The New York Stock Exchange and its parent, Intercontinental Exchange, outlined an NYSE tokenization plan to support 24 7 trading and instant settlement for stocks and ETFs using a blockchain post trade system. The plan also mentions custody and multi chain support.

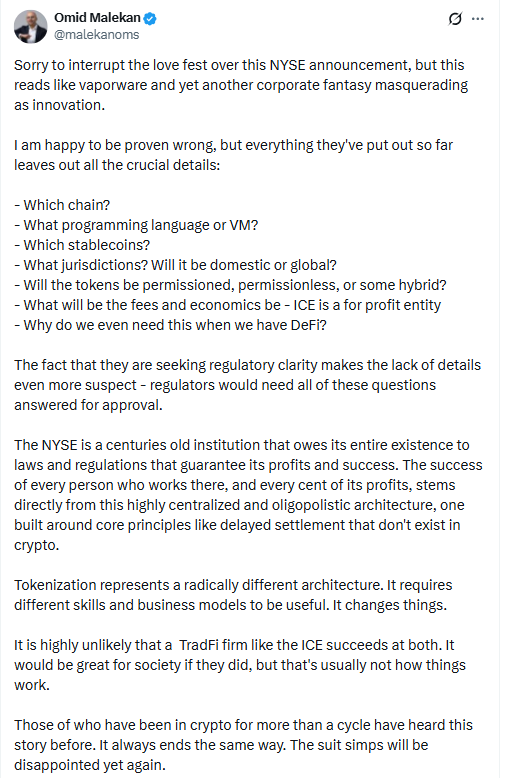

A Columbia Business School professor, Omid Malekan, said the NYSE tokenization plan reads like “vaporware.”

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

He said the announcement lacked key technical and market structure details.

ICE said the platform would enable blockchain based settlement for tokenized products. However, the initial announcement did not specify a launch date or chain choice.

NYSE tokenization plan targets tokenized equities with 24 7 trading and instant settlement

ICE said the platform would bring tokenized equities into a structure that runs beyond standard market hours.

As a result, the NYSE tokenization plan centers on always on access and faster completion of trades.

The company said the system would use a blockchain post trade layer. It also said the platform would include custody features and support more than one chain.

ICE linked the plan to stocks and ETFs and described a shift in the settlement flow. The pitch focused on instant settlement and a 24 7 market, instead of a traditional cycle.

Omid Malekan says NYSE tokenization plan looks like vaporware

In a post on X, Omid Malekan questioned basic design choices in the NYSE tokenization plan. He asked which chain it would use and how permissions would work.

He also flagged open questions about fees and token economics. The post focused on missing information, not performance claims.

Malekan also wrote that NYSE operates through a “highly centralized and oligopolistic architecture.” He added that “no amount of computer science and cryptography” changes that unless NYSE changes partner relationships.

Tokenized equities debate grows as Securitize comments and ARK Invest cites big figures

While Malekan raised concerns, other executives described the NYSE tokenization plan as constructive for real world asset tokenization. Their comments focused on native issuance and market access.

Carlos Domingo, founder and CEO of Securitize, wrote on X:

“On chain trading of native tokenized equities coming from NYSE, no wrappers, no derivatives, no tokenized entitlements.”

His post tied the NYSE tokenization plan to direct tokenized equity trading.

Separately, ARK Invest projected that the tokenization market could grow from $22.2 billion to $11 trillion by 2030.

The estimate linked growth to clearer rules and stronger institutional infrastructure, as firms keep building systems for tokenized assets.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 22, 2026 • 🕓 Last updated: January 22, 2026