Imagine a world where Bitcoin, the supposed digital gold, behaves more like a reckless teenager than a stable investment.

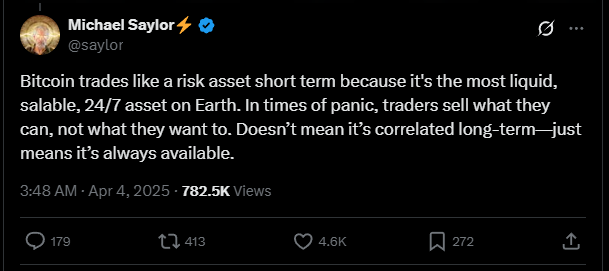

Welcome to reality. Michael Saylor, the co-founder of Strategy, has a simple explanation for why Bitcoin is trading like a risk asset, as it’s the most liquid and salable asset out there.

In times of panic, traders sell what they can, not what they want to. It’s like a fire sale, where everything must go, no matter how valuable it is.

Early stage

But Saylor believes this correlation with stocks is just a short-term fling, and he thinks that over time, Bitcoin will break free from its stock market shackles and forge its own path. This isn’t just Saylor’s optimism btw, other experts are also agree.

They argue that while Bitcoin might follow the market initially, it diverges when you look at the bigger picture.

Short term chaos, long term perspective

The tariff chaos has sent the U.S. stock market into a tailspin, with some of the biggest drops on record.

Yet, Bitcoin has held its ground remarkably well compared to the S&P 500. Justin Spittler, a seasoned trader, thinks Bitcoin will outperform stocks if the market stays risk-off.

It’s like Bitcoin is the rebellious kid who refuses to follow the rules, and sometimes, that’s exactly what you need in your investment portfolio.

Criticism

But not everyone is convinced. JPMorgan has questioned Bitcoin’s digital gold narrative, pointing out its persistent correlation with U.S. equities.

It’s a bit like saying Bitcoin is just another high-risk asset, not the safe haven it’s often touted to be.

Dave Portnoy, the founder of Barstool Sports, also went viral asking why Bitcoin behaves like U.S. stocks despite being an uncorrelated currency. It’s a question that has sparked a lot of debate.

So, what does the future hold for Bitcoin? Will it continue to dance with the stock market or forge its own path? Bitcoin is full of surprises, yes, but we’re only in the fourth halving epoch.

Only a few percent of the population use Bitcoin. And if you’re brave enough to being part of it, you might just find yourself on a journey that’s as unpredictable as it is exhilarating.

After all, as Saylor would say, Bitcoin is not just an asset, but it’s a movement. And movements are rarely predictable.

I don't think $BTC has bottomed.

But I think it will outperforms stocks (declines less) should the market stay risk off…

BTC holding up incredibly well relative to $SPY pic.twitter.com/Ru9xQ7h7sw

— Justin Spittler (@JSpitTrades) April 4, 2025

Have you read it yet? PayPal announced that Solana and Chainlink join the party

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.