Stripe just made a move that’s got the whole financial world losing their mind. They rolled out stablecoin accounts in over 100 countries. Global takeover, let me say this.

Deal

Stripe’s letting their clients send, receive, and hold balances in US dollar stablecoins, USDC and USDB, if you’re keeping score at home.

It’s like having a regular bank account, but instead of dealing with your local branch manager, you’re moving digital dollars around the world at the speed of light. And who do they partner with?

Circle for USDC, and Bridge for USDB. Stripe even scooped up Bridge last October, because when you’re this big, you don’t just make deals, you buy the whole operation.

Demand

Now, you might be thinking, why all the fuss about stablecoins? Lemme tell you, in places like Argentina, Turkey, Colombia, and Peru, the local currency’s about as stable as a house of cards in a hurricane.

Inflation’s eating people’s savings for breakfast. So, stablecoins? The thing is, today they’re not just a tech fad out there, but they’re a real lifeline for many.

People are using them to store value, dodge capital controls, and make sure their hard-earned cash doesn’t vanish overnight.

Stripe’s not blind to this. They saw the demand spike when they let people pay merchants with stablecoins last October.

Seventy countries lit up the board, clamoring for more. So now, they’re rolling out the red carpet, making it easier for anyone with a phone and an internet connection to join the global economy.

Forget about bank branches and paperwork, this is banking for the 21st century.

Fee

Of course, Stripe’s not doing this out of the goodness of their hearts. They see the writing on the wall.

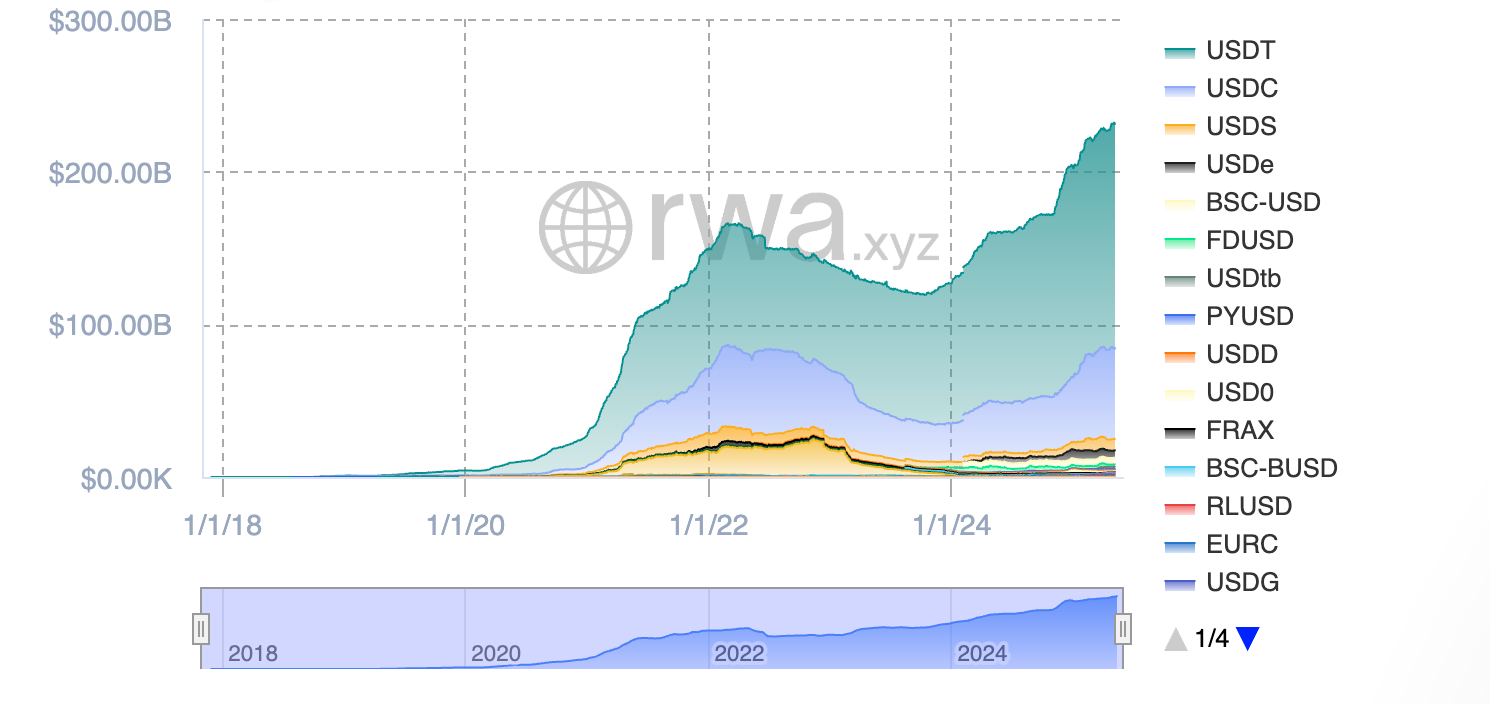

The stablecoin market cap just blew past $231 billion in May, and that’s a lotta zeroes, my friend.

And with more people in Latin America using stablecoins for everyday purchases, Stripe wants a piece of that action.

So, is this the dawn of a new era for global finance, or just another power grab by the big players? Maybe it’s both.

All I know is, when Stripe makes a move, the world pays attention.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.