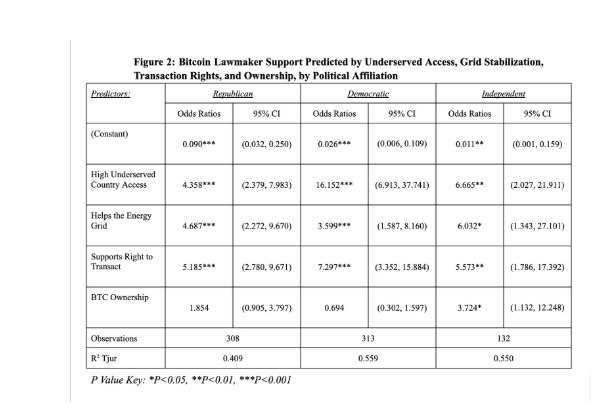

Bitcoin can win support from U.S. voters across the political spectrum when framed through their own values, according to a new analysis from the BTC Policy Institute.

The group used data from a June 2025 survey by U.S. polling firm Cygnal to model how Democrats, Republicans and Independents react to different Bitcoin narratives.

The analysis found that Democrats responded most positively when Bitcoin was presented as a tool for financial freedom and inclusion, especially for underserved communities.

In this framing, Bitcoin’s role in expanding access to financial services and reducing barriers for marginalized groups drew the strongest support.

Republicans and Independents, by contrast, favored messages that stressed the stability Bitcoin mining can bring to the energy grid and the right to transact without government interference.

These voters aligned more with arguments about grid resilience, property rights and protection from overreach, rather than investment-focused language.

Independents still stood out as the most engaged group. The survey data showed they were about twice as likely to own Bitcoin as Republicans and more than five times as likely as Democrats, underscoring a higher level of direct participation in the asset.

The BTC Policy Institute noted that Bitcoin has recently been framed as a driver of financial innovation, with the Trump administration in 2025 taking a more welcoming stance toward the sector compared with the prior administration’s caution.

However, the group emphasized that Bitcoin itself operates on code and consensus, without ties to any person, company or political party.

Given that backdrop, BTC Policy argued that pro-Bitcoin policymakers should adjust their messaging.

Instead of pitching Bitcoin as an investment opportunity, they should focus on how it fits voters’ core beliefs, whether those center on inclusion, liberty or technological progress.

The group added that Bitcoin’s roles in financial inclusion, protection from authoritarian control and sustainable technology can support bipartisan cooperation.

It said those narratives could help build support for measures such as a Strategic Bitcoin Reserve while appealing to shared values of financial freedom and democracy, with limited risk of alienating party bases.

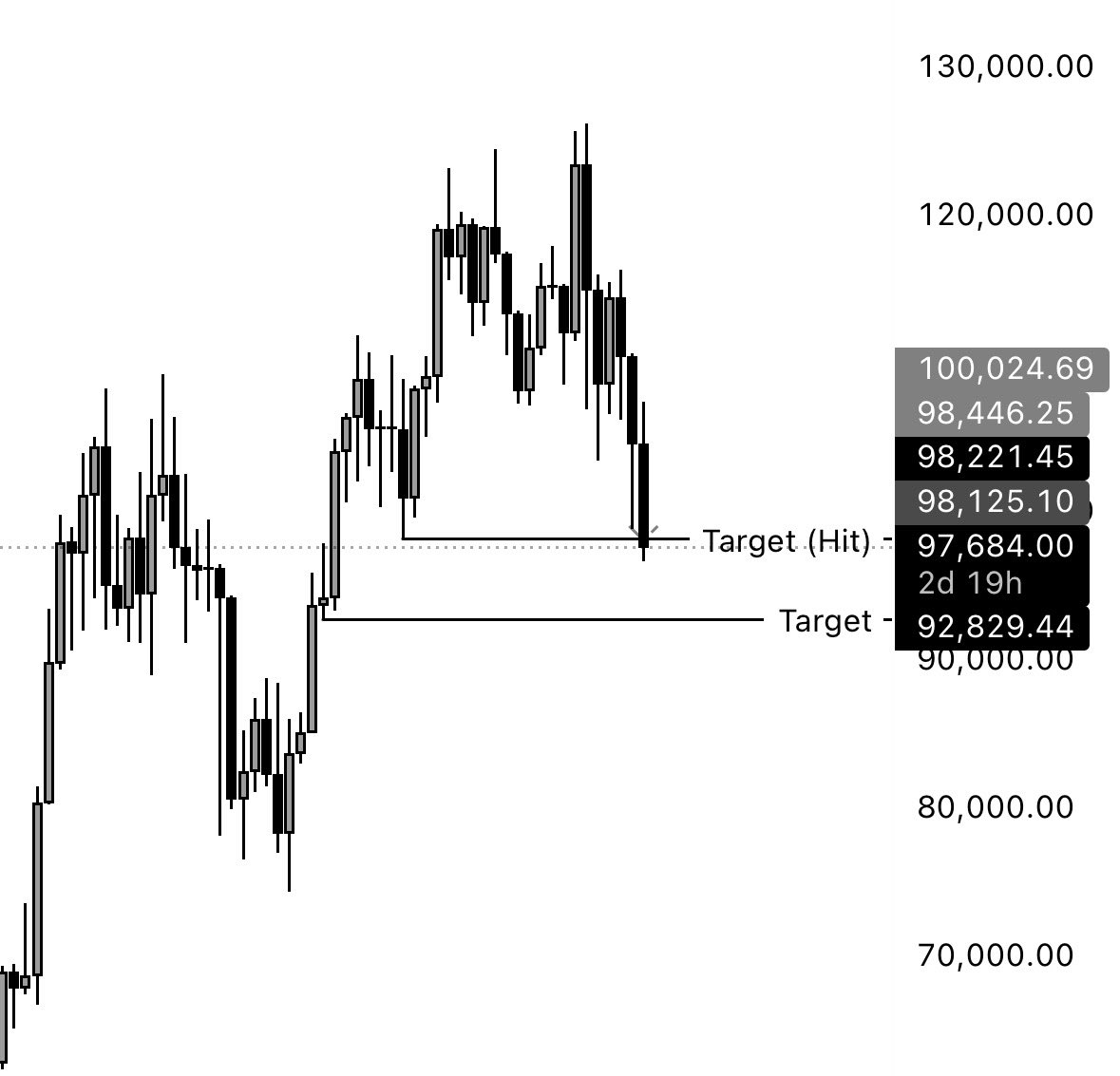

Bitcoin loses key 50-week moving averages as price dips near $97K

Bitcoin has slipped below its 50-week simple and exponential moving averages, signaling a decisive break in its longer-term trend structure.

The weekly chart shows the price dropping to around $97,000, with the latest candle closing under the rising 50-week EMA line after several weeks of steady selling pressure.

This move places Bitcoin back below a level that had acted as dynamic support throughout most of the recent uptrend.

When price trades above the 50-week moving averages, it typically reflects sustained bullish momentum and confidence from longer-term holders.

Now, with the weekly candle cutting through those lines, the market is testing how strong that conviction remains after months of gains.

At the same time, the chart highlights a series of lower weekly highs since the peak near the recent range top, underscoring a gradual loss of upside momentum before the breakdown.

The long blue EMA line still points upward, which suggests the broader trend has not fully reversed, but the price now sits on the underside of that trend guide.

A quick recovery back above the 50-week moving averages would show that buyers remain willing to defend the longer-term trend.

However, if weekly closes continue to print below the 50-week EMA and MA, the market could treat these levels as resistance instead of support, reshaping the structure that has guided the rally so far.