Listen up, the situation is dire. Bitcoin’s been taking a beating lately, and you know who’s loving every minute of it?

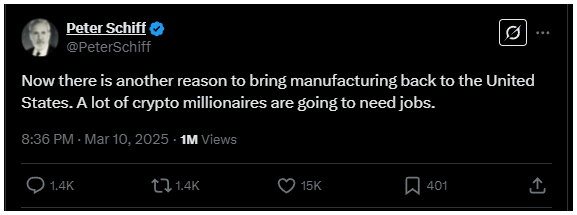

Peter Schiff, the gold-loving economist with a penchant for bashing crypto. Bitcoin briefly dipped below $77,000, and Schiff was quick to rub it in, saying those crypto millionaires might need to dust off their old résumés soon.

Schiff’s sarcasm on full display

Schiff took to X to poke fun at crypto investors, suggesting that the U.S. government holding cryptocurrencies as reserve assets is pure madness. With Ethereum also hitting a 17-month low, Schiff couldn’t resist another jab.

“Time to bring manufacturing back to the States, because those crypto millionaires are gonna need jobs.”

Okay, this is actually a good roast, well done!

A familiar pattern?

Despite Schiff’s trolling, some analysts see this correction as part of the usual bull cycle dance. In 2017 and 2021, Bitcoin saw corrections of 35% and 37%, respectively.

If history repeats, we might see Bitcoin drop to $70,000 before stabilizing. BitMEX co-founder Arthur Hayes has already warned traders to be patient, suggesting that a bottom near $70,000 is just part of the cycle.

Targeting Strategy

Schiff didn’t stop at Bitcoin, but he also took a swing at Saylor’s Strategy, which has invested billions in the cryptocurrency.

Ethereum, the second most popular crypto token, which Trump claimed to love, just cracked below $1,900, trading at its lowest price since Nov. 2023. The Ethereum ETFs are trading at new record lows, down over 45% since Wall Street first sold them to the public in July 2024.

— Peter Schiff (@PeterSchiff) March 10, 2025

With the company’s stock plummeting over 55% since November, Schiff called for the ouster of Executive Chairman Michael Saylor.

“The strategy isn’t working. Time to fire Saylor.”

Saylor’s defenders pointed out that the stock has still surged significantly over the past five years, but Schiff remains unconvinced, predicting bankruptcy for the company. And he wasn’t done yet.

He also criticized Ethereum and its spot ETFs, which have tanked 45% since their launch.

Ethereum itself recently fell below $1,800, a level not seen since years. It’s clear Schiff is on a mission to prove his point, cryptocurrencies are a risky bet.

Have you read it yet? Trump’s crypto gambit is a shot in the dark?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.