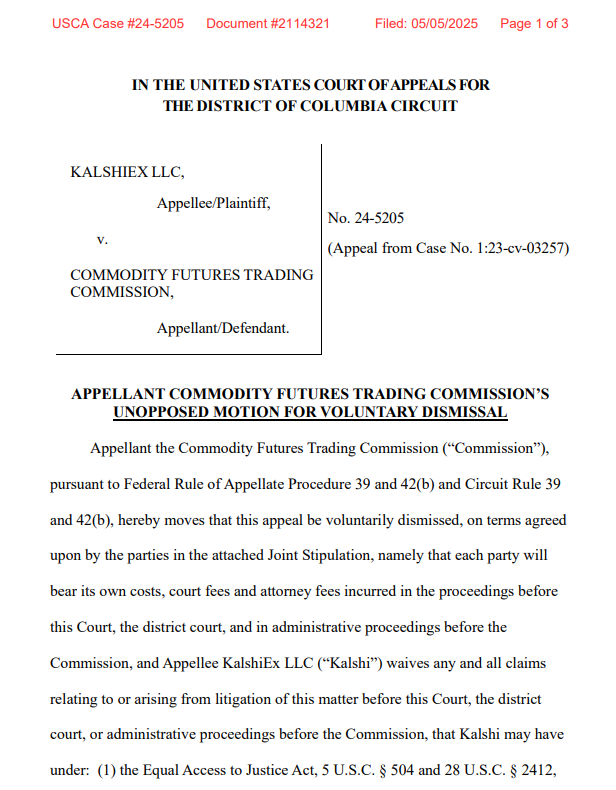

On May 5, 2025, the U.S. Commodity Futures Trading Commission (CFTC) filed a motion to dismiss its appeal against Kalshi.

The case was submitted to the U.S. Court of Appeals for the District of Columbia Circuit. The motion was unopposed, indicating no legal challenge from Kalshi.

The CFTC had appealed a lower court decision that blocked it from stopping Kalshi’s political event contracts.

These contracts allow users to place bets on election outcomes. The appeal followed a lawsuit Kalshi filed in 2023, after the CFTC ordered the firm to shut down those markets. The regulator’s latest motion seeks voluntary dismissal.

The official document confirms the CFTC’s decision to withdraw. Kalshi agreed to cover its own legal expenses if the motion is granted.

Kalshi Reacts to CFTC Filing After Court Agreement

On May 6, Kalshi posted a short statement on X, saying, “Election markets are here to stay.” The post came one day after the CFTC’s court filing.

The message reflected the company’s long-term stance throughout its legal battle with the agency.

Kalshi’s original complaint argued that offering political event contracts was within regulatory boundaries.

A lower federal court ruled in Kalshi’s favor. The CFTC responded by appealing the decision in September 2024. That appeal is now subject to dismissal.

No additional comments were issued by Kalshi at the time of publication. The firm was launched in 2021 and gained users by offering regulated markets on events, including elections.

Political Event Contracts Gain Ground Under New CFTC Leadership

The CFTC’s move follows a leadership shift after President Donald Trump returned to office. Acting CFTC Chair Caroline Pham now leads the agency.

The case had progressed mostly before this transition. The recent motion may reflect a revised position under Pham’s direction.

Earlier, the CFTC had warned that political event contracts could lead to market manipulation.

The agency argued these markets could harm the public interest. However, no such claims were made in the May 5 filing.

CFTC Commissioner Summer Mersinger commented on the issue in February 2025.

Appointed by former President Joe Biden, Mersinger said that election prediction markets appeared to have staying power. Her remarks aligned with Kalshi’s legal arguments.

Kalshi also integrated cryptocurrency support in the past year, including Bitcoin deposits. This feature targeted crypto-native users, especially during the 2024 U.S. election season.

The court has not yet ruled on the CFTC’s dismissal request. If approved, the decision would finalize the legal case and allow Kalshi to resume offering political event contracts without further dispute.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.