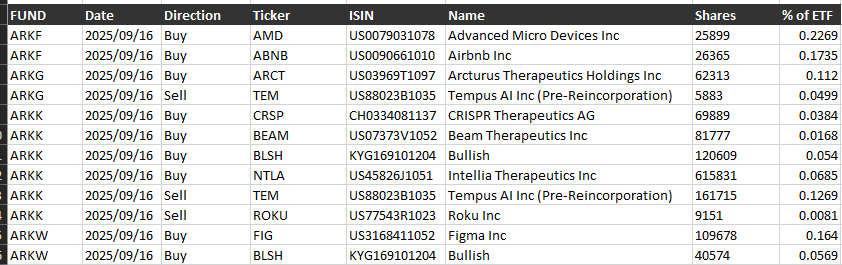

ARK Invest bought 161,183 Bullish (BLSH) shares on Tuesday for about $8.21M across ARKK and ARKW.

The firm’s combined Bullish holdings across ARKK, ARKW, and ARKF now stand near $129M. Current ownership is about 2.52M shares.

ARK Invest adds Bullish shares across ARKK and ARKW

ARK Invest disclosed purchases of 120,609 BLSH shares for ARKK and 40,574 shares for ARKW.

The reported total value for Tuesday’s trade was roughly $8.21M. The update came through the firm’s daily trade report.

ARK Invest entered Bullish on Aug 13, 2025 during the NYSE listing. That day, ARKK, ARKW, and ARKF bought about 2.53M shares. The initial position was valued near $172M at the time.

Additional activity followed. ARK Invest reported about $21M of Bullish purchases on Aug 20 and about $7.5M earlier this month.

The current share count is 2.52M, which is slightly below the first disclosed total.

Bullish stock and IPO context ahead of earnings

Bullish priced its IPO at $37 on Aug 13, 2025. During the first session, the stock reached an intraday high near $118. That peak came before a steady retrace into September.

On Tuesday, BLSH closed around $51.36. The level is about 57% below the high and above the IPO price. Recent sessions showed a range near $48 to $52.

Company metrics are available ahead of results. Reported revenue fell 0.2% year over year for the quarter ending March.

Operating income decreased about 270% for the same period. Bullish will release second quarter results on Thursday.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Analyst ratings on Bullish and ARK Invest activity in crypto equities

Coverage began last week with several initiations. Jefferies rated Bullish at Hold. JPMorgan started at Neutral, and Bernstein also set a neutral stance. Cantor Fitzgerald issued Overweight.

Targets cluster near the high $40s to low $60s. That range sits around recent trading levels. The calls arrived as the market tracks the first report as a public company.

ARK Invest remained active in other crypto exposed names. On Sept 9, the firm bought about $4.4M of BitMine, bringing the stake to roughly 6.7M shares valued near $284M at that time.

On Aug 12, filings showed about $193M of Block shares held after fresh buys. These positions sit alongside the updated Bullish stake.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 17, 2025 • 🕓 Last updated: September 17, 2025