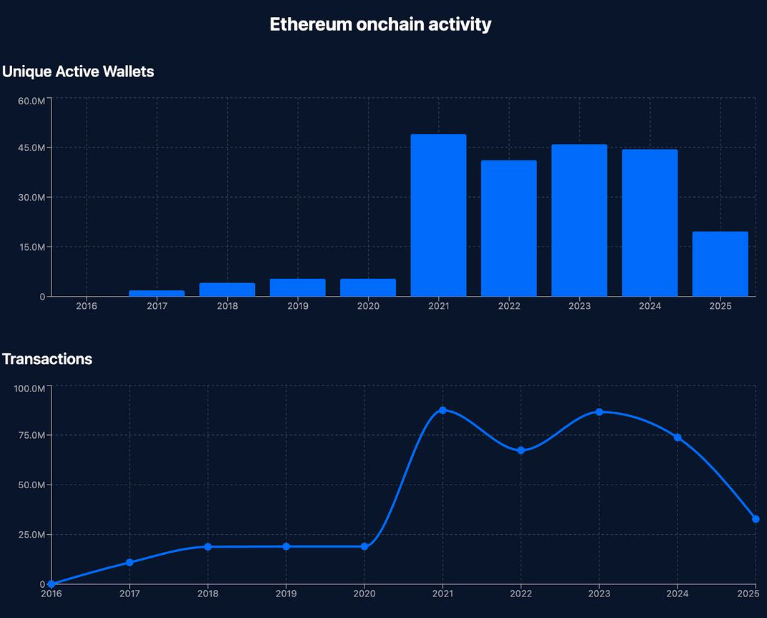

Ethereum shows no signs of slowing down. According to DappRadar, Ethereum’s 2025 on-chain activity is on track to match — or even surpass — last year’s numbers.

That’s no small feat, especially with faster, cheaper competitors promising the moon.

452 Million Transactions and Counting

Back in 2021, Ethereum led the charge during the bull market. Unique wallets spiked, transactions surged, and the ecosystem thrived.

The buzz cooled off a bit in 2022, but 2023 and 2024 saw a resurgence, fueled by DeFi, NFTs, and layer-2 scaling solutions.

Fast forward to 2025, and Ethereum’s momentum is still strong. Sara Gherghelas of DappRadar calls it the cornerstone of Web3, particularly for key sectors like DeFi and NFTs.

Over the past decade, Ethereum has seen 234 million unique wallets interacting with dapps. It also processed over 452 million transactions, solidifying its role as the engine of decentralized activity.

Price Action and On-Chain Signals

Ethereum’s fundamentals are gaining steam. Open interest in ETH futures hit $58 billion, and network activity rose 7.2% over the last month.

Last week, ETH fluctuated between $3,530 and $3,933, closing near $3,862 — up 5.8% in just seven days.

Still, not everyone is entirely bullish. Some analysts point to potential overvaluation, and the cost of borrowing wrapped Ether has also jumped, hinting at market caution.

ETH as a Treasury Asset

Another sign of Ethereum’s maturation? Companies are starting to treat it like a treasury-grade asset.

DappRadar reports that 2.73 million ETH (worth $10.56 billion) is held across 65 treasury entities.

Names like BitMine and SharpLink Gaming are leading the pack, placing Ethereum alongside Bitcoin in the growing trend of crypto treasury diversification.

Bottom Line: Ethereum Still Rules

Ethereum continues to dominate the DeFi and NFT space, proving that while new blockchains may emerge, legacy doesn’t mean lagging.

With deep adoption, developer activity, and institutional confidence, Ethereum’s crown remains firmly in place — at least for now.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 1, 2025 • 🕓 Last updated: August 1, 2025

✉️ Contact: [email protected]