Listen guys, because what I’m about to tell you isn’t your average hopium story. No, this is the kind of tale your accountant warns you about, the kind that keeps crypto traders up at night, staring at the ceiling, wondering if their Bitcoin stash is about to moon, or crash.

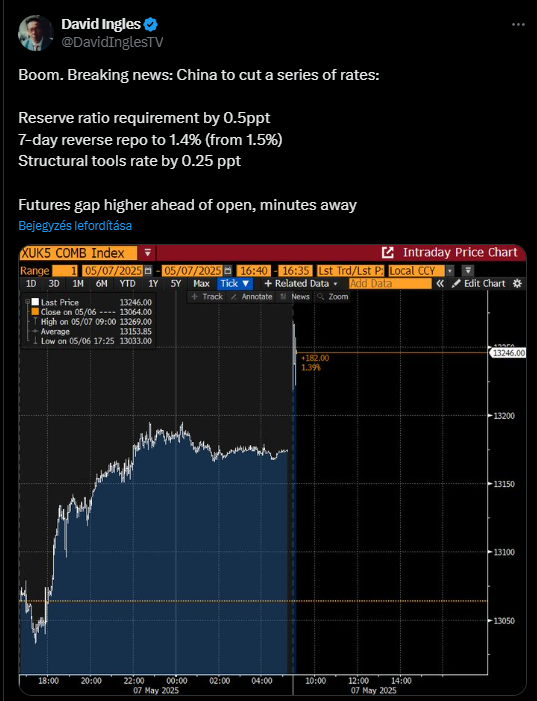

The People’s Bank of China, the big boss in Beijing, just dropped a bombshell, cutting the reserve requirement ratio by half a percentage point.

It’s like quantitative easing

Let me break it down for you. When China lowers this so-called RRR, it’s basically telling its banks, hey, you don’t need to keep so much cash locked up. Go ahead, lend it out, invest, make it rain. And boy, the market love to hear this!

With a lower policy rate thrown in for good measure, you’ve got a recipe for one thing, more liquidity.

A trillion dollars’ worth of fresh capital, ready to chase returns wherever they look hottest. And guess what’s looking spicy? Crypto, baby.

Now, you might be thinking, so what? That’s China’s business. True, but you know money doesn’t respect borders, all hail globalization.

When there’s more cash sloshing around, it tends to find its way into all sorts of places, tech stocks, memecoins, you name it.

More money

Remember 2023? Bitcoin doubled when central banks worldwide started loosening the purse strings.

CoinShares says digital asset investment products pulled in $2.9 billion in just the last quarter of that year, right as the money printers started humming.

If China’s move gets the rest of Asia, or the world, thinking dovish, you better believe crypto could catch some serious tailwinds.

Right now the elephant in the room is China’s relationship with crypto. Complicated, like a family dinner where nobody agrees on politics.

They’ve cracked down on retail trading and mining, sure, but don’t think for a second that what happens in Beijing stays in Beijing.

Hong Kong, with a wink and a nod from the mainland, is hustling to become a crypto hub. More liquidity in China could mean more capital sneaking through those regulated doors, looking for action.

Performance

And let’s not forget USDT, the king of stablecoins, especially in Asia’s back alleys and neon-lit trading floors.

If liquidity surges, expect USDT volumes to pop off, bringing more volatility, and maybe a few headaches for the faint of heart.

🇭🇰 HONG KONG NOW OFFICIALLY ACCEPTS #BITCOIN AND CRYPTO AS PROOF OF ASSETS TO APPLY FOR RESIDENCY 🤯

CHINA IS GETTING PREPARED 🚀 pic.twitter.com/ifOB1tU11Z

— Vivek⚡️ (@Vivek4real_) February 8, 2025

When China opens the taps, the whole world feels the flood. Crypto markets, already twitchy, could get a fresh jolt. Number go up, hell yeah!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.