BlackRock has quietly taken its first formal step toward a U.S. staked Ethereum ETF.

A new Delaware filing shows the asset manager building a trust that could let investors earn staking rewards inside a regulated fund.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

BlackRock Registers iShares Staked Ethereum Trust in Delaware

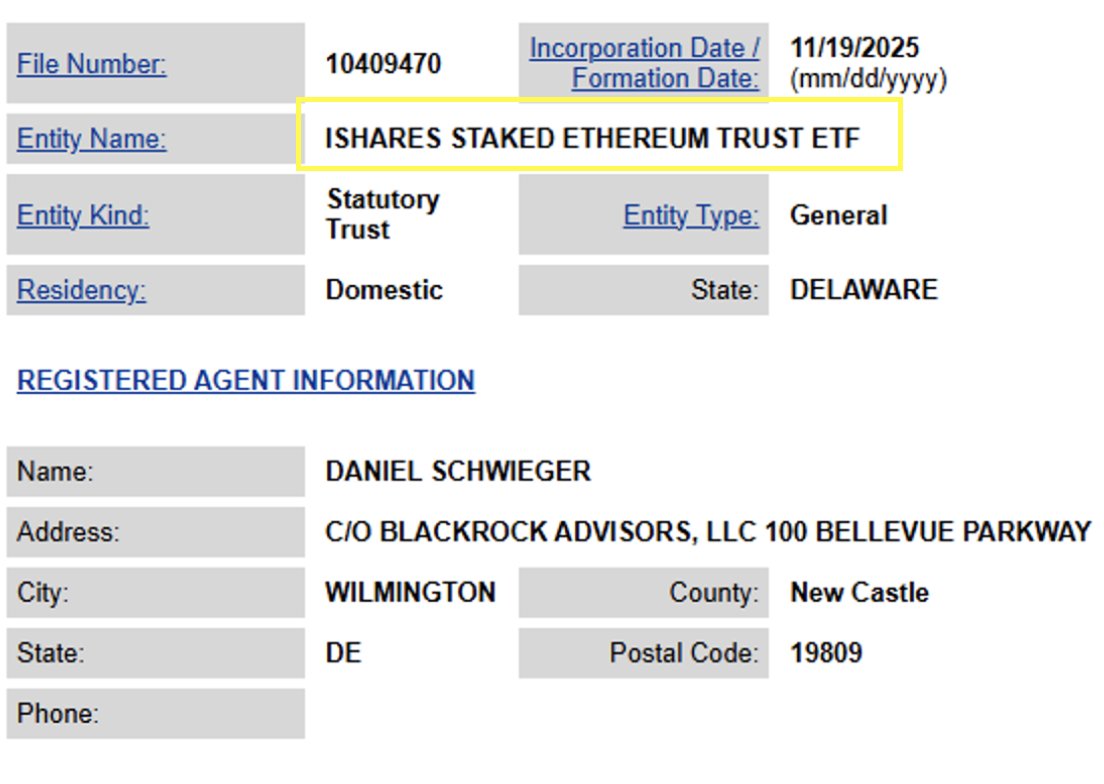

Delaware Division of Corporations records list a new entity called iSharesStaked Ethereum Trust ETF, formed on Nov. 19, 2025, as a domestic statutory trust.

The registered agent is Daniel Schwieger of BlackRock Advisors in Wilmington, Delaware, the same executive who handled earlier iShares Ethereum trust paperwork.

Delaware name registrations usually appear days or weeks before a full Securities and Exchange Commission filing for an ETF, repeating the pattern seen with BlackRock’s spot Bitcoin and Ethereum vehicles.

Delaware Move Points to Staking-Focused ETH ETF

Senior Bloomberg ETF analyst Eric Balchunas said the new trust signals that a ’33 Act ETF filing for a staked Ethereum product is “coming soon.”

The trust follows a separate move earlier this year, when Nasdaq submitted an SEC filing to add on-chain staking to BlackRock’s existing iShares Ethereum Trust (ticker ETHA).

Together, the steps suggest BlackRock wants a structure that combines spot ETH exposure with validator rewards, turning Ethereum into a total-return product for institutions.

BlackRock Joins Race for Yield-Driven Crypto ETFs

BlackRock’s registration comes after rivals REX-Osprey and Grayscale launched staked Ethereum funds in recent months, giving investors regulated access to staking yield.

Staked ETH ETFs aim to solve a key problem for traditional investors, who often cannot run their own validators or use on-chain platforms but still want income on their holdings.

If BlackRock proceeds to a full SEC application and wins approval, the product would deepen competition in the already crowded Ethereum ETF market and test regulators’ comfort with staking inside U.S. funds.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 20, 2025 • 🕓 Last updated: November 20, 2025