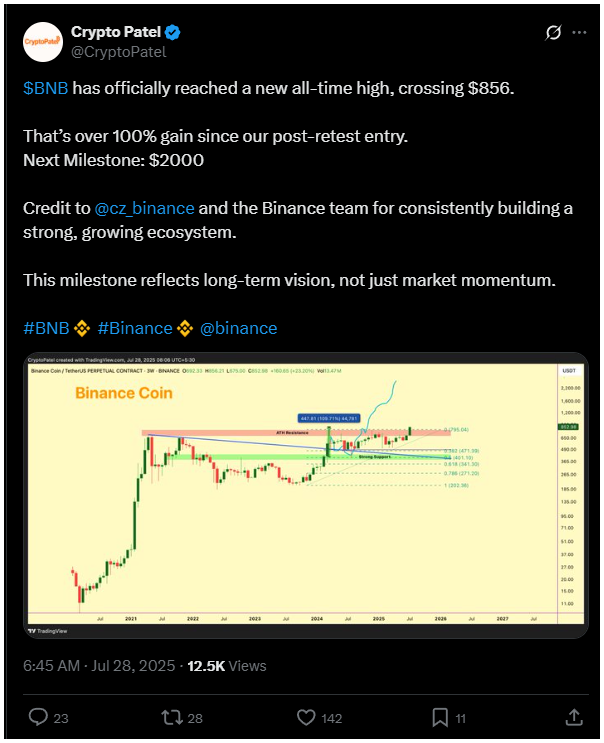

The crypto market’s new heavyweight champ is the BNB. This beast just smashed through the $855 barrier, a fresh record.

It’s like when your underdog coworker suddenly nails that impossible presentation and the whole office goes, whoa, where’d this guy come from?

Popular expert Crypto Patel are already whispering sweet nothings about $2,000 being the next target. Pretty much everyone talk about BNB now.

Chill and relax

BNB has doubled its value since the last bounce-back. Experts say it’s backed by solid growth all across the Binance ecosystem.

Henry, another sharp-eyed analyst, pointed out that BNB just cleared a six-month channel, picture a boxer breaking through a tough defense, and held strong at $780 during the retest.

The smart money, the real heavy hitters, they stepped in. Volume up, demand zones stood their ground, and a group called Nano Labs casually scooped up over 120,000 BNB. Now that’s serious accumulation.

But don’t get caught up thinking this party’s overdone. Joao Wedson, the Alphractal boss, says BNB’s Sharpe Ratio is still under 1.0.

What does that mean, you ask? It means the ride isn’t getting crazy just yet, no red flags, no overheating. Remember back in 2021 when markets flipped?

The ratio was blowing through the roof, screaming peak! But today? It’s chill, relaxed, more like your laid-back uncle at a family barbecue, enjoying the breeze.

Flexing against Ethereum?

Wedson also tracked the Normalized Risk Metric, chilling at a low 0.005, signaling that BNB isn’t under crazy pressure.

🚀 BNB is surging — and risk analysis shows there’s still plenty of room to climb!

A $1,000 BNB might not be an exaggeration… In fact, it could be a conservative target for the coming month.

Today, BNB's market cap is just 25% of Ethereum’s, and historically, whenever BNB… pic.twitter.com/3K3jRIDNa3

— Joao Wedson (@joao_wedson) July 27, 2025

So apparently, there’s some runway left for BNB to keep climbing before alarm bells start ringing.

And BNB is flexing against Ethereum too, the BNB/ETH ratio is rising. This move usually swings in tandem with Bitcoin’s mood swings, acting like the sniff test for bigger market moves.

Traders are all eyes, hoping this strength spills over into Bitcoin and other big players.

Convertible notes

And get this, in a move that sounds straight out of a Wall Street playbook, Windtree Therapeutics, a biotech firm on Nasdaq, is loading up on BNB.

They locked down $520 million through funding deals just to beef up their reserves.

A Chinese blockchain company isn’t messing around either, dropping half a billion on convertible notes targeting to bag up to 10% of all BNB out there. That’s like owning the whole block’s pizza joint, guys.

Do they know something that we don’t? This is the real question, right?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.