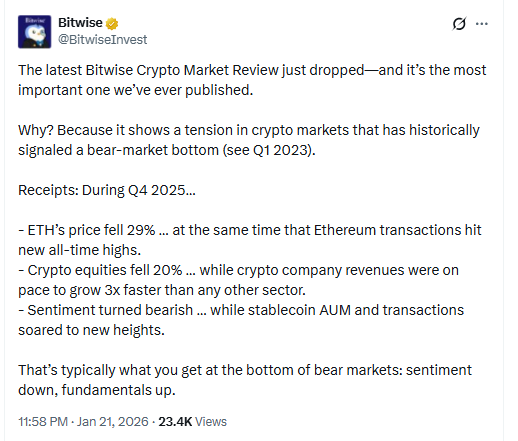

Bitwise said Q4 2025 showed signals that can appear near a crypto bear market bottom, even as prices stayed weak.

Matt Hougan, Bitwise’s chief investment officer, wrote that the quarter delivered mixed data, with several crypto fundamentals rising while crypto prices pulled back.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Hougan compared the Q4 2025 setup to early 2023 after the FTX collapse. He said the market saw uneven data at that time, and later price performance improved.

“At the time, we were starting to rebound post-FTX, and the data was topsy-turvy; some up, some down, some sideways. In the two years that followed, crypto prices soared,”

Hougan said.

Hougan then tied that earlier pattern to the current quarter. “That’s happening again here. In fact, the report shows a unique split, with strong growth on many fundamental statistics—and major pullbacks on price,” he said.

Bitwise Q4 2025 Report Points to Bitcoin Context and a Crypto Bear Market Bottom Setup

The Bitwise report said crypto markets struggled in Q4 2025 even as activity measures improved.

Hougan said the mismatch mattered because it created the type of divergence often seen near a bear market bottom.

He pointed to Bitcoin as a reference for the last cycle. He said Bitcoin climbed from around $16,000 in 2023 to about $98,000 by the start of 2025, after the market absorbed the FTX fallout. He used that move to show how weak sentiment and uneven data can occur before a sustained recovery.

The report did not describe a single trigger for the Q4 weakness. Instead, it focused on the gap between price action and crypto fundamentals across several categories, including Ethereum transactions, stablecoin market cap, and DeFi adoption.

2026 Crypto Market Views Split as Fundstrat’s Tom Lee and VanEck Map Different Paths

Analysts quoted alongside the Bitwise report gave different expectations for the 2026 crypto market. The split showed up in timing rather than in the focus on macro conditions.

Tom Lee, Fundstrat’s head of research, said the market could struggle through much of 2026 before improving late in the year. The report linked that view to tariffs and political tensions as pressure points.

Meanwhile, VanEck said Q1 2026 could support “risk-on” assets such as crypto. The firm pointed to more clarity around fiscal policy and signs of stabilization in the United States, according to the report summary.

Hougan kept his focus on Q4 data, and he argued that the divergence between sentiment and activity appeared during the quarter’s pullback.

Ethereum Transactions, Stablecoin Market Cap Above $300B, and DeFi Adoption Led the Bitwise Q4 2025 Signals

Hougan listed four trends from Q4 2025 that he said supported the case for stronger underlying conditions. He presented them as measures that moved higher while prices weakened.

First, he said Ethereum and layer-2 transactions reached all-time highs. He tied the rise to network usage and on-chain activity rather than price movement.

Second, he said crypto company revenues outpaced other sectors in the stock market, based on the report’s tracking. He used that point to show that business activity did not move in line with the Q4 pullback.

Third, Hougan pointed to stablecoin transactions and assets under management rising to new highs in Q4. He also said the stablecoin market cap moved above $300 billion during the quarter, setting a new high level for fiat-pegged assets.

Fourth, he cited DeFi adoption, with Uniswap as the example. He said Uniswap “now reliably processes more transaction volume than Coinbase.”

He then tied that to the broader pattern he saw in Q4 2025.

“That’s the kind of divergence you get at the bottom of bear markets, when sentiment is down but fundamentals are up,” Hougan said.

CLARITY Act, Stablecoin Supercycle, Fed Chair Change, and Wirehouse Crypto ETF Access Featured in Bitwise 2026 Watchlist

Bitwise also listed several developments it said could matter in 2026. The report cited progress on the CLARITY Act and framed stablecoins as a continuing theme, calling it a “stablecoin supercycle.”

The report also noted a future U.S. Federal Reserve chair announcement as a market factor to watch. It did not attach a date in the summary, but it grouped the topic with policy and access changes.

Finally, Bitwise said three major wirehouses could open client access to crypto exchange-traded funds. The report framed that as a distribution shift that could widen participation in crypto ETFs.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 22, 2026 • 🕓 Last updated: January 22, 2026