Once upon a high-yield Treasury, America’s monetary wizards slipped out of their fortress with a magic trick nobody asked for.

The Federal Reserve, in a dazzling act of fiscal showmanship, just hit pause on quantitative tightening, raising eyebrows, and possibly the price of every ounce of shiny metal and pixelated digital coin from Manhattan to Mars.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The Fed’s latest pivot

Ray Dalio, Bridgewater Associates’ captain took to the digital soapbox, waving red flags at the Fed’s latest pivot, balance sheet maintenance at $6.5 trillion starting December.

Instead of weaving mortgage-backed securities, they’re shuffling income straight into Treasury bills.

“Technical maneuver,” they say, like slapping duct tape on a leaking spaceship and calling it innovation.

But Dalio’s not buying the cover story. He’s labeled it as late-cycle bubble stimulation, not recession triage.

In a market where the S&P 500’s earning yield is barely a whisker above the 10-year Treasury, the fiscal terrain is about as stable as a Jenga tower in a hurricane.

Big Debt Cycle

Let’s skirt backward through history for a sec. The Fed wasn’t always in the habit of pumping liquidity while stocks scaled mountaintops and inflation jumped past its 2% goal like a caffeinated gazelle.

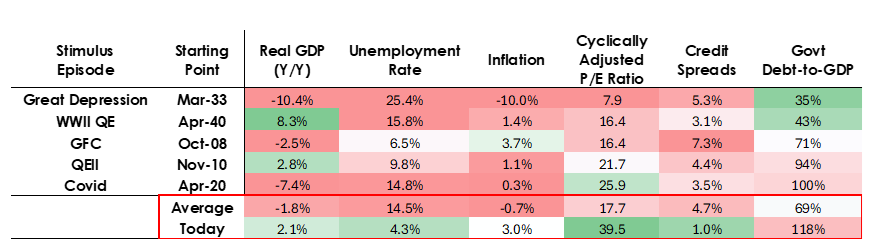

But now? Dalio thinks we’re living in an upside-down wonderland, 2% GDP growth, 4.3% unemployment, and the kind of inflation that makes economists sweat through their suits.

Dalio says Fed easing today is rocket fuel for bubbles, AI stocks lighting up his proprietary warning lights for speculative insanity.

Mix in titanic government spending, Treasury bill sleight-of-hand, and perpetual balance sheet inflation, and you’ve got all the ingredients for what he dubs “Big Debt Cycle” excess.

And what happens when liquidity gushes in? Experts say true market moves started well before anyone cut ribbons at this policy grand opening.

Crypto markets, as sensitive to Fed moods as a cat in a thunderstorm, aren’t really bottoming out until genuine easing floods the streets.

The perfect moment to cash-out

Many says it’s not a coincidence that gold just blasted past $4,000 per ounce.

The World Gold Council’s latest dispatch reads like a treasure map, with Q3 demand climbing 3% as global investors pile on. Central banks, it seems, have caught bubble fever.

But Dalio’s warning isn’t just for torchbearers in gold caves or Bitcoin evangelists.

When the Fed stirs this cauldron, rate cuts, deficit theatrics, and explosive balance sheets, the only sure bet is a liquidity melt-up, a mad dash we last saw in the roaring sunsets of 1999 and 2011.

So, if you’re waiting for the perfect moment to cash out, Dalio says watch for the market melt-up and get your parachute ready before the tightening smackdown pops the bubble.

Tick tock, seekers of asset glory.

Ray Dalio’s warning feels like déjà vu for anyone who’s lived through past boom-and-bust cycles. The Federal Reserve’s pivot might look technical on paper, but markets are already sniffing the scent of easy money.

Gold hitting new highs, Bitcoin rebounding, and tech valuations flirting with madness all scream “liquidity party.”

Still, Dalio’s voice reminds us — parties like these don’t end quietly. As the Fed dances closer to the fire, investors might want to keep one hand on their exit strategy.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: November 7, 2025 • 🕓 Last updated: November 7, 2025

✉️ Contact: [email protected]