Bitcoin is no longer the new kid on the block. President Donald Trump just signed an executive order that’s going to change the game.

We’re talking about a Strategic Bitcoin Reserve and a Digital Asset Stockpile, big league stuff!

This isn’t just any move, it’s the first real step towards integrating Bitcoin into the global financial system.

A new era for Bitcoin

Now, you might be wondering what this means. Well, it’s simple, Bitcoin is officially part of the big boys’ club. It’s no longer an outsider, it’s right up there with traditional reserves, like gold, or foreign currencies.

JUST NOW!

President Trump signs an Executive Order establishing the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile 🇺🇸 pic.twitter.com/N9p2sQknVS

— Margo Martin (@MargoMartin47) March 7, 2025

And let’s talk numbers, Bitcoin is the seventh-most valuable asset on Earth based on capitalization.

This shift shows how governments and institutions are changing their approach to financial security and inflation protection.

The market’s mixed reaction

But here’s the thing, despite this historic move, Bitcoin’s price took a hit. It dropped over 6% after the announcement.

Why? Well, investors were hoping for more, like the government buying up more Bitcoin. But don’t worry, this is just a minor setback. The real excitement is what comes next.

Imagine new financial products backed by Bitcoin. We’re talking lending mechanisms and alternative settlement solutions that could revolutionize how we do business.

Joe Burnett from Unchained thinks this is just the beginning.

“Expect to see new financial products designed around Bitcoin.”

This is where things get really interesting. Developers are already working on Bitcoin-based DeFi, or BTCFi. This sector is booming, with a 22-fold increase in value last year alone.

The rise of BTCFi

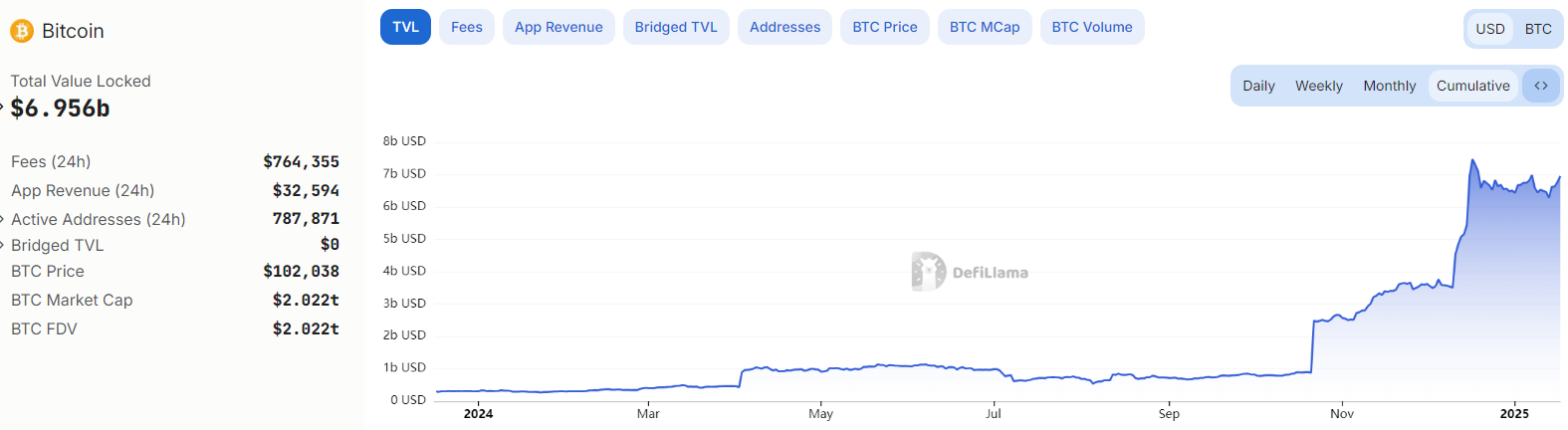

In 2024, the total value locked in the Bitcoin network skyrocketed by over 2,000%, reaching $6.5 billion by the end of the year.

This growth was largely driven by platforms like Babylon, which controls over 80% of the TVL in BTCFi.

Babylon introduced Bitcoin-native staking for the first time, and it’s been a game-changer.

So, what does the future hold? Well, Trump’s upcoming White House Crypto Summit is where we’ll get more details. This is where the rubber meets the road.

“What happens next will define the integration era.”

Have you read it yet? Crypto’s not dead yet, developers keep building

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.