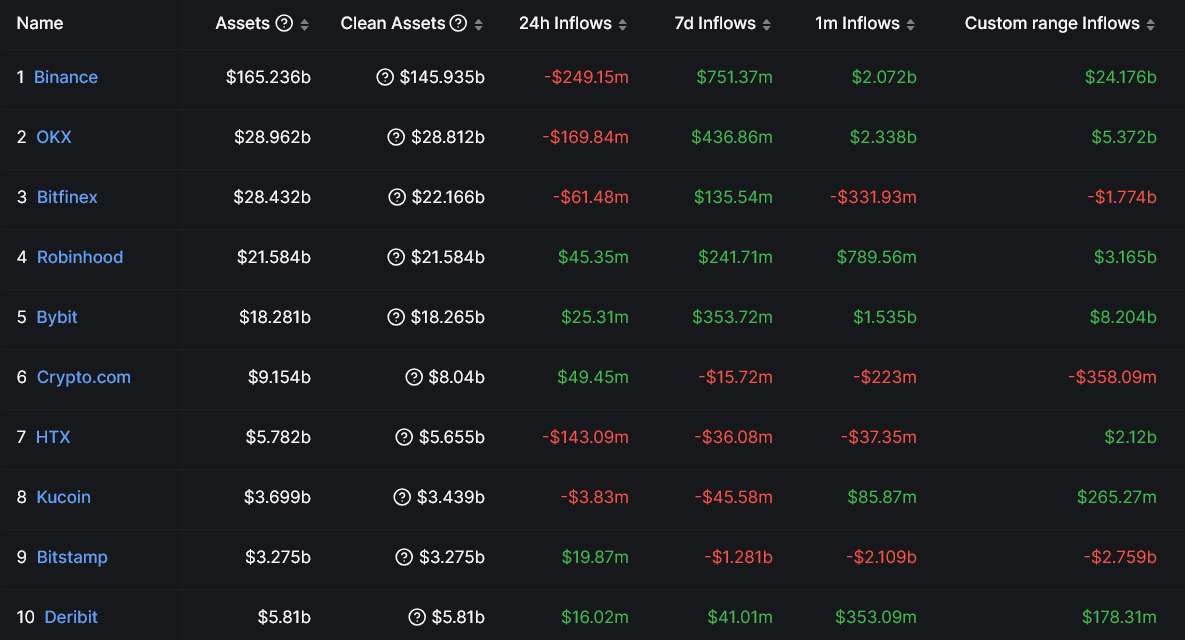

The crypto exchange has racked up over $24 billion in inflows from user deposits so far this year, thanks to a booming interest in crypto assets.

Data from DefiLlama reveals that this impressive figure surpasses the combined inflows of ten other exchanges.

Domination

In a new blog post, Binance attributed its growth to a global surge in crypto adoption, driven by regulatory wins, historic price milestones, and the launch of spot Bitcoin ETFs in major markets like the U.S. and Hong Kong.

“These developments have attracted millions of users to Binance, bringing our global user base to nearly 250 million.”

Bybit comes in second with $8.2 billion in inflows, followed by OKX at $5.3 billion. Interestingly, DefiLlama doesn’t track platforms like Coinbase and Gemini due to their lack of “wallet transparency” with proof-of-reserves.

Multiplayer

Among other exchanges, BitMEX, Robinhood, and HTX have seen inflows of $3.45 billion, $3.165 billion, and $2.12 billion, respectively.

On the other hand, Bitstamp, Bitfinex, and Crypto.com have experienced outflows of $2.75 billion, $1.77 billion, and $358.1 million.

DefiLlama explained that they don’t track Coinbase and similar exchanges because they haven’t provided sufficient transparency regarding their wallets.

“While they report assets held due to being a publicly listed company, they haven’t provided wallet transparency,” they noted.

Hall of fame

On a positive note for Binance and others in the crypto space, there’s been a big uptick in institutional capital, and the average Bitcoin deposit has jumped from 0.36 Bitcoin to 1.65 Bitcoin, while USDT deposits skyrocketed from about $19,600 to $230,000.

In another nice milestone, Binance has become the first centralized exchange to surpass $100 trillion in trading volume! OKX follows with a lifetime trading volume of $25 trillion.

Despite predictions that decentralized exchanges would take over after the FTX collapse in November 2022, CEXs continue to dominate trading volume, and CoinGecko reports that CEXs tracked over $276 billion in trading volume within the last 24 hours, while DEXs managed only $28.5 billion.