TRON fell to about $0.278 on the daily TRX/USD chart from TradingView dated Feb. 13, 2026, extending a multi-week decline and keeping price below the 50-day exponential moving average near $0.289. As a result, the broader structure remains weak.

Price trades inside a falling channel drawn from the August peak, and recent candles failed to reclaim the descending trendline, which continues to cap rebounds.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Therefore, rallies have stalled near the channel top, while pullbacks have held above the late-June base.

Fibonacci retracement levels from the July low near $0.2575 to the August high near $0.3660 frame the current range.

The 0.618 level sits near $0.299, while the 0.50 midpoint stands around $0.311. Price now trades below both levels, which places TRX in the lower half of the prior impulse zone.

In addition, the 50-day EMA aligns close to the 0.618 retracement, which tightens overhead resistance and explains repeated rejections near the $0.29–$0.30 band. As long as price holds below that confluence, upside attempts remain limited.

At the same time, momentum reflects fading strength. The daily RSI prints near the low-40s and sits below its signal average, which shows weak follow-through on rebounds.

However, price continues to respect the lower boundary of the descending channel and the July base near $0.2575, which marks the key downside reference from the same Fibonacci swing.

A reversal confirmation would require a daily close back above the descending trendline and the 0.618 retracement near $0.299, followed by acceptance above the 50-day EMA near $0.289.

If that sequence holds, the next technical test sits at the 0.50 retracement near $0.311, which would signal a shift from channel resistance into reclaimed support.

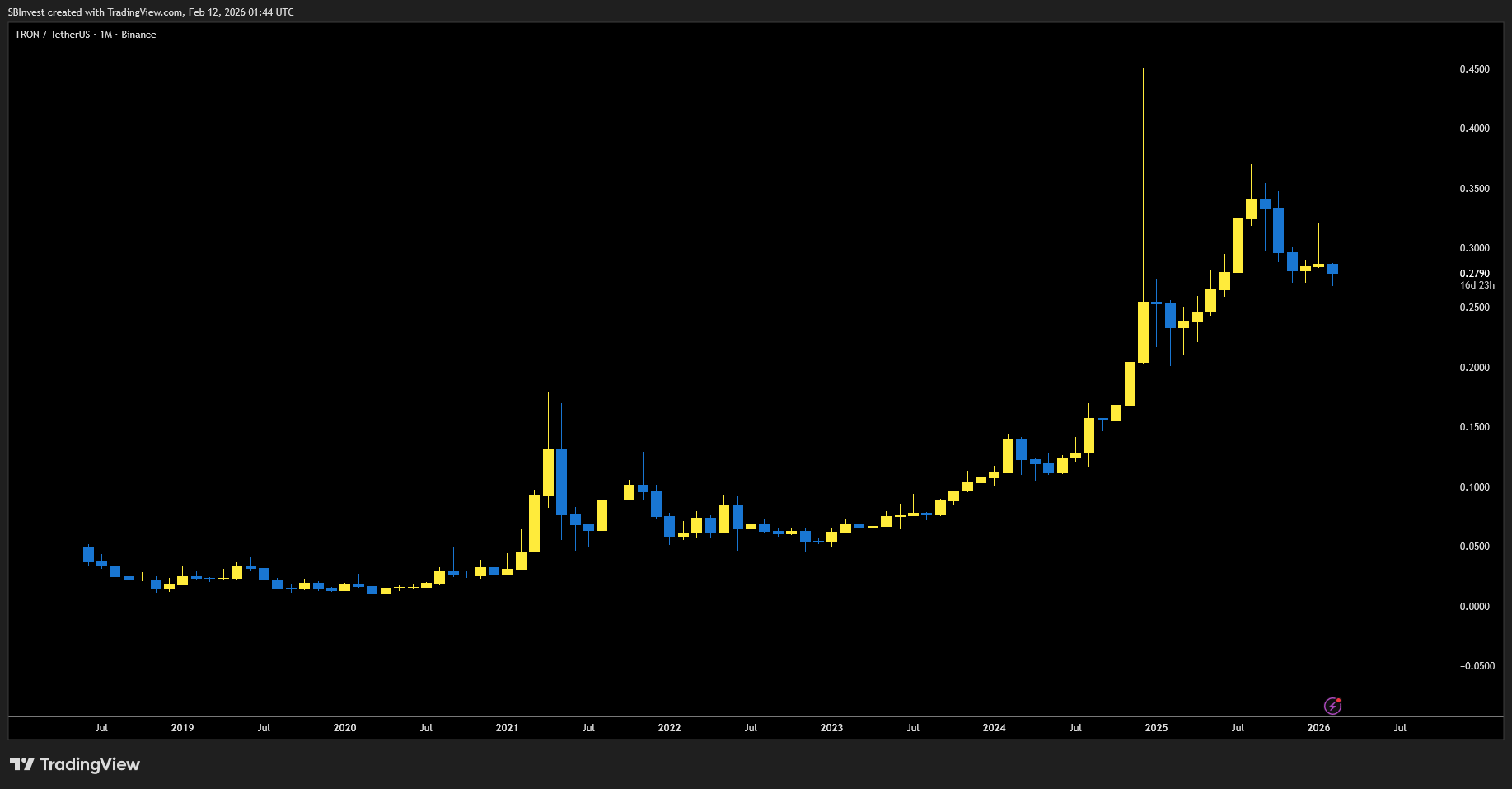

TRX Monthly Structure Shows Pullback From Cycle High as Long-Term Trend Holds

TRON’s monthly TRX/USDT chart from TradingView on Binance shows price rising in stages from 2020 through 2025, followed by a pullback after a sharp cycle peak.

The structure keeps higher swing lows across the multi-year trend, which places the broader move inside a long-term uptrend despite the recent cooling phase.

The last cluster of monthly candles forms a consolidation band after a steep advance, which reflects slowing momentum rather than a full trend break. As a result, price now trades inside a pause zone that follows a parabolic leg higher.

The cycle history adds context to the current range. Earlier peaks in 2021 printed fast spikes that failed to hold, then gave way to long base building through 2022 and 2023.

The latest advance expanded more gradually before the vertical push into the cycle high, which then met swift rejection.

That sequence mirrors prior blow-off phases where upside strength faded after extended runs. Therefore, the chart shows exhaustion at the top of the move, followed by digestion through overlapping monthly candles.

Structure across the middle of the range remains intact. The post-peak pullback retraced part of the prior impulse but did not unwind the higher-low sequence formed since 2023.

As long as monthly closes continue to hold above the prior expansion base from the earlier breakout zone, the long-term trend structure remains intact.

A structural shift would require sustained monthly acceptance below that base, which would mark a break in the multi-year higher-low pattern and confirm a broader trend change.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 13, 2026 • 🕓 Last updated: February 13, 2026