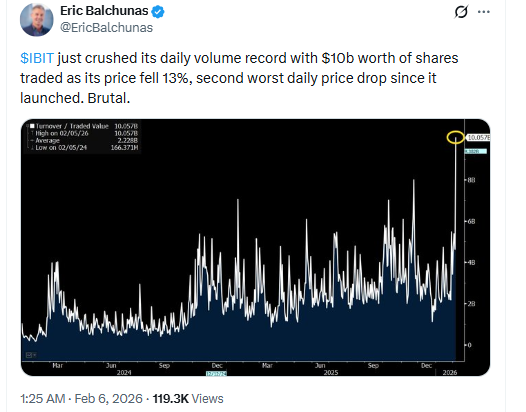

BlackRock IBIT set a new daily trading record as the Bitcoin crash deepened on Thursday. The iShares Bitcoin Trust saw about $10 billion in shares traded in one day, according to Eric Balchunas.

Balchunas, a Bloomberg ETF analyst, posted on X that the IBIT trading volume “crushed its daily volume record.” The surge came as Bitcoin price dropped sharply during the same session.

Meanwhile, CoinGecko data showed Bitcoin price fell 12% in the past 24 hours to around $64,000. Bitcoin later bounced after touching a low near $60,300.

IBIT trading volume hits $10B during spot Bitcoin ETF rush

The IBIT trading volume figure reflects intense activity inside the spot Bitcoin ETF. Traders rotated positions as Bitcoin price moved fast.

Balchunas said BlackRock IBIT fell 13% on the day. He described it as the fund’s “second-worst daily price drop since it launched.”

He also pointed to a prior low day. Balchunas said the largest one day drop was 15% on May 8, 2024.

Bitcoin crash drags iShares Bitcoin Trust from $70 peak to $36.10

The Bitcoin crash followed a longer decline from earlier highs. CoinGecko data showed Bitcoin fell about 50% from an all time high near $126,000 in early October.

Even so, the intraday move showed a rebound. Bitcoin climbed after it printed $60,300, then traded near $64,000.

The iShares Bitcoin Trust tracked that slide. BlackRock IBIT peaked near $70 in early October, then dropped about 48% to $36.10 by Thursday’s close.

Bitcoin ETF outflows reach $373.4M as IBIT net outflows build

Flow data showed pressure ahead of the record session. On Wednesday, IBIT net outflows totaled $373.4 million.

The report also said BlackRock IBIT has logged just 10 trading days of net inflows so far in 2026. That count highlights a choppy stretch for the spot Bitcoin ETF.

The same report linked weaker demand to an earlier market break in early October. Since then, the Bitcoin crash has continued to weigh on broader crypto prices.

Eric Balchunas flags record activity as CoinGecko data tracks $60,300 low

The record day landed as macro headlines hit risk assets. The report tied the Bitcoin crash to weak US job market data.

The report also cited concerns about capital flows into the artificial intelligence sector. Those concerns appeared as investors adjusted exposure across markets.

Separately, Bob Elliott of Unlimited Funds said on Sunday that the average dollar invested in BlackRock IBIT is now underwater, as of the prior Friday close.

In another reaction, veteran trader Peter Brandt wrote on Wednesday that Bitcoin shows “fingerprints of campaign selling,” while he also noted few buyers stepping in.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 6, 2026 • 🕓 Last updated: February 6, 2026