Bitcoin’s making moves again, and it’s not just some casual stroll in the park. The Coinbase Premium, the price gap between Coinbase’s BTC/USD and Binance’s BTC/USDT, is hitting levels we haven’t seen since February.

That’s a serious sign that US buyers are back in the game, hungry and ready to snatch up Bitcoin like it’s the last slice of pizza at the office party.

There’s no price sensitivity

What’s this Coinbase Premium, you ask? Think of it like a sneaky little barometer for US demand.

When the premium’s high, it means people on Coinbase, mostly Americans, are paying more for Bitcoin than buyers on Binance, signaling stronger appetite stateside.

And right now? That appetite’s roaring louder than a Monday morning coffee rush.

The popular expert, Crypto Dan, put it straight, and said this isn’t some overheated frenzy.

Nah, it’s the kind of steady, confident buying you see when a market’s gearing up for a big run after a correction. Translation? The second half of 2025 might just be Bitcoin’s time to shine.

Buy and hold

And honestly, it’s not just retail investors, because institutional money is wading back in, too. Remember when Bitcoin flirted with $100,000 and some guys got jittery?

That was just a blip, a knee-jerk reaction to macro uncertainty. Now, with BlackRock’s iShares Bitcoin Trust smashing records, $70 billion in assets faster than any ETF ever, big players are making their moves.

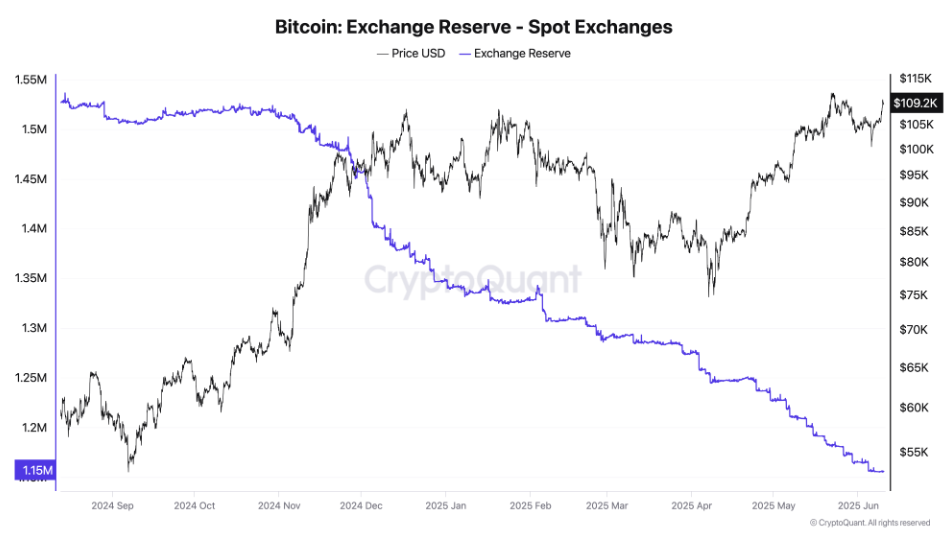

Another sign is that Bitcoin’s liquidity on exchanges is drying up faster than your favorite snack in the office breakroom.

Since July last year, over 550,000 BTC have left spot exchanges, disappearing into private wallets, cold storage, wherever long-term holders stash their treasure.

People aren’t selling, they’re locking their coins down, holding tight like it’s the championship game and they’re not letting go.

Something is coming?

CryptoQuant contributor Baykuş revealed that every rally needs secret prep work, and now Bitcoin’s quietly gearing up for a sprint toward $110,000.

The supply on exchanges is shrinking, demand is heating up, and the stage is set. Maybe this is that secret prep work now.

So, this noticeable growth in US demand and the exodus of BTC from exchanges is a clear sign. Bitcoin is likely gearing up for a serious breakout.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.