The crypto platform has teamed up with 21X, a European firm gearing up to launch a tokenized asset settlement system.

With Chainlink providing its oracle services, users can expect reliable pricing data that connects on-chain events with real-world financial information.

Chainlink’s European venture

In the past months, Chainlink has been busy researching business processes for fintech and trading companies, including some big names in investment banking.

Their goal? To streamline operations and make data fetching easier for everyone involved.

And now 21X is set to launch its platform using Chainlink’s approach to on-chain finance.

While trading isn’t live just yet, the platform will operate under the watchful eye of Germany’s financial authority, BaFin.

Chainlink will also supply its Cross-Chain Interoperability Protocol, allowing 21X to settle assets from various blockchains.

21X plans to treat stablecoins as tokenized assets and will onboard stablecoins from multiple chains for its clients.

2025 is the year of the growth

The platform is expected to go live in Q1 next year, immediately tapping into Chainlink’s data on listed products.

This partnership marks Chainlink’s entry into the regulated crypto asset space in Europe, connecting all compliant assets with 21X’s tokenized ecosystem.

21X wants to be one of the few fintech companies operating under the EU’s proposed distributed ledger technology legal framework.

They plan to offer tokenized stocks, bonds, and funds, along with contract-based issuance, trading, and settlement for those assets.

The EU has strict rules for stablecoins, which are among the most common tokenized assets.

For stocks, bonds, or funds, there’s a sandbox regulation in place. While EU-based companies have previously tried to introduce security tokens, their impact has been quite limited so far.

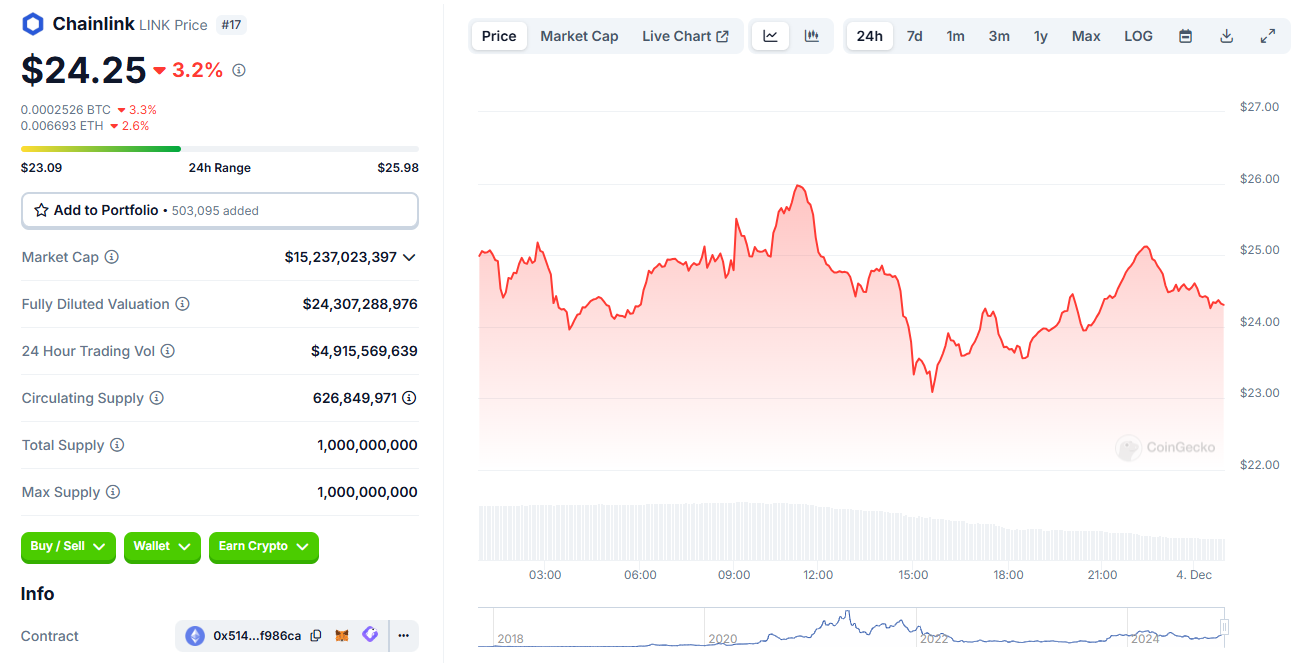

LINK price

As signs of an active altseason emerge, LINK just rallied above $24, thanks to news about new integrations for its oracle services.

This is the highest level for LINK since January 2022, and the token already broken its 2024 record and saw daily trading volumes soar above $7 billion in just 24 hours.

This impressive recovery led to a nice turnover of LINK tokens, with more than 50% of its supply traded within a day.

Following the trend of older coins like XRP and utility projects such as IOTA and EOS, LINK holders are gearing up for long-term gains as they anticipate a price breakout.