Warren Buffett, the Oracle himself, is stepping down as CEO of Berkshire Hathaway by the end of 2025.

In walks Greg Abel, the new boss, and he’s got a pile of cash so big it would make Scrooge McDuck blush, $347 billion, to be exact.

Now, people are whispering, what if Berkshire went all in on Bitcoin? Unlikely, but they could.

Buying spree?

First off, let’s talk numbers. With Bitcoin hovering around $95,000 in the time of writing, Berkshire could theoretically scoop up about 3.5 million BTC with that cash mountain. That’s almost 18% of all Bitcoin in circulation, a fifth of the whole pie.

Even if they just used their Treasury stash, about $296 billion, they’d still walk away with 3.1 million coins, or 16% of the supply. Saylor in disbelief, huh.

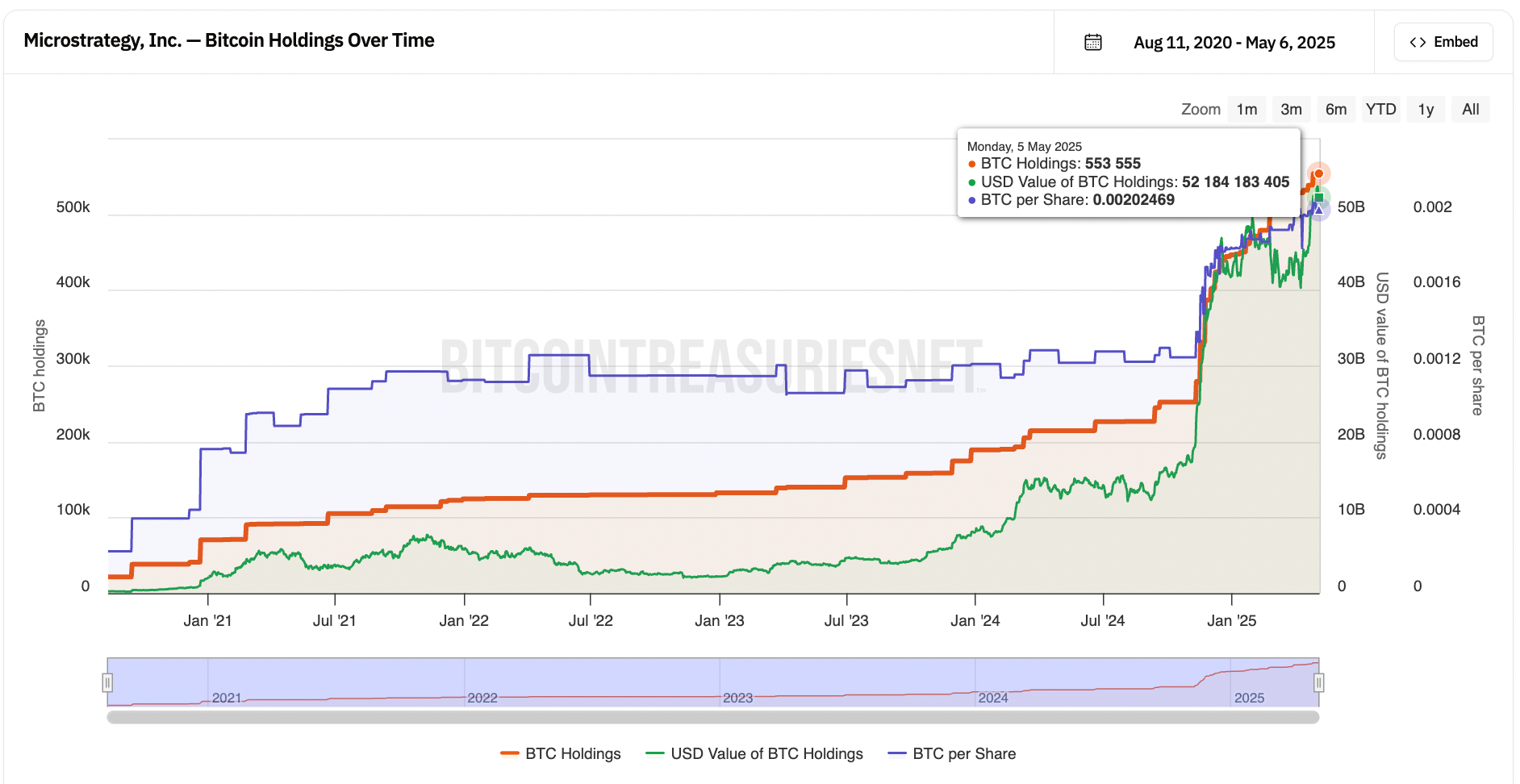

You think MicroStrategy’s got a big stack? Please. They’re sitting on 553,555 BTC, worth about $52 billion.

Berkshire could match that with just a fraction of its cash pile. If Abel wanted, he could make MicroStrategy look like a kid with a piggy bank.

Rat poison squared

But here’s the rub, is Berkshire actually gonna do it? Don’t hold your breath.

Greg Abel hasn’t dropped any hints about flipping the script on Buffett’s legendary anti-Bitcoin stance. Remember, Buffett once called Bitcoin “rat poison squared.”

Let’s say the guy’s not exactly shopping for digital wallets. And let’s not forget, since he trashed Bitcoin back in 2018, the price has jumped nearly 900%. So much for rat poison, looks more like rocket fuel to me.

Still, Berkshire isn’t totally out of the crypto game. They’ve got indirect exposure through companies like Nu Holdings and Jefferies Financial Group.

It’s like saying you don’t eat pizza but you own half the pizzerias in town. Classic Buffett-talks tough, but always finds a way to get a taste.

Chances

And what about the future? Analysts are betting big on corporate money flooding into Bitcoin, $330 billion by 2029, with a chunk of that coming from companies chasing MicroStrategy’s playbook.

Will Berkshire join the party? Maybe they’ll dip a toe, maybe not. But with Abel in charge, you never know.

Sometimes the new boss wants to make his own mark, even if the old boss is still watching from the corner office.

So, could Berkshire buy up Bitcoin and shake the whole market? Absolutely. Will they? That’s the billion-dollar question.

For now, let’s just say, if Abel ever gets the itch, he’s got the muscle to make it happen. But don’t bet the house on it, this crew likes to keep you guessing.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.