Bitcoin reached its highest price this month, climbing above $64,000 early on October 14. This led to the liquidation of over $52 million from traders who had bet against its price.

Short squeeze in action

As Bitcoin’s price increased, crypto derivatives traders who expected a market decline faced painful losses.

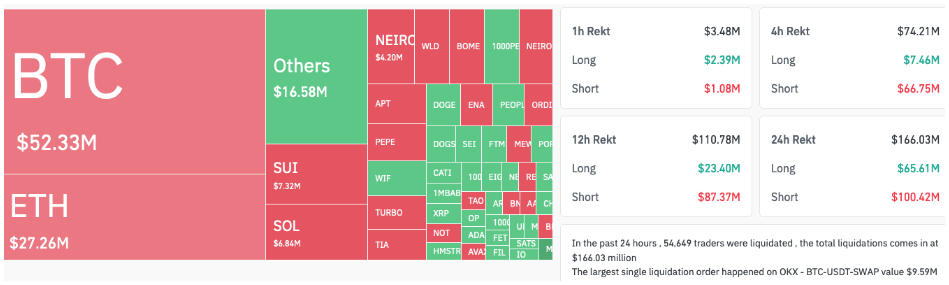

In just one day, more than $100 million in short positions were liquidated as Bitcoin grew by 2.1%, and then peaked at $64,100, on its highest level since September 30.

The sudden price movement resulted in over $101.4 million in liquidations across the entire crypto market.

In total, 54,649 traders lost their positions, with Bitcoin shorts accounting for approximately $52.33 million of this amount, followed by Ether shorts at about $27.26 million.

No land for short sellers

Bitcoin’s rally also boosted its market dominance back above 58%, nearing levels not seen since April 2021.

Analysts have been curious about when the anticipated “Uptober” would begin, as historically, October has produced positive returns for Bitcoin in nine of the last eleven years, hence the Uptober term, half meme, half truth.

A few Bitcoiners in the social media suggest that “the tides are shifting,” and we may be entering an exciting phase in the market.

The view now is that the next big rally isn’t just a possibility but a reality waiting to happen. Not if, but when.

Onchain analyst James Check added a note of caution for those betting against Bitcoin by saying, “Pray for the bears.”

Green days ahead?

In addition to Bitcoin’s rise, Ether also climbed back above $2,500, reaching a two-week high of $2,540 after a 2.9% increase in the last day.

Other altcoins have mostly shown positive movement as well, for example Solana gained 4.4% over the past 24 hours.

While high-cap altcoins like BNB, XRP, and Dogecoin saw smaller gains of less than 1%, the overall trend signals a growing interest in cryptocurrencies as market conditions shift.