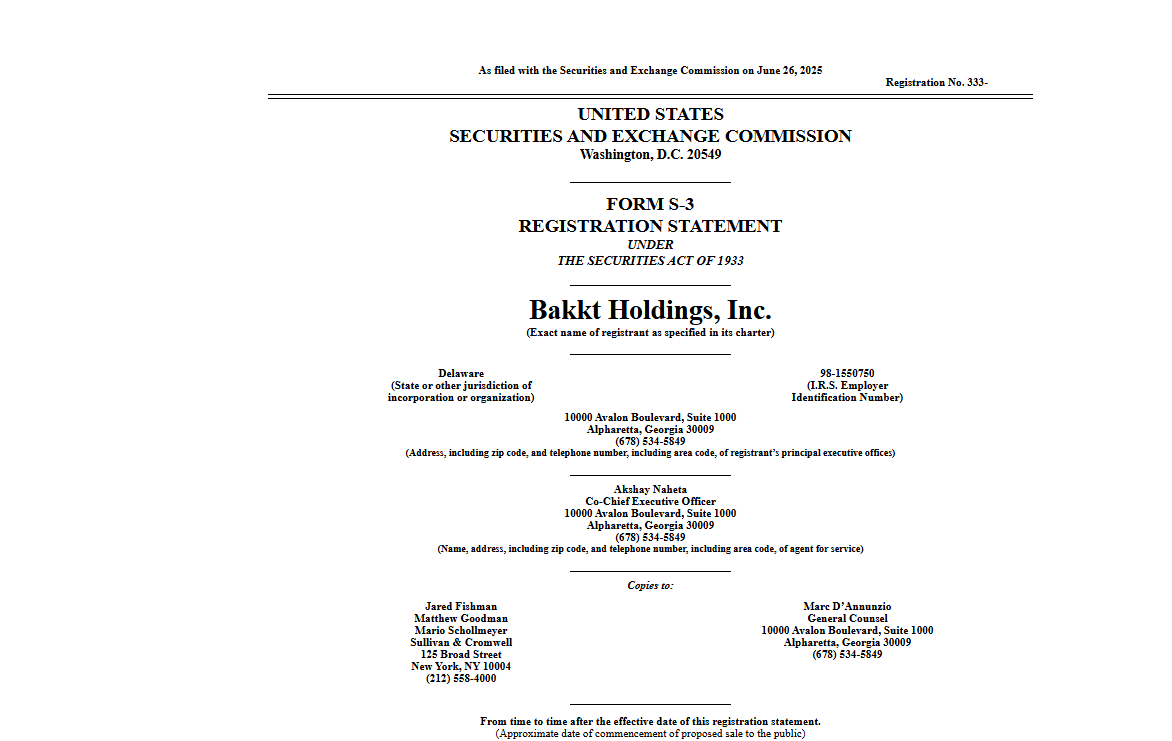

Bakkt Holdings Inc. has filed a shelf registration with the U.S. Securities and Exchange Commission (SEC) to raise up to $1 billion. The company disclosed this in a Form S-3 filing submitted on June 27, 2025. This Bakkt shelf offering allows the crypto platform to issue different types of securities, including Class A common stock, preferred stock, debt securities, and warrants.

Bakkt, a subsidiary of Intercontinental Exchange, stated it may use proceeds for general purposes or to buy Bitcoin and other cryptocurrencies. The filing follows a recent change in the company’s investment policy that now permits holding crypto assets. According to the document, Bakkt has not yet made any Bitcoin purchases.

Bakkt confirmed it could use excess cash or money raised through future financings to acquire crypto. The Bakkt SEC filing also emphasized that the company will act based on capital availability and market conditions.

Bitcoin Investment Policy Added to Treasury Strategy

Earlier in June, Bakkt updated its internal treasury strategy to include Bitcoin and other crypto assets. This marked a change in how the company manages its capital. The Bakkt Bitcoin plan allows the firm to consider crypto allocations alongside traditional corporate assets.

According to the SEC filing, Bakkt has not yet purchased any digital assets. The document explained that potential crypto acquisitions would depend on performance, cash flow, and external conditions. The company stated,

“We may acquire Bitcoin or other digital assets using excess cash, proceeds from future equity or debt financings, or other capital sources.”

This section of the Bakkt crypto strategy shows that the company is preparing to act when conditions align, although no action has been taken yet.

Bakkt Flags Financial Challenges in SEC Filing

In the same document, Bakkt disclosed several financial concerns. The company stated that it has a “limited operating history and a history of operating losses.” The filing also acknowledged “substantial doubt” about its ability to continue as a going concern. These warnings are part of the Bakkt SEC filing language.

The Bakkt shelf offering gives the firm flexibility to raise funds if needed. It allows Bakkt to quickly issue securities without submitting a new registration each time. The company did not specify when it will sell the securities or how the funds will be allocated.

Bakkt has raised similar financial concerns in previous earnings reports. The company’s losses and uncertainty about future performance continue to shape its capital planning.

Bakkt Stock Reacts to Filing but Remains Down for 2025

Bakkt’s stock (NYSE: BKKT) rose 3% on Thursday to $13.33, according to Google Finance. This gain came after news of the Bakkt shelf offering and the Bitcoin investment policy update. However, Bakkt stock performance remains weak in 2025. Shares are down 46% since the beginning of the year.

In March 2025, Bakkt stock dropped 30% after announcing that Bank of America and Webull would not renew their contracts. These companies were among Bakkt’s largest commercial clients. The cancellations affected projected revenue and impacted the Bakkt financial status.

The year-to-date chart of Bakkt stock reflects this trend. While short-term gains followed the SEC filing, broader market confidence has not fully returned.

Bakkt Responds to Industry IPO Activity on X

Bakkt commented on recent crypto IPO activity on its official X account. It mentioned the public filing moves by Circle, eToro, and Gemini. The post said these were part of a broader movement in the digital assets space.

“These developments bring validation, visibility, and maturity to the market,”

Bakkt wrote. This public statement aligns with the Bakkt crypto strategy and recent structural updates inside the company.

Bakkt recently appointed a new co-CEO. This leadership change was part of a broader shift in company priorities, with more focus on crypto offerings and platform development.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.