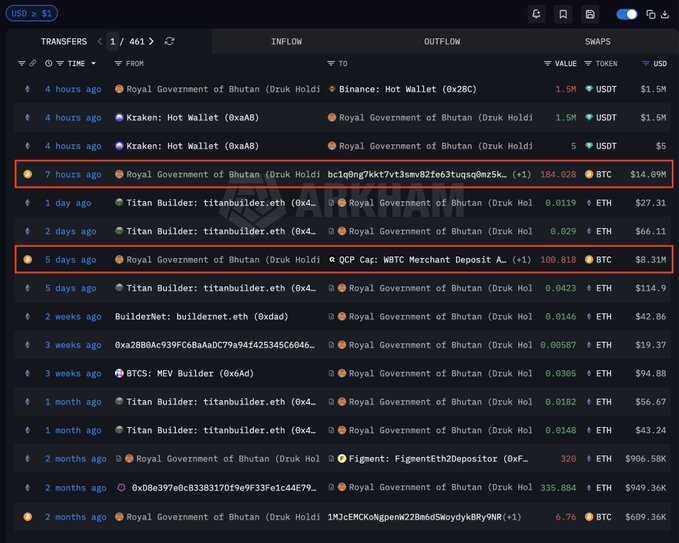

Bhutan shifted more than $22 million in Bitcoin from wallets tied to its national reserve, according to Arkham data.

Arkham tracking showed a transfer of 184 BTC worth about $14.09 million on Feb. 4, 2026.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

It followed a separate move of about 100.818 BTC worth around $8.31 million on Jan. 30, 2026, also flagged through Arkham monitoring.

Arkham said the combined Bhutan Bitcoin sale transfers went to QCP Capital.

QCP Capital operates as a trading firm and market maker. In practice, transfers to market makers often appear when holders want faster access to liquid markets.

Arkham did not confirm a sale execution on chain. Still, the destination and timing put the movement under the “possible sale” lens used for similar flows.

Bhutan Bitcoin holdings fall to about 5,700 BTC, slipping in nation state rankings

Arkham research shows Bhutan Bitcoin holdings declined from a peak of 13,295 BTC in October 2024 to about 5,700 BTC.

That drop pushed Bhutan down the list of nation state Bitcoin holders, based on public rankings that track government treasuries.

Bitcoin Treasuries data places Bhutan seventh, behind the United States, China, the United Kingdom, Ukraine, El Salvador, and the United Arab Emirates.

Arkham has linked Bhutan’s stash to state backed mining. It said Bhutan’s Bitcoin came from mining operations rather than seizures tied to criminal cases.

The same Arkham coverage ties the operations to Druk Holding and Investments. It describes mining activity dating back to 2019.

Bitcoin halving raises Bitcoin mining cost as Bitcoin hashrate dips under 1 zettahash

Arkham said Bitcoin mining cost to produce 1 BTC roughly doubled after the 2024 Bitcoin halving.

It also noted Bhutan now mines less than in 2023, when it mined about 8,200 BTC.

Mining pressure has shown up in network measures too. CoinDesk reported the network’s average computing power fell from around 1.1 zettahashes per second in October to roughly 977 exahashes per second by mid January.

Other coverage also reported the Bitcoin hashrate slipping below 1 zettahash per second around that period, as miners cut back when margins tightened.

The Bhutan moves also landed during a broader Bitcoin slide. Reuters reported Bitcoin hit an all time high above $125,000 in early October 2025.

Later reporting described Bitcoin trading more than 40% below an October peak near $126,000, as macro uncertainty weighed on risk assets.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 5, 2026 • 🕓 Last updated: February 5, 2026