Coinbase confirmed it is considering applying for a US federal bank charter. The company told

“This is something Coinbase is actively considering but has not made any formal decisions yet.”

A Coinbase banking license would allow the crypto exchange to offer traditional banking services.

This includes accepting deposits and issuing loans. Coinbase has not explained the reason for its interest in a federal charter.

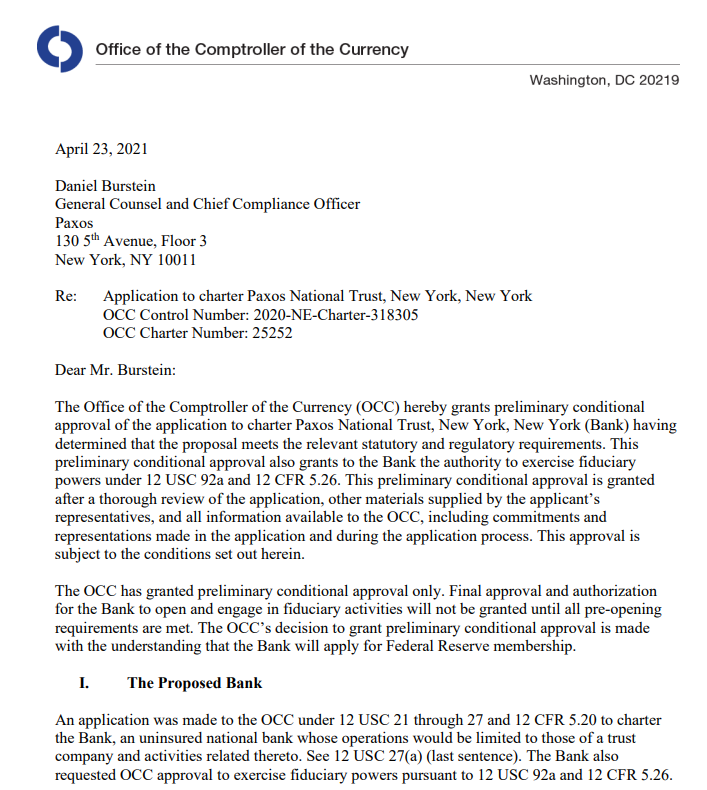

Alongside Coinbase, other crypto firms such as Circle, Paxos, and BitGo are also reportedly exploring the same route.

A license would place them under the authority of the Office of the Comptroller of the Currency (OCC) and other regulators.

Anchorage Digital Sets Charter Example for Crypto Firms

Anchorage Digital is the first known crypto firm to receive a US federal bank charter. The OCC granted conditional approval in 2021. The charter allows Anchorage to operate under federal banking laws.

Despite receiving the license, Anchorage Digital Bank is now under investigation. The US Department of Homeland Security’s El Dorado Task Force is probing the firm. No additional details about the probe were made public.

The case reflects the strict oversight that comes with a Coinbase banking license or any federal charter. Firms must follow rules on reporting, auditing, and reserve controls under US banking law.

US Government Adopts Softer Tone on Stablecoin Regulation

Coinbase’s move comes as US authorities appear more open to regulating stablecoins. Federal Reserve Chair Jerome Powell said that building a clear legal structure for stablecoins is a “good idea.” He said digital assets now have clear consumer applications.

The Coinbase banking license discussion also follows the OCC’s earlier approval of a preliminary charter for Paxos. Circle and BitGo are also said to be exploring similar steps.

The shift shows stronger alignment between crypto-bank integration efforts and federal financial policy. With more crypto firms applying for licenses, new rules may be set.

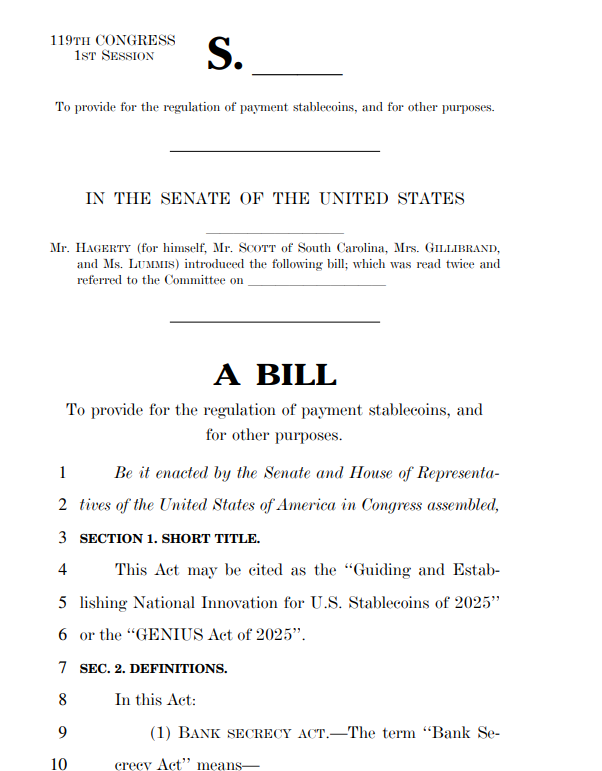

STABLE and GENIUS Acts Aim to Shape Stablecoin Laws

Two major bills are advancing in Congress. The STABLE Act and GENIUS Act both focus on stablecoin regulation, but take different paths.

The STABLE Act passed the US House Financial Services Committee in April 2025. It calls for a two-year ban on collateralized stablecoins backed by self-issued assets. It also requires reserve funds to be kept apart from corporate assets.

The GENIUS Act passed the US Senate Banking Committee in March 2025. It pushes for a joint state and federal approach.

It includes stronger AML checks, clearer reserve standards, and defines stablecoin issuers as financial institutions.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.