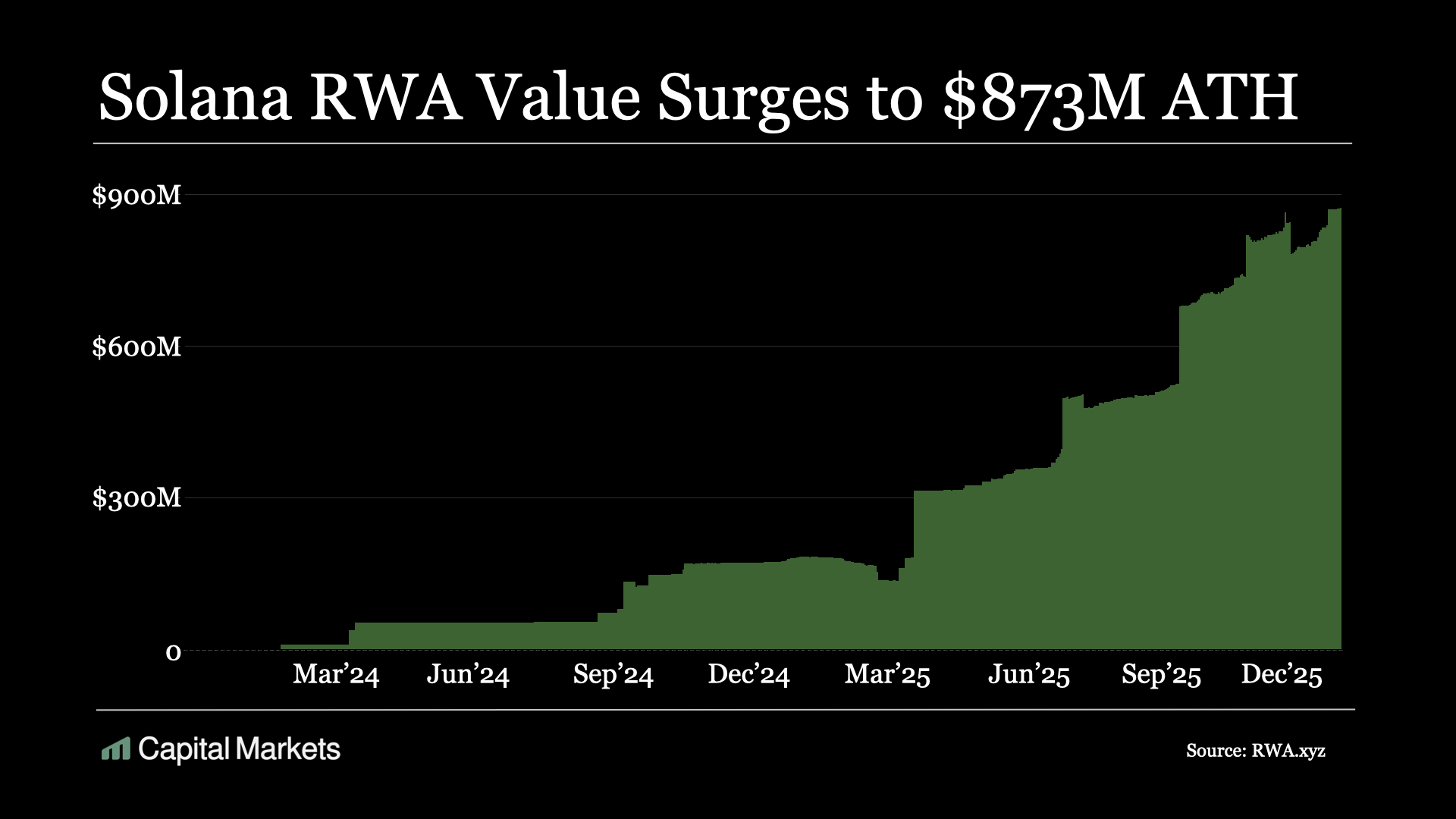

Solana RWA activity rose into the end of 2025, based on RWA.xyz data.

The dataset showed tokenized RWAs on Solana increased nearly 10% over the last month to a record $873.3 million.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

At the same time, the number of holders expanded. RWA.xyz data showed 126,236 Solana RWA token holders, up more than 18.4% over the same period.

The reported mix stayed heavy on government debt products. Much of the real world asset tokenization on Solana backed US Treasuries, including BlackRock BUIDL and Ondo US Dollar Yield, according to the figures cited.

Solana tokenized Treasuries lead with BlackRock BUIDL $255.4M and Ondo US Dollar Yield $175.8M

The report listed two large Treasury-linked products on Solana. It cited BlackRock BUIDL with a market cap of $255.4 million, while Ondo US Dollar Yield stood at $175.8 million.

It also pointed to growth in tokenized equities. Tesla xStock was cited at $48.3 million, and Nvidia xStock was cited at $17.6 million, adding to the broader Solana RWA base.

A chart said Solana is positioned to become the third blockchain to exceed $1 billion in tokenized RWAs, behind Ethereum at $12.3 billion and BNB Chain, which it said recently passed $2 billion.

Solana spot ETFs show $765 million inflows, while Western Union picks Solana for stablecoin settlements

The report tied part of the shift to US-listed funds. It said the US Securities and Exchange Commission approved the first group of Solana spot ETFs in late October, and it described a total of six spot Solana exchange-traded funds.

It also cited inflow totals for those funds. Using Farside Investors data, it reported combined inflows of $765 million into the Solana spot ETFs.

Separately, the report said Western Union chose Solana for a stablecoin settlements platform. It said the system targets more than 150 million customers across 200+ countries and territories, with a rollout expected in the first half of 2026.

SOL price starts 2026 near $125, still 57% below the $293.3 all-time high

The report placed SOL price around $125 as 2026 began. It compared that level with roughly $190 at the same time a year earlier.

It also referenced Solana’s peak. The report said SOL remains more than 57% below its $293.3 all-time high from Jan. 19, 2025.

For comparison, the report said Bitcoin and Ether set all-time highs more recently, in October and August, and trade closer to those levels than SOL, based on the prices cited.

Solana app revenue tops $110 million in 30 days, DeFiLlama data shows

The report pointed to network revenue as a separate metric. It said Solana app revenue led all blockchains over the past 30 days, based on DeFiLlama data.

It listed Solana at more than $110 million over that period. It also listed Hyperliquid at $61.1 million and Ethereum at $47.2 million.

The report framed those figures as evidence of sustained usage beyond short-lived trends.

It connected the revenue numbers to Solana’s broader activity alongside Solana RWA growth and Solana spot ETFs inflows, without changing the underlying data points.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 2, 2026 • 🕓 Last updated: January 2, 2026