The whales, and the institutional sharks are swimming in Bitcoin waters, and they’re gobbling up coins like it’s the last slice of pizza at the office party.

Bitcoin supply is tightening, and these heavy hitters just dropped a cool $164 million worth of BTC into their bags. So, what’s cooking? Is this the start of another bull run?

Something good is coming?

First off, institutions are not just dipping their toes, nope. BlackRock, that financial giant you hear about in every boardroom whisper, just scooped up about 1,388 BTC, valued at roughly $164.3 million.

That’s not pocket change, guys. When the big guns move like this, it’s a loud signal that they believe Bitcoin’s got legs to run.

Now, it’s not just institutions playing the game. Crypto whales are also piling on. This coordinated accumulation?

It’s like when the office’s smartest, most experienced guys start buying shares in the company’s stock before the big product launch. They don’t do that on a whim. They see something good coming.

Steady accumulation

Open Interest in Bitcoin derivatives has been climbing steadily. For those not in the know, OI is like the total bets on Bitcoin’s future price.

When it goes up, it means more money is flowing into the market, expecting either a big move up or down.

But with all this institutional money coming through ETFs and regulated products, the scale is tipping toward a more stable, bullish foundation.

Think of it as the difference between a chaotic office poker game and a well-organized tournament with serious players.

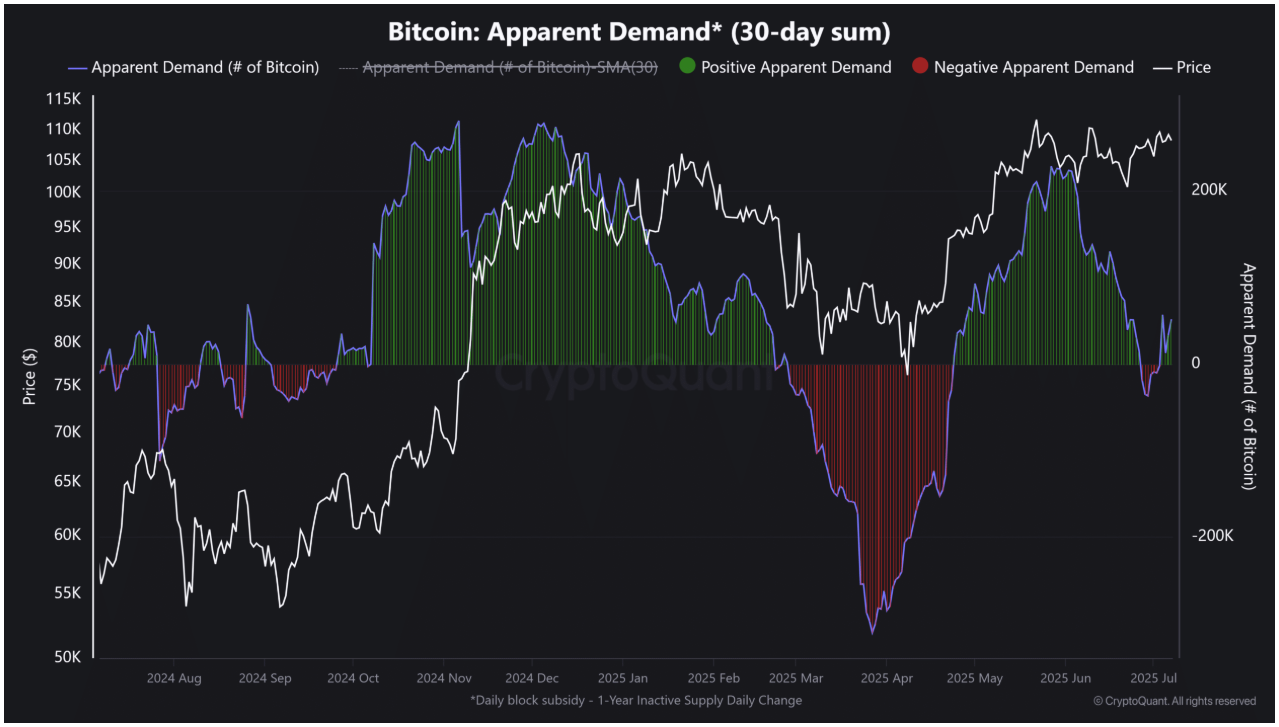

On-chain data backs this up. CryptoQuant’s 30-day Apparent Demand metric shows Bitcoin is being steadily accumulated, filtering out the noise of day traders and hype.

Analysts say this kind of sustained demand usually precedes a price rally.

The next big jump?

On the other hand, mined Bitcoin blocks are slowing down. Fewer new coins hitting the market means supply is tightening just as demand is heating up.

Imagine the office vending machine suddenly dispensing fewer snacks while everyone’s craving more. Prices? They’re bound to climb.

So, with supply shrinking and whales plus institutions loading up, the stage is set. Bitcoin’s market dynamics are shifting in favor of higher prices.

Will we see the next big jump? If history and the smart money are any guide, buckle up, because we will.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.