Bitcoin’s on the brink of a wild ride, and James Check from Glassnode shared we could see Bitcoin going past $150,000 before it takes a breather, much like it did back in 2017.

Checklist

Check was a guest in the Theya podcast, suggesting that the sweet spot for Bitcoin’s peak is between $120,000 and $150,000, and he calls this range the topping cloud.

But don’t get too comfy, because he warns that if Bitcoin climbs above that, it’s likely to tumble back down pretty quickly.

Right now, Bitcoin is hanging around $104,000, and if it hits $120,000, the average Joe who invested will be feeling quiet good, especially if it reaches $150K too. That’s kind of a comfort zone, right?

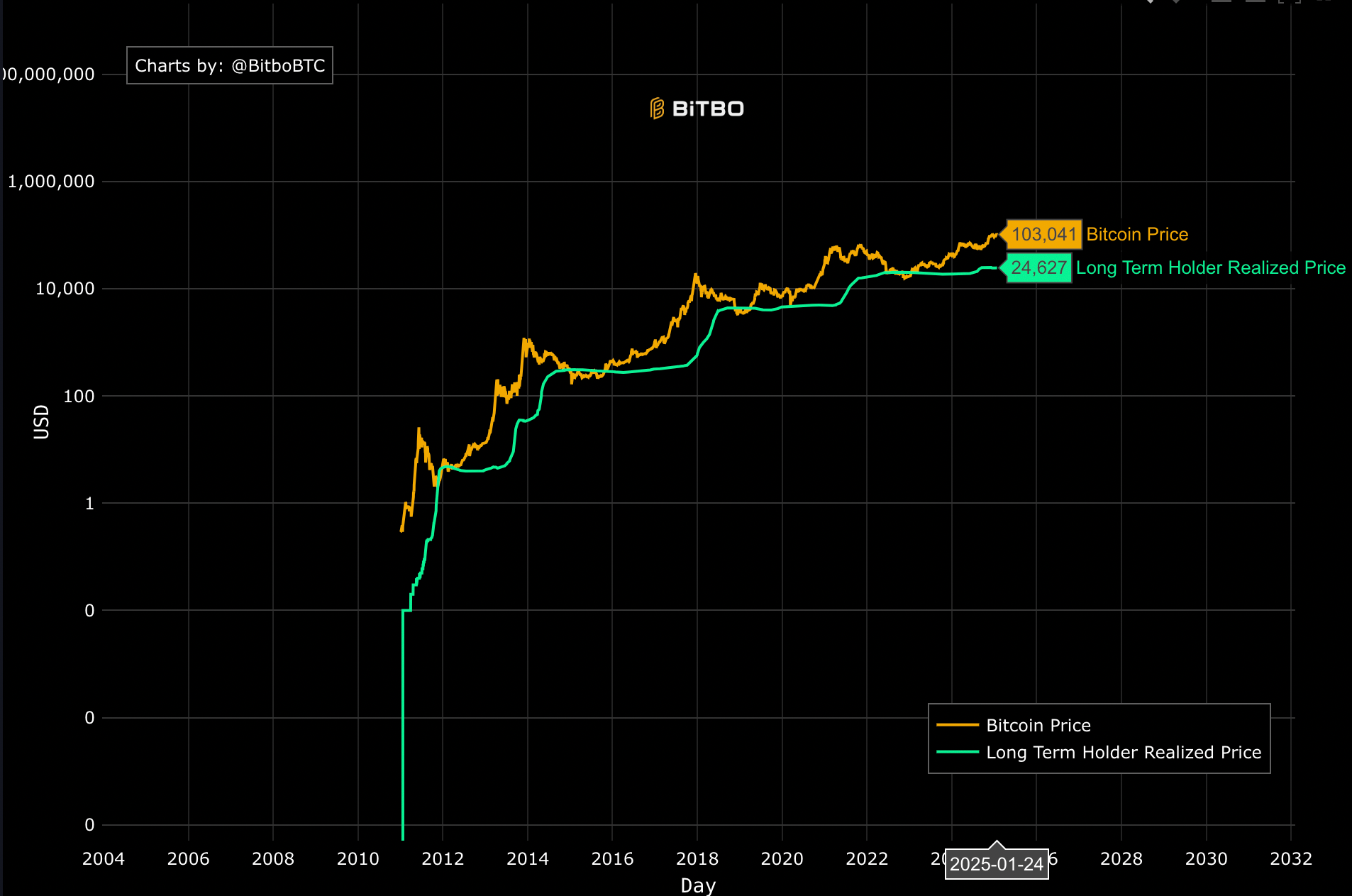

If Bitcoin hits $150K, short-term holders could rake in an average profit of 66%, while long-term holders might be laughing all the way to the bank with 509% profit.

History repeats itself, or rhymes?

Check draws some parallels between today’s crypto market and what went down in 2016-2017. Back then, Bitcoin was just starting to gain traction, trading around $800 to $1,600 before exploding to nearly $20,000 by year-end.

If history repeats itself, and let’s be real, it often does, we might see Bitcoin consolidate for a bit longer before making its next big move.

He describes the current market as having nice moderate rallies followed by cool-down periods, definitely a textbook rollercoaster vibe.

Don’t you know pump it up?

There’s more chatter in the crypto community, because some traders think we won’t see Bitcoin hit its peak for 2025 until later in the year.

A trader known as Bitquant argues that anyone claiming Bitcoin has already peaked is just setting themselves up to miss out on some serious gains.

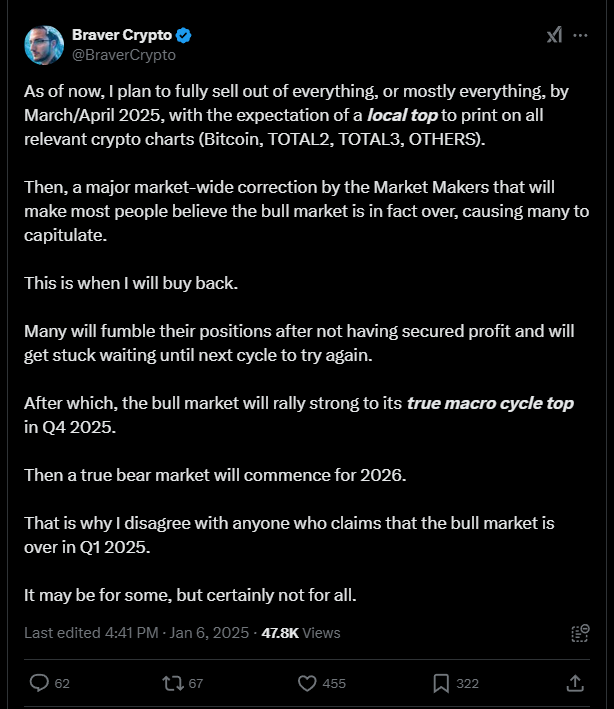

Another trader named Braver believes that while we might see a bull run in early 2025, the real fireworks will happen in Q4 when we hit that macro cycle top.

Crypto trader Mags suggests that since Bitcoin smashed its ATH of over $109,000 on January 20, history could repeat itself within the next 230 to 330 days.