The crypto market has been a bit of a mess lately. Alts have been taking a beating. Solana, Ethereum, and the gang?

They’ve dropped over 65% in value since the start of 2025. But there’s a whisper in the wind, because a key indicator just flashed a big, bold “BUY” signal.

Signs

CryptoQuant analyst DarkFost, dope nickname btw, sounds like someone straight out of Gotham, says it might be the perfect moment to tiptoe back into alt positions.

It might be time to start a DCA strategy on Altcoins.

“We’ve entered a buying zone, which is defined by the 30-day moving average falling below the annual average… last time we reached these levels was in September 2023, right after the bear market ended.” – By @Darkfost_Coc pic.twitter.com/xEHnHD5bg8

— CryptoQuant.com (@cryptoquant_com) April 11, 2025

Why? He’s looking at trading volume trends, specifically the 30-day moving average dipping below the yearly average.

The last time this happened was September 2023, just before altcoins went on a bull run. History repeating itself? Maybe. Or maybe it’s just another tease from the crypto gods.

To really understand altcoin momentum, you’ve got to check out Bitcoin dominance, the BTC.D and Tether dominance, aka USDT.D.

Back in November 2023, when altcoins were partying hard, USDT.D dropped as traders swapped stablecoins for altcoins. BTC.D fell too as capital flowed from Bitcoin into these smaller coins.

Vibe shift

But fast-forward to now, and the vibe is totally different. BTC.D has climbed to 63.5%, meaning investors are sticking with good ol’ Bitcoin instead of gambling on alts.

USDT.D also rose from 4% to 5.6%, showing cautious traders are parking their cash in stablecoins after some nasty market drawdowns earlier this year. Translation? Nobody’s rushing into altcoins just yet.

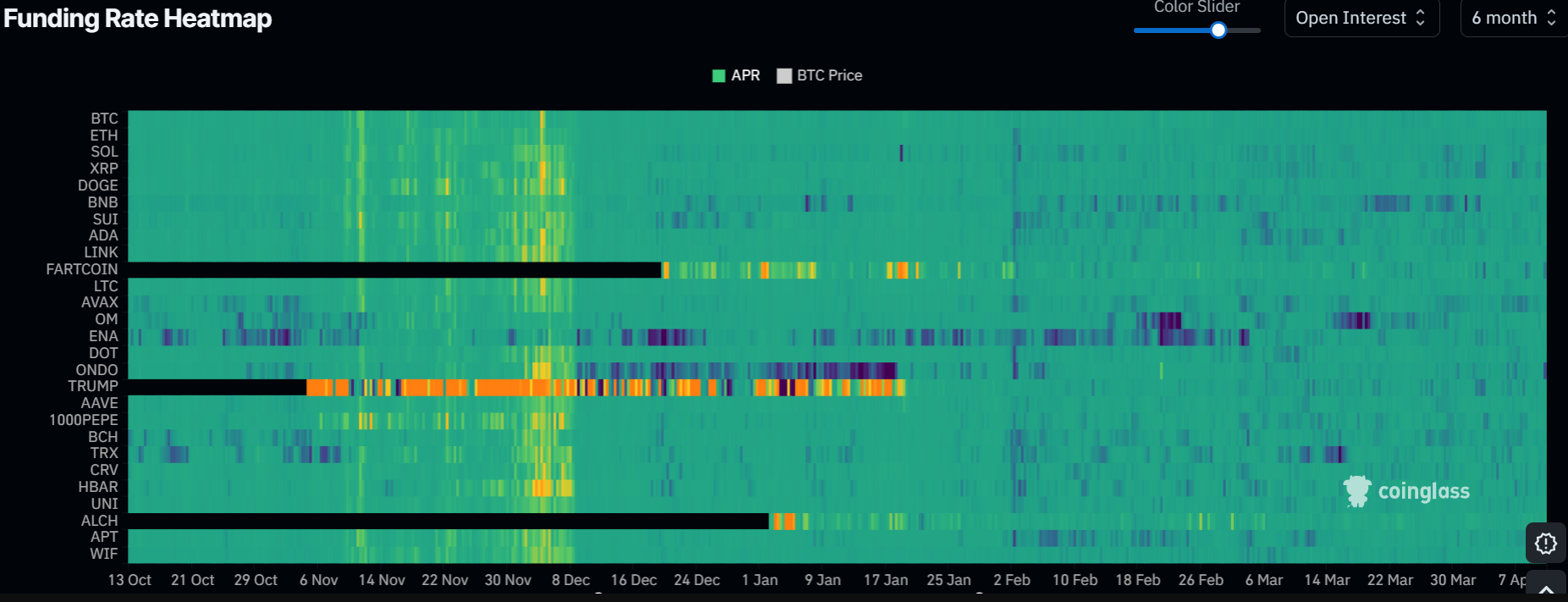

Here’s where things get interesting again, as funding rates and RSI heatmaps suggest that altcoins are undervalued right now.

Unlike late 2024, when funding rates jumped to 50-80%, they’re now chilling below 10%. That means less froth and more stability, a setup that could lead to gains if the macro environment plays nice.

Outliers

Still, not all altcoins are snoozing through this slump. Some outliers like Onyxcoin and Fartcoin, yes, that’s its real name, imagine reading this five years ago, have skyrocketed over 100% in just a week.

Curve DAO isn’t doing too shabby either, up nearly 50% in the past month. So while most of the sector looks like it’s stuck in quicksand, these gems are defying gravity.

DarkFost thinks it’s time to start DCA-ing at altcoins with a mid-term outlook, but don’t go all-in just yet.

The market’s undervalued, sure, but it’s also cautious and waiting for bigger catalysts to shake things up.

Have you read it yet? Bitcoin is strong, unbothered by tariffs and market turmoil?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.