In a regulatory filing on Tuesday, BlackRock and Nasdaq proposed introducing options trading for the BlackRock spot Ethereum ETF.

New Ethereum ETF, but for option trading

The proposed iShares Ethereum Trust will exclusively hold Ethereum in custody with Coinbase, while cash management will be handled by the Bank of New York Mellon.

The fund will remain a passive investment, as it will not engage in staking its Ether holdings.

Options trading allows investors to buy or sell an asset at a predetermined price within a set period. By recommending options trading for the BlackRock spot Ethereum ETF, Nasdaq wants to offer investors a cost-effective way to gain exposure to Ethereum.

This move is expected to support the ETF’s attractiveness and competitiveness. Nasdaq previously listed options on other commodity ETFs structured as trusts, including BlackRock’s iShares COMEX Gold Trust and iShares Silver Trust.

Paperwork for ETF approval

The SEC is currently reviewing the rule changes required to list options on the new Ethereum trust.

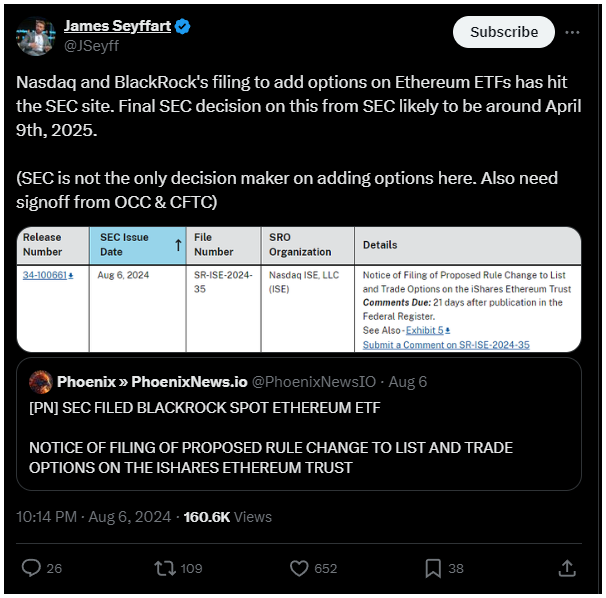

Bloomberg ETF analyst James Seyffart shared in the social media, the SEC has 21 days to comment on the proposal, with a final decision anticipated by April 9, 2025.

Approval from the Office of the Comptroller of the Currency and the Commodity Futures Trading Commission is also necessary.

Risk squared?

While the SEC has not yet approved options trading for spot Bitcoin ETFs, which began trading in January and now hold approximately $50 billion worth of Bitcoin, it is still considering the consequences ofallowing such options trading.

The SEC highlights the need for more time to evaluate the potential impact and risks associated with options trading for Bitcoin ETFs.