Bitcoin’s price is approaching the $73,000 mark, the current ATH, a closely watched level.

Among the investors and traders there is a growing speculation about Bitcoin’s next significant move and the potential implications for the crypto market.

Escape Velocity

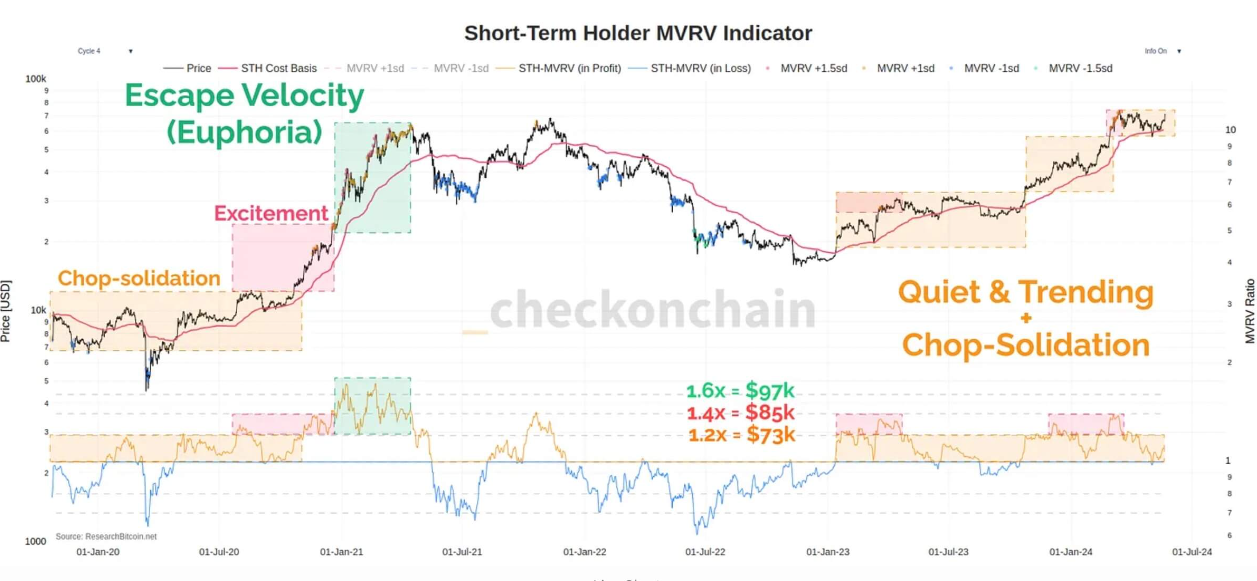

Crypto analyst James Check has introduced the concept of “escape velocity” in relation to Bitcoin’s price. In physics, escape velocity is the speed needed for an object to break free from gravitational pull.

It’s the speed what a space rocket needs for launch. Similarly, Check suggests that reaching $73,000 could signal a breakout for Bitcoin, leading to a substantial and sustained price increase.

This level is seen as a potential threshold that, once crossed, could trigger a new phase of rally.

Short-Term Holder Resistance for Bitcoin

While the $73,000 level is seen as a significant point, it also poses a risk of triggering selling pressure from short-term Bitcoin holders.

These holders, who are currently in profit, might decide to sell their assets once this price level is reached, leading to increased market volatility, and growing selling pressure.

This resistance could causing fluctuations before any upward trend is established.

A sustained move above $73,000 could be interpreted as a strong, verified bull market signal. Analysts believe that crossing this threshold might indicate the beginning of a “euphoric escape velocity” phase, where Bitcoin’s price could see exponential growth.

This speculative outlook suggests that if Bitcoin can maintain momentum above $73,000, it could lead to a prolonged and intensified bull market, attracting more investors and driving further price increases.

Market Euphoria and Bitcoin Price

Despite the optimism, several analysts believe that the market has not yet reached a state of euphoria.

This perspective indicates that there might still be room for further price growth before the market hits its peak.

Historically, Bitcoin bull markets are characterized by an euphoric sentiment among investors, often leading to sharp price increases followed by corrections.

The absence of such euphoria at present suggests that Bitcoin’s price might continue to rise before experiencing significant pullbacks.

The long-term predictions for Bitcoin’s price remain varied and of course, uncertain.

While some analysts waiting for substantial growth, driven by factors such as increased adoption, institutional investment, and macroeconomic trends, others caution that the cryptocurrency market is inherently volatile.

The speculative nature of these predictions means that while Bitcoin has the potential for significant appreciation, investors should remember the risks.