The crypto world is like a high-stakes poker game, and volatility is the name of the game.

You’re either all in or you’re out. In March 2025, altcoins like Cardano, Solana, and XRP were on fire, with realized volatility hitting record highs, like 150% for ADA and over 100% for SOL and XRP.

On the other hand, Bitcoin was chillin’ at 50%, looking like the calm in the storm.

Degen play

But let’s get real, alts are like playing with fire. They’re driven by rumors, news, and community hype, which can send prices swinging wildly.

XRP, for instance, is like a yo-yo with the SEC lawsuit hanging over its head. When the market’s hot, investors jump from Bitcoin to altcoins for those juicy returns, but that just amplifies the risk.

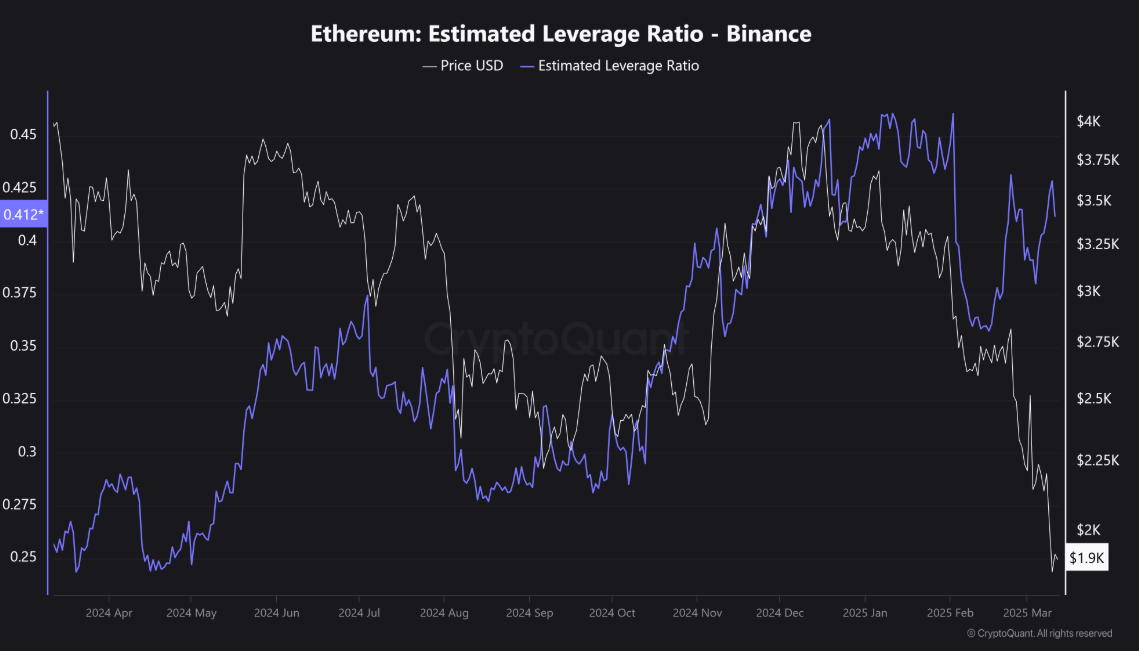

Ethereum’s a perfect example, its leverage ratio is through the roof, meaning traders are betting big, and that’s a recipe for disaster.

Having fun, or having results?

Now, Bitcoin’s not immune to volatility, but it’s been looking like the safer bet lately. Historically, it’s seen spikes above 100%, but in March, it seemed more stable.

The thing is, with lower volatility comes less potential for short-term gains. It’s like choosing between a rollercoaster and a steady climb up a mountain.

Bitcoin’s the mountain, solid, reliable, but not exactly thrilling.

Risk business

But here’s the thing, seasoned investors aren’t flinching. Even when Bitcoin dipped below $80k, long-term holders didn’t blink.

That tells you something about confidence in its future. So, if you’re in it for the long haul, Bitcoin might be your best bet.

But if you’re looking for a quick score, altcoins are where the action is, just don’t say I didn’t warn you.

Volatility is shaping trading strategies, and it’s clear, alts are for the thrill-seekers, while Bitcoin’s for those playing the long game. In the end, it’s all about what you’re willing to risk.

Have you read it yet? Bitcoin takes a beating, so it’s Peter Schiff’s „I-told-you-so” moment

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.