to solid, institutional conviction.

Kang even compares this to XRP’s alleged pump-and-dump history, warning that hype-driven valuations won’t last forever.

So, are these South Korean traders the final firewall keeping Ethereum treasury ambitions alive, or just the last desperate cheerleaders before the curtain falls? We can’t know, unfortunately.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 7, 2025 • 🕓 Last updated: October 7, 2025

✉️ Contact: [email protected]