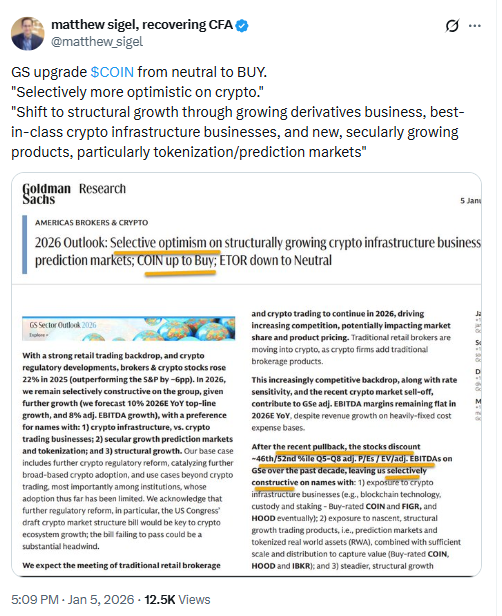

Coinbase stock rose 8% after a Goldman Sachs upgrade moved COIN from “neutral” to “buy.” The move came as the bank raised its COIN price target for the next 12 months.

Goldman Sachs analyst James Yaro said the bank holds “selective optimism” about US brokers. He also pointed to “structurally growing crypto infrastructure businesses” such as Coinbase.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Goldman raised its COIN price target to $303 from $294. COIN closed at $254.92, while after hours trading showed limited movement.

At $254.92, Goldman’s $303 target implies an 18% gain over 12 months. The note tied that view to crypto infrastructure activity instead of reliance on trading alone.

Crypto Infrastructure, Tokenization, and Prediction Markets Shape the Coinbase Story

In the report, James Yaro highlighted crypto infrastructure as a focus area. He pointed to growth potential in firms that expand beyond a trading desk model.

Yaro flagged tokenization and prediction markets as key areas. He described these as examples of use cases that go beyond standard spot trading activity.

The note also linked its view to comments from Coinbase CEO Brian Armstrong. Armstrong said Coinbase is doubling down on an “everything exchange” approach, while setting priorities for 2026.

Armstrong’s plan included a stronger focus on stablecoins, broader exchange services, and continued work on Base, Coinbase’s Ethereum layer 2 network.

The strategy aligned with the report’s emphasis on crypto infrastructure that supports multiple products.

Coinbase also expanded into prediction markets through a Kalshi partnership.

The integration brought prediction markets into the Coinbase platform, as the company targeted activity that grew quickly across crypto last year.

Goldman Sachs Links 2026 Crypto Adoption to Crypto Regulation and Market Structure Bill Risk

Goldman’s note also addressed the wider market outlook. James Yaro said the bank expects higher crypto adoption in 2026 from both retail users and institutions.

Yaro tied that expectation to crypto regulation progress in the United States. He said policy changes could support new use cases beyond trading, especially for institutions.

“Our base case includes further crypto regulatory reform, catalyzing further broad-based crypto adoption, and use cases beyond crypto trading, most importantly among institutions, whose adoption thus far has been limited.”

Yaro also pointed to a risk tied to the US Congress draft market structure bill.

“We acknowledge that further regulatory reform, in particular, the US Congress’ draft crypto market structure bill would be key to crypto ecosystem growth; the bill failing to pass could be a substantial headwind,” he added.

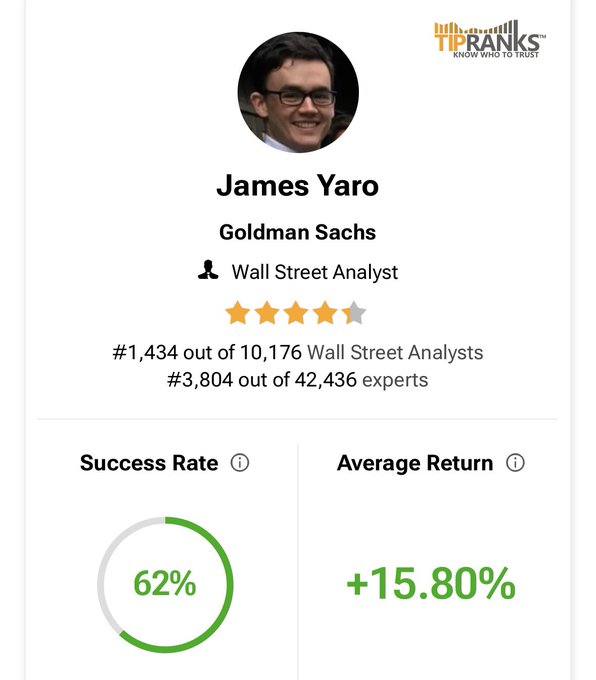

The report included analyst performance data cited from TipRanks. It said James Yaro has a 62% success rate and an average return of almost 16% per year.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 6, 2026 • 🕓 Last updated: January 6, 2026