Brett Harrison, the former president of FTX US, raised $35 million for Architect Financial Technologies, a new exchange venture focused on an institutional trading platform. The report came from The Information.

The $35 million funding round backs a platform that plans to cover crypto derivatives, equities and futures, and other derivatives products.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The company said it will support multi asset trading across digital assets and traditional markets.

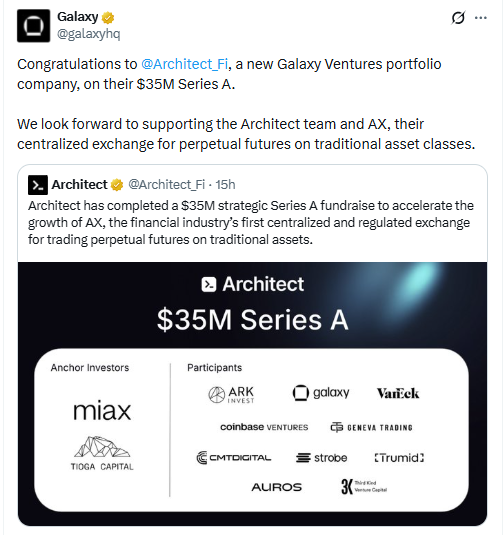

Investors in the $35 million funding round included Miax, Tioga Capital, ARK Investment, Galaxy, and VanEck, according to the report.

Architect Financial Technologies Builds an Institutional Trading Platform Across Equities and Futures

Architect Financial Technologies said it is building for professional users. The platform plans to offer tools for algorithmic execution and risk controls. It also plans to support derivatives across several asset types.

The report said the institutional trading platform will span derivatives, equities and futures, and digital assets. That scope puts crypto derivatives in the same product stack as traditional contracts.

The new $35 million funding round followed an earlier $12 million raise in 2024. The report said that round included Coinbase Ventures, Circle Ventures, and SALT Fund, among other backers.

Perpetual Futures Plan Follows Bermuda Approval for Traditional Asset Contracts

Architect Financial Technologies received Bermuda approval to offer perpetual futures tied to traditional assets, the report said. Those assets included stocks, commodities, and foreign currencies.

Perpetual futures, also called perps, do not have an expiry date. Traders keep exposure open while margin rules allow. Crypto venues made perps a major product, and they later became central at FTX before its collapse in late 2022.

The report said Architect Financial Technologies plans to expand beyond Bermuda. It named Europe and the Asia Pacific region as targets for future market entry.

Crypto Derivatives Dominance and Liquidity Limits Follow a $19 Billion Liquidation Day

The report said crypto derivatives make up most activity on major exchanges. It cited estimates that derivatives account for about 75% to 80% of total trading volume across large crypto platforms.

It also referenced a February report from S&P Global. That report said derivatives markets keep changing, while liquidity remains a core issue across many asset classes. It also noted that market participants focus on products with tight spreads and deeper liquidity.

The report pointed to an Oct. 10 liquidation event as a recent stress point. It said the event erased $19 billion in a single day, which it described as the largest liquidation day on record.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 24, 2025 • 🕓 Last updated: December 24, 2025