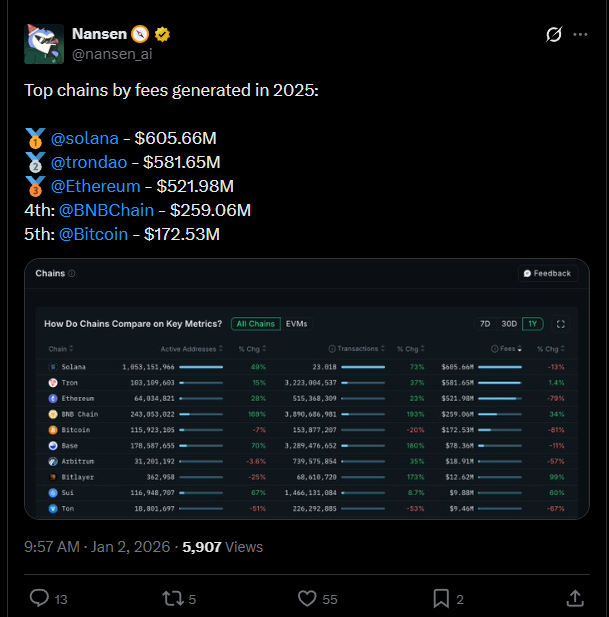

Strap in for the 2025 blockchain revenue rodeo, where BNB Chain plays the dusty fourth fiddle behind the big dogs.

Yeah, the Binance behemoth raked in $259.06 million in fees, solid, but honestly, just a distant echo to Solana’s $605.66 million jackpot.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

As Nansen shared, Tron snarled in second at $581.65 million, Ethereum limped third with $521.98 million despite its sleepy memecoin scene.

Bitcoin? Fifth place scrub at $172.53 million.

Stablecoins to $14 billion, RWAs topped at $1.8 billion

Don’t cry for BNB yet. Active addresses crowned it king of the hill. Adoption roared, and TVL surged over 40%, transactions ballooned 150% year-over-year.

Stablecoin cap doubled to $14 billion peak, real-world assets topped $1.8 billion, backed by heavyweights like BlackRock’s BUIDL, Franklin Templeton’s BENJI, and VanEck’s VBILL.

Not too shabby for a “loser.”

CZ rebooted memecoins with Four.meme

So why the fee generation faceplant? Blame the herd stampede to utility champs like Tron and volume vampires like Solana.

Tron rules as a cheap payment highway, hogging 50-60% of global USDT for microtransaction maniacs.

Solana? Memecoin mayhem pumps endless high-volume frenzy. BNB slashed gas to 0.05 gwei amid cutthroat wars, even CZ rebooted memecoins with Four.meme, a Pump.fun clone dropped in October. Close, but no cigar.

Flash to the glory days, Lorentz and Maxwell upgrades slashed block times, turboed finality, cratered fees 20-fold without stiffing validators.

Zero downtime proved BNB’s iron gut at scale. Bitcoin hopefuls got humbled, Ethereum’s memecoin ghosts couldn’t save it.

BNB Chain lagged 2025 fees but stacked wins everywhere else

Now, 2026 beckons like a high-roller’s promise. Analysts say BNB’s squad eyes a trading titan makeover, 20,000 TPS with sub-second finality, dirt-cheap tx costs intact.

Dual-client blitz, Geth for rock-steady, Rust-powered Reth for speed demonics. Parallel execution, storage wizardry, database overhauls to tame state bloat.

So yes, BNB Chain lagged 2025 fees but stacked wins everywhere else, active users, TVL spikes, RWA muscle.

Solana and Tron stole the spotlight with memefrenzy and cheap rails, yet BNB’s upgrades scream comeback. This chain’s no has-been, it’s the gritty underdog reloading for the kill.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: January 3, 2026 • 🕓 Last updated: January 3, 2026

✉️ Contact: [email protected]