In February, Bybit, one of the biggest names in the crypto market, gets hit with a $1.4 billion hack.

Billion with a B. Liquid-staked Ether, Mantle Staked ETH, and other cryptocurrencies vanish into the digital void. Chaos ensues. Investors panic. Trust gone.

We remember the day, right? But Bybit clawed its way back to the top.

Rebuild

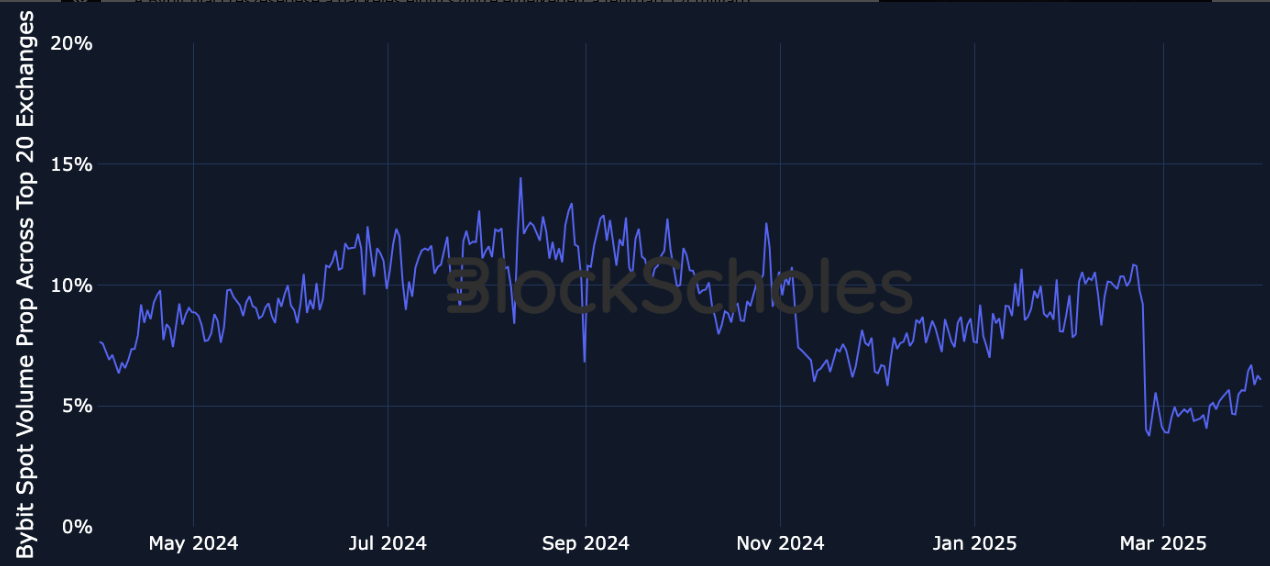

Fast forward to today, and Bybit has reclaimed over 7% of the crypto market share, bouncing back from a post-hack low of 4%. How?

A mix of grit, transparency, and good old-fashioned damage control. Bybit’s spot trading volumes are back in action, proving that even after the worst storm, you can rebuild, if you’ve got the chops.

Turns out, the hack wasn’t your run-of-the-mill cyber heist. Blockchain sleuths have pointed the finger at North Korea’s infamous Lazarus Group, the same ones who’ve been wreaking havoc on the crypto industry for years.

But here’s where it gets juicy, because after a suspicious lull in their hacking spree last year, thanks to North Korea shifting resources toward Russia’s war in Ukraine, they came back swinging with this Bybit exploit.

3.20.25 Executive Summary on Hacked Funds:

Hacker started to use BTC mixers: 1. Wasbi 2. CryptoMixer 3. Railgun 4. TornadoCash

Total hacked funds of USD 1.4bn around 500k ETH. 88.87% remain traceable, 7.59% have gone dark, 3.54% have been frozen.

Breakdown: – 86.29% (440,091…— Ben Zhou (@benbybit) March 20, 2025

Washing

And get this, it took them just 10 days to launder most of the stolen funds through THORChain. Slick? Sure.

But not foolproof, blockchain experts managed to trace about 89% of the loot. So while Lazarus might be good at what they do, they’re not exactly untouchable or untraceable.

But let’s not forget Bybit’s role in this story, as they didn’t just sit around licking their wounds.

The exchange ramped up security protocols and launched a transparent recovery plan that’s nothing short of impressive.

They restored 77% of their assets under management and beefed up liquidity across top trading pairs, outperforming industry benchmarks.

Oh, and their trading volume? A cool $40 billion in just two days last month.

Dark forest

The takeaway here is that Bybit’s attitude is a masterclass in crisis management.

Sure, it highlights how vulnerable even the biggest players are to cyberattacks, but it also shows that with enough determination, and a solid strategy, you can turn even the worst disaster into a comeback story for the ages.

Bybit is back in business, Lazarus is still lurking, and crypto remains as wild as ever. Stay vigilant out there, it’s a dark jungle.

Have you read it yet? Pakistan’s plan is turning excess electricity into Bitcoin

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.