The first US spot XRP ETF could start trading on Thursday as Canary Capital’s Canary XRP ETF (XRPC) moves through final listing steps.

Nasdaq has certified the XRP ETF for listing, but SEC approval for trading is still pending, so the exact launch time remains uncertain.

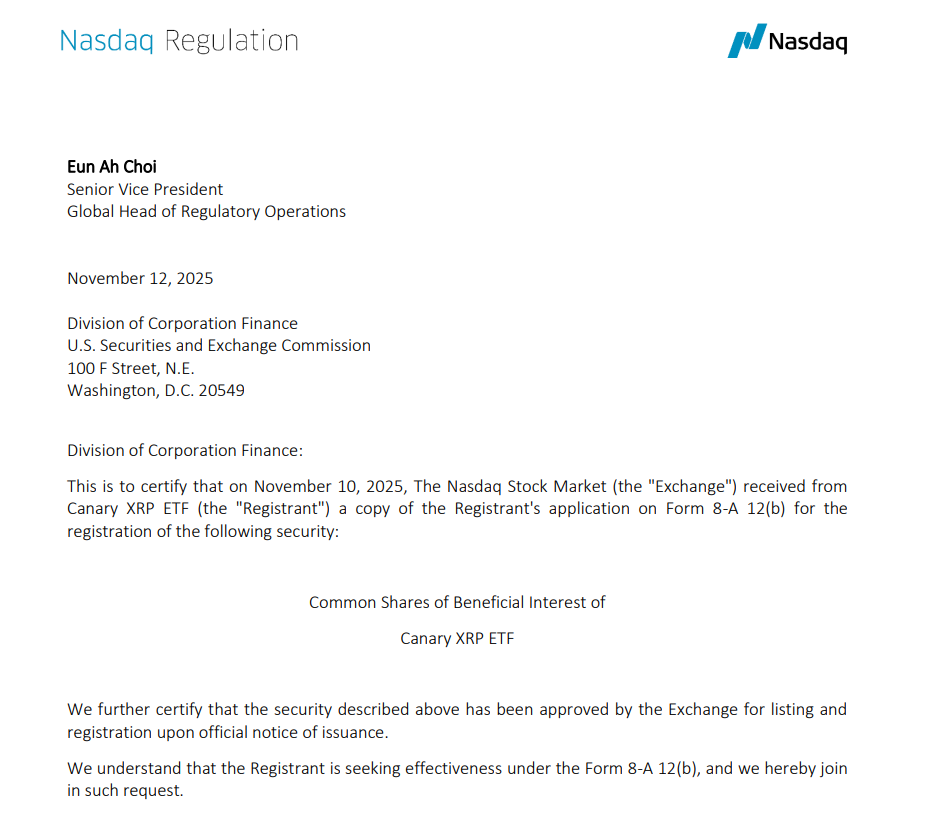

The crypto community tracks the XRP ETF closely after Nasdaq told the US Securities and Exchange Commission (SEC) that it received Form 8-A for XRPC.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

This filing registers the Canary XRP ETF under the Exchange Act and prepares it for listing on Nasdaq once the SEC declares the registration effective.

Bloomberg senior ETF analyst Eric Balchunas highlighted the update on X.

“The official listing notice for XRPC has arrived from Nasdaq,”

he wrote, adding:

“Looks like tomorrow is on for the launch.”

His post placed extra attention on the XRP ETF listing timetable.

At the time referenced in the original report, XRP traded near $2.52, which framed market interest around a possible XRP ETF debut.

XRP ETF countdown starts after Canary Capital’s Nasdaq listing notice

The Nasdaq listing notice confirms that the exchange has finished its review of the Canary XRP ETF.

In practical terms, the XRP ETF now has a Nasdaq listing slot under the ticker XRPC, ready for use once the SEC effectiveness step is complete.

The Form 8-A attached to the XRP ETF is a short registration document. It brings the Canary XRP ETF under the Securities Exchange Act of 1934, which is required for securities traded on major US exchanges.

For readers less familiar with ETFs, this means the spot XRP ETF has moved from a planning stage into a phase where it can trade once regulators finish their process.

Balchunas’ reference to the XRP ETF launch “tomorrow” reflects the common pattern in earlier crypto ETF rollouts.

In several previous cases, an ETF appeared on an exchange eligibility or listing list shortly before trading started, which now shapes expectations for the Canary XRP ETF as well.

However, the report notes that the SEC approval for XRPC to begin trading is not yet final.

The XRP ETF therefore sits in a narrow gap: the Nasdaq listing is in place, but the spot XRP ETF still awaits formal effectiveness from the SEC.

Canary XRP ETF would become sixth US single-asset crypto ETF

On X, Nate Geraci, president of NovaDius Wealth Management, pointed to one more sign that the Canary XRP ETF is close to launch.

He noted that Canary Capital had already gone live with a website for the Canary XRP ETF, which outlines the product and signals readiness from the issuer’s side.

“Canary Capital will be first to market,”

Geraci wrote, stressing that the XRP ETF would join a short list of single-asset crypto ETFs in the United States.

According to the report, the Canary XRP ETF would be the sixth single crypto asset ETF in the country.

The existing group already includes spot ETFs for Bitcoin (BTC), Ether (ETH), Solana (SOL), Litecoin (LTC) and Hedera (HBAR).

At the time of the article, BTC traded around $103,092, ETH near $3,507, SOL close to $155.79, LTC around $100.04 and HBAR near $0.18.

Adding the Canary XRP ETF would extend this list from five to six products. It would also mark the first US spot XRP ETF to hold XRP directly, rather than using futures or other synthetic structures.

That detail explains why the XRP ETF has drawn extra attention from market participants.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 13, 2025 • 🕓 Last updated: November 13, 2025