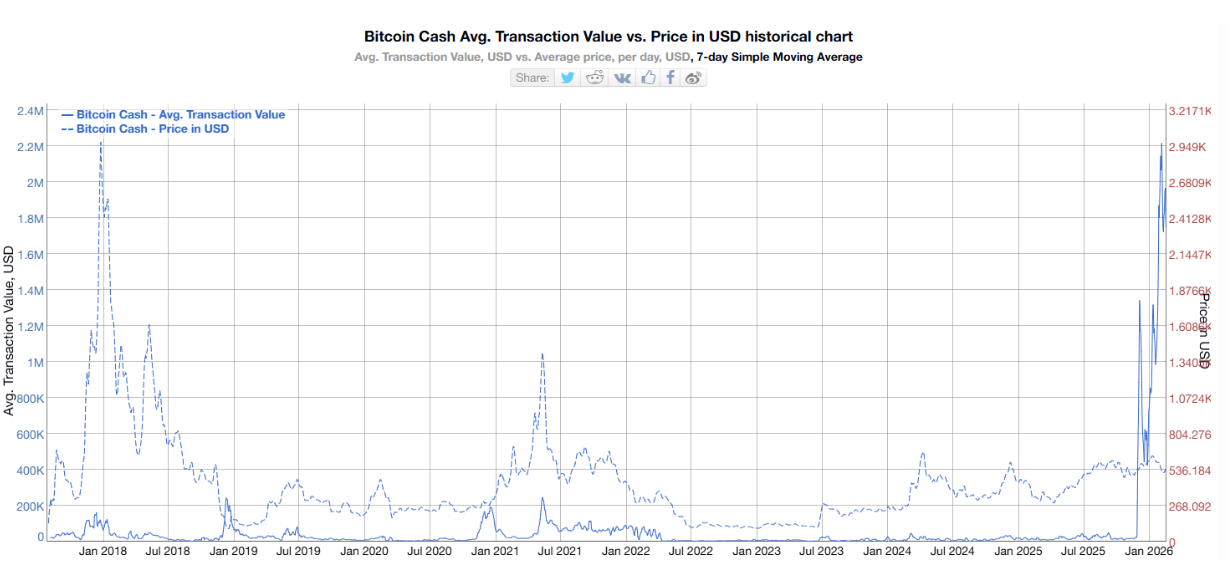

While the crypto market panics, Bitcoin Cash is thriving. BCH has set multiple records in February despite extreme market fear.

The network has seen increased activity and transaction volume. The price has shown resilience even as broader markets decline.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

What’s behind the resilience

The performance is notable because it runs counter to the broader trend. Most altcoins are down.

Fear is high. Bitcoin itself has struggled. But BCH is setting records. What’s behind the resilience? Part of it is utility.

Bitcoin Cash has positioned itself as a payments-focused cryptocurrency. When markets get volatile, utility matters more than speculation.

Community and fundamentals

Part of it is the community. Bitcoin Cash has a dedicated base of users and developers who believe in the original vision of peer-to-peer electronic cash.

That belief translates into sustained activity even during downturns.

The record metrics include transaction count, active addresses, and network activity. These are fundamental indicators. They suggest real usage, not just speculative trading.

Proving demand for payments crypto

The contrast with other altcoins is striking. Many projects are seeing declining activity.

Their communities are quiet. Their prices are falling. BCH is bucking the trend. This doesn’t mean BCH is immune to market conditions.

If the bear market continues, BCH will likely feel pressure. But the relative strength is worth noting.

Bitcoin Cash is proving that there’s still demand for a simple, payments-focused cryptocurrency. Even in a bear market. Especially in a bear market.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 22, 2026 • 🕓 Last updated: February 22, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.