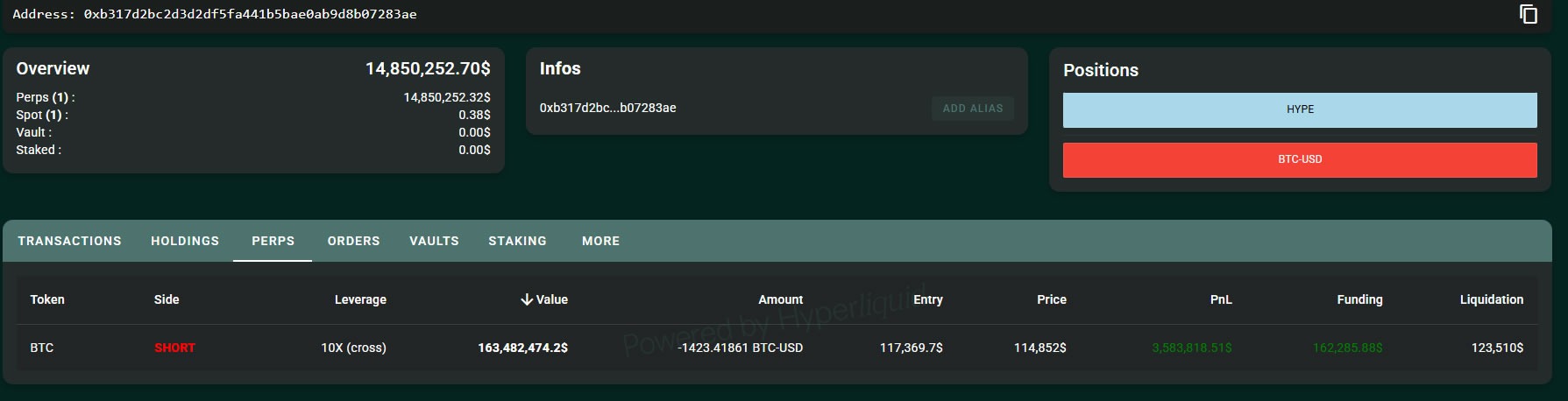

A Hyperliquid trader opened a $163 million Bitcoin short on Sunday. The Bitcoin short uses 10x leverage on a perpetual contract.

At the time reported, the position showed about $3.5 million in profit.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The Hyperliquid trader operates under the address 0xb317. The Bitcoin short faces liquidation if BTC reaches $125,500.

The reference price for BTC stood near $115,325 in the report.

The Hyperliquid trader drew attention after a $192 million gain last week. That Bitcoin short preceded a sharp decline. The timing put the Hyperliquid trader in focus again.

Insider Whale Timing: Minutes Before Trump Tariff Announcement

The first Bitcoin short appeared about 30 minutes before Donald Trump’s tariff announcement on Friday.

The Trump tariff announcement hit, and the market sold off. The Hyperliquid trader then realized a large profit.

Community posts called the address an “insider whale.” Screens from Hypurrscan tracked the entries and size. The public Hyperliquid footprint made the activity easy to follow.

Observer “MLM” commented on the sequence.

“The crazy part is that he shorted another nine figures worth of BTC and ETH minutes before the cascade happened,”

he said. He added, “And this was just publicly on Hyperliquid, imagine what he did on CEXs or elsewhere.” The insider whale label spread after those remarks.

Leverage Flush Data: HyperTracker Counts 250+ Millionaire Wallets Lost

The weekend brought a broad leverage flush across crypto derivatives. Liquidations spread as order books thinned. The Bitcoin short narrative merged with the flush.

HyperTracker reported over 250 wallets on Hyperliquid that lost millionaire status since Friday’s crash.

The count captured equity drawdowns and forced exits. It also showed how fast leveraged gains can disappear.

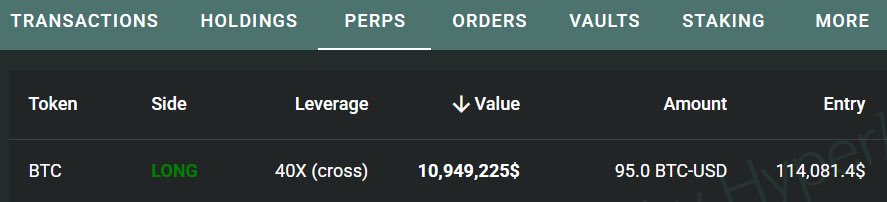

Positioning was not one-way. Another trader opened a $11 million Bitcoin long with 40x leverage.

The long showed that some participants tried to fade the leverage flush. The Hyperliquid trader story still dominated attention.

Binance Display Issue Response: Engines Stayed Online, $283M Compensation

Attention shifted to Binance during the sell-off. Some traders reported order book issues and missed stop-loss executions. Others flagged depegs or extreme wicks in several tokens.

Binance called it a “display issue.” The exchange said spot and futures matching engines and API trading “remained operational.” Binance rejected claims that platform instability caused the market drop.

Binance also addressed collateral effects from USDE, BNSOL, and WBETH. It denied that depegs triggered the crash.

It still outlined about $283 million in compensation for users liquidated while those tokens served as collateral. Meanwhile, BNB price rose 14% over 24 hours to about $1,351.38.

Hyperliquid Trader Risk: Liquidation at $125,500, 10x Leverage Matters

The Hyperliquid trader still holds the $163 million Bitcoin short. The published liquidation level is $125,500. If BTC reaches that price, the position liquidates.

The reported $3.5 million profit can move fast with 10x leverage. Funding and basis can shift Bitcoin short P&L quickly.

Therefore, the BTC handle remains central to the Hyperliquid trader risk.

Trackers continue to monitor 0xb317 on Hyperliquid. The prior $192 million result keeps interest high. Each new Bitcoin short by the Hyperliquid trader draws immediate scrutiny.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 13, 2025 • 🕓 Last updated: October 13, 2025