Binance’s Bitcoin futures market just took a hard left turn away from the chaos highway, according to CryptoQuant’s latest intel, brought to you by analyst Crazzyblockk.

After a bruising sell-off last week, the speculative leverage that had traders biting their nails has cooled off sharply, signaling a possible calming of the storm.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Stable market behavior

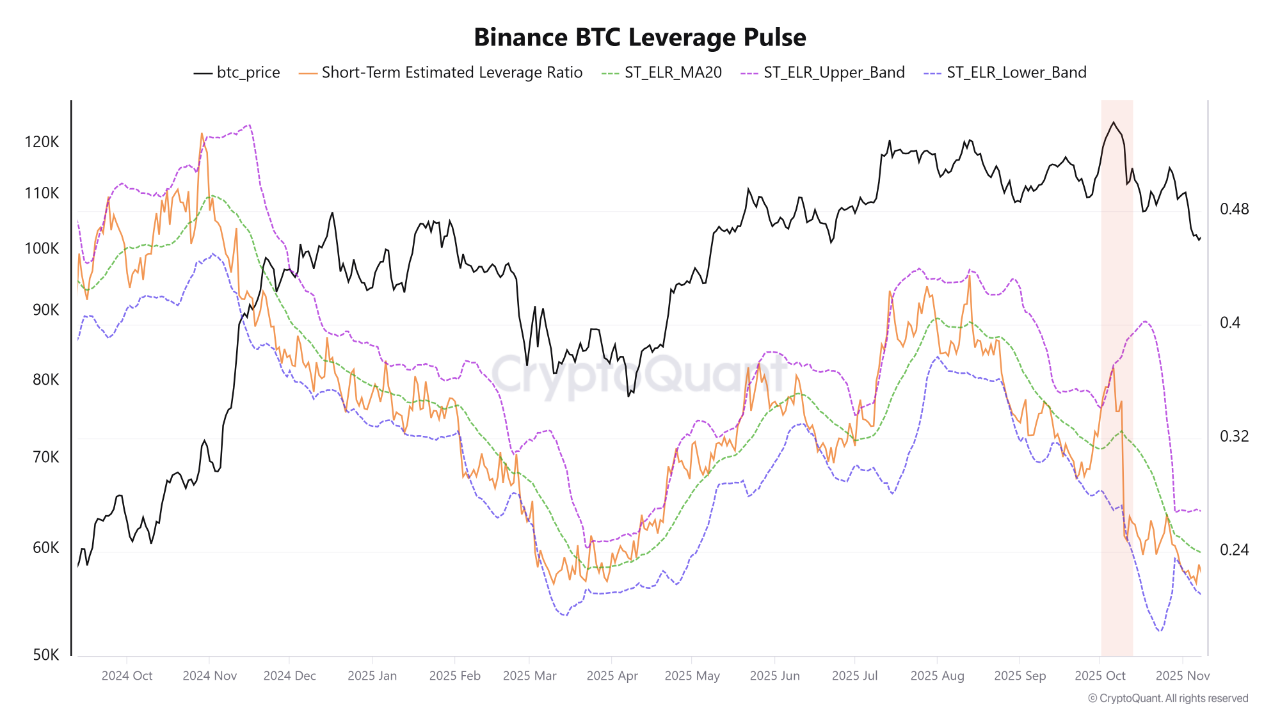

The Short-Term Estimated Leverage Ratio on Binance dropped to 0.2247 on November 8, 2025, slipping below its 20-day average of 0.2391 and eyeballing the lower boundary of stable market behavior, around 0.2069.

Imagine leverage as the market’s caffeine buzz. Too much and it jitters wildly, less, and it breathes easier.

This fresh dip in leverage came hot on the heels of Bitcoin tumbling from $110,000 to the low $102,000 territory as panicked traders scrambled to close out risky leveraged bets.

Calmer path

CryptoQuant calls this the “cleansing phase,” where frazzled traders get nudged out of the ring and liquidity takes center stage.

This reset is far from a disaster, it’s the market hitting the refresh button, slashing short-term risk, and laying bricks for a steadier road ahead.

The ST_ELR itself is a neat little formula, it’s Open Interest divided by Stablecoin Reserves, giving a slick glimpse of how leveraged the market is versus how much backup cash is stashed away. Lower numbers mean safer ground.

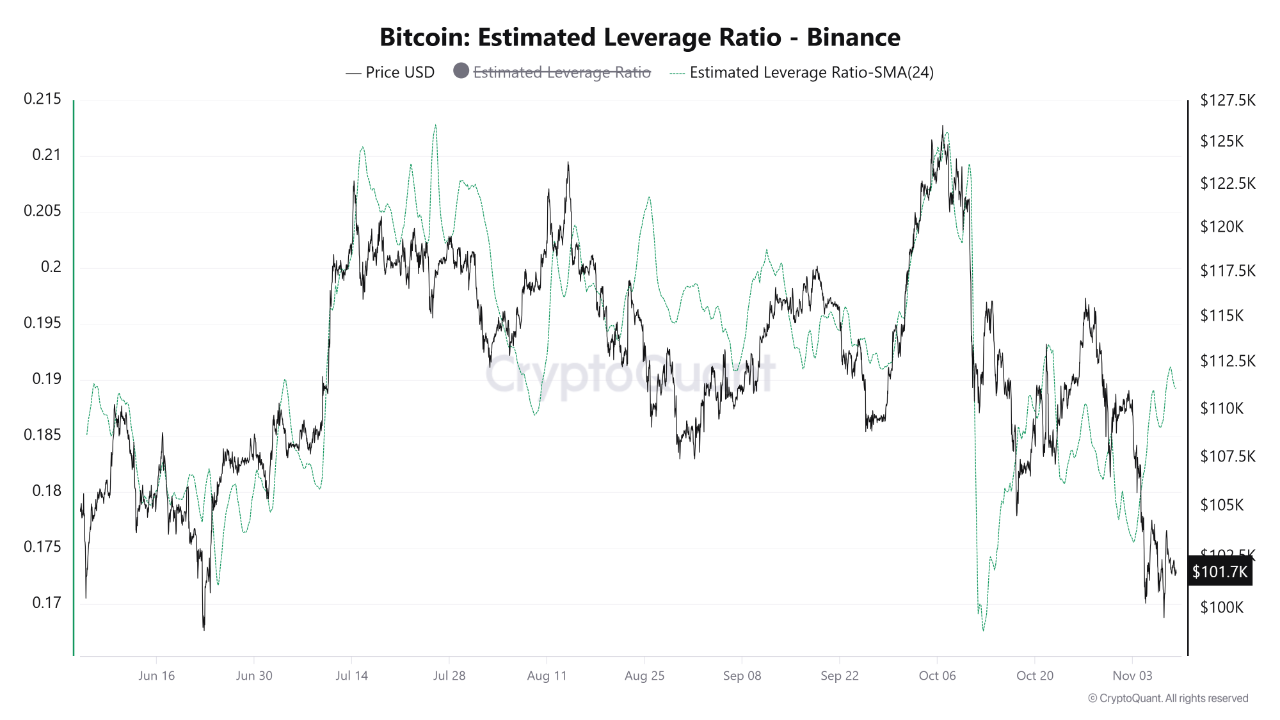

Analysts say Binance’s toolbox is also looking good here. Its automated controls and a treasure chest of stablecoins have soaked up recent shocks like a pro, making that market rollercoaster a bit less stomach-churning.

This suggests leverage is no longer driving crazy swings, instead, the platform’s risk management is steering a calmer path.

Slow-but-steady climb

What’s next? CryptoQuant’s crystal ball sees the leverages plunging into historically low territory, a usual harbinger of stabilization or, if you’re lucky, a short-term bounce.

The liquidation tidal wave that shook crypto markets may be crashing into quieter waters, with risk mellowing and liquidity flowing freely. That spells sideways action or a slow-but-steady climb in the near future.

When leverage cools, crypto breathes.

Binance’s deleveraging isn’t a sign of weakness — it’s the hangover cure the market needed. After months of high-octane trading, this drop feels like a collective deep breath before the next move.

CryptoQuant’s data hints at a maturing cycle: fewer wild bets, more stability, and the kind of controlled environment institutions love.

Still, traders should remember — calm seas in crypto often precede another storm.

Whether this reset leads to consolidation or sparks a stealth rally, Binance’s risk controls are proving why the exchange still sets the tone for the entire derivatives landscape.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: November 11, 2025 • 🕓 Last updated: November 11, 2025

✉️ Contact: [email protected]