The BNB price is flirting with $650, and traders are buzzing, some say $680 is just around the corner, others warn it’s a tightrope walk. So, what’s really cooking in the market kitchen?

Money talks, and it says BNB is on fire

First off, money’s flowing in. On June 8th, BNB saw $4.6 million pouring in, outpacing $3.7 million going out.

That’s a net positive, baby! It’s like when your office coffee fund suddenly gets a boost, everyone perks up.

This inflow shows investors are starting to believe again, and both the crowd and the so-called smart money are nodding in agreement. When that happens, you know something’s up.

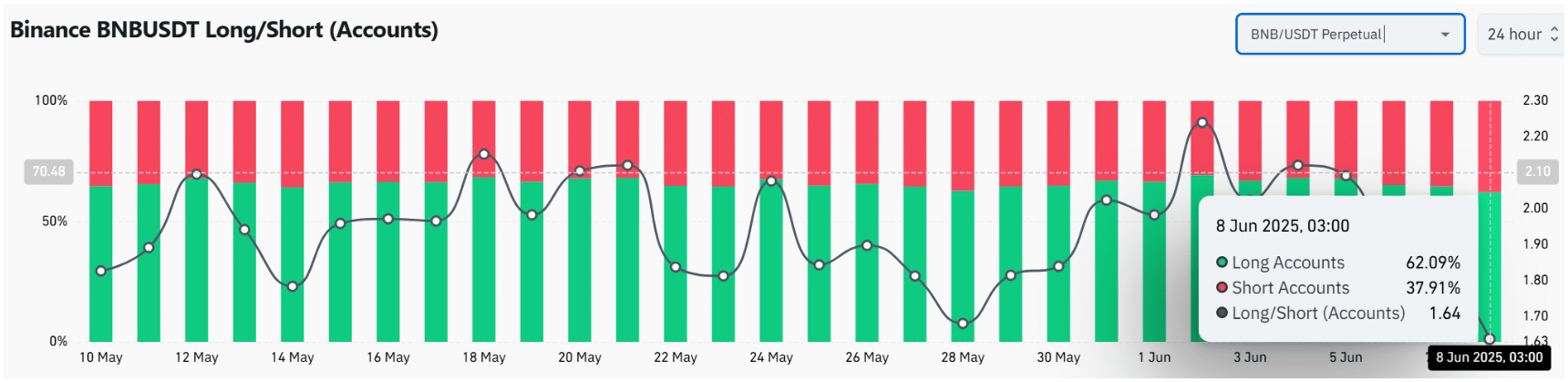

Now, retail traders? They’re all in on the upside. Over 62% of BNB/USDT accounts are holding long positions.

The Long/Short ratio is sitting pretty at 1.64. Sounds bullish, right? Maybe, maybe, or it’s a trap, and a huge long squeeze is coming Wouldn’t be fun.

When too many traders lean one way, especially long, it’s like everyone crowding the same elevator, one hiccup, and it’s a free fall.

If the price stalls or dips, those longs could get squeezed pretty hard. Volatility loves to mess with overcrowded trades.

Domino effect on the crypto market?

Speaking of squeezes, there’s a cluster of short positions hanging out between $623 and $639. With BNB trading near $650, most of these shorts are underwater, gasping for air.

If the bulls keep pushing above $650, these shorts could get liquidated fast, sending the price rocketing higher.

Historically, breaking through these zones triggers a domino effect, stop-losses hit, liquidations fire off, and the market moves like a rollercoaster on steroids. But, hey, this only happens if buyers keep the pressure on.

Trading strategies

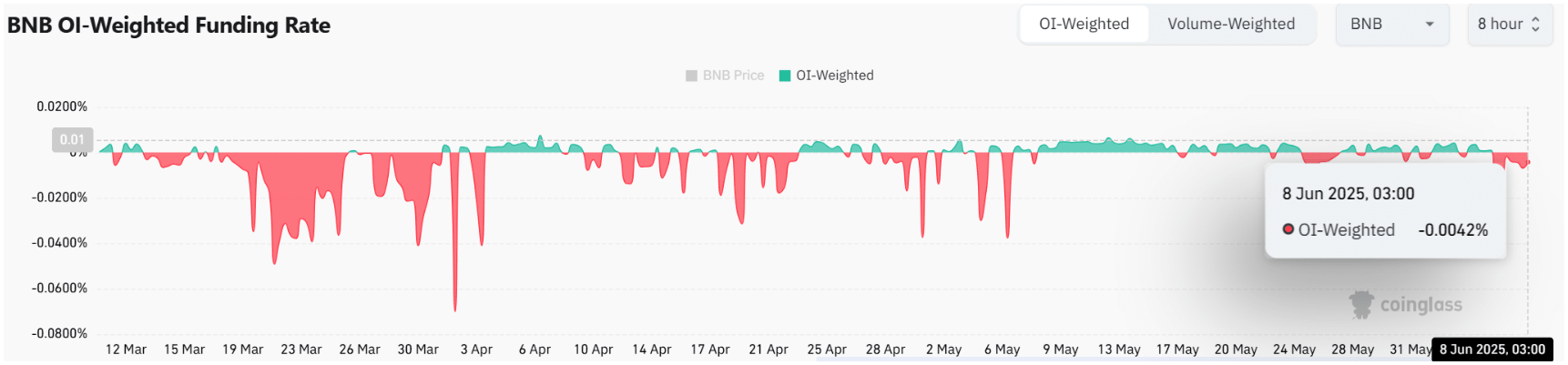

BNB’s derivatives volume dropped by over 42%, and futures Open Interest slipped slightly. Sounds like traders are cooling off? Not quite.

Options Open Interest jumped 12%, meaning some players are gearing up for big moves, hedging their bets or just speculating on volatility.

Plus, the funding rate is negative, so shorts are paying to stay in the game. That’s a juicy setup for a potential short squeeze brewing under the surface.

So yes, BNB’s got the wind in its sails, spot inflows rising, retail bulls loading up, and shorts piled up ready to get crushed.

The market’s fragile, sure, but the sentiment and structure favor a breakout if momentum holds. Keep your eyes on $650, because if that line holds, $680 might not be a pipe dream after all.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.